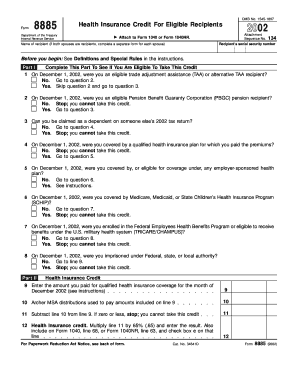

Form 8885 Health Insurance Credit for Eligible Recipients

What is the Form 8885 Health Insurance Credit For Eligible Recipients

The Form 8885 is a tax form used by eligible recipients to claim the Health Insurance Credit. This credit is designed to assist individuals who have purchased health insurance through the Health Insurance Marketplace. It helps reduce the overall cost of health insurance premiums, making healthcare more affordable for those who qualify. The credit is particularly beneficial for low- to moderate-income individuals and families who may struggle to meet their healthcare expenses.

Eligibility Criteria

To qualify for the Health Insurance Credit using Form 8885, recipients must meet specific eligibility requirements. These include:

- Having purchased health insurance through the Health Insurance Marketplace.

- Meeting income requirements based on the federal poverty level.

- Being a U.S. citizen or a legal resident.

- Not being eligible for other types of health coverage, such as Medicare or Medicaid.

It is essential for applicants to review their eligibility carefully, as incorrect submissions can lead to delays or denials of the credit.

Steps to complete the Form 8885 Health Insurance Credit For Eligible Recipients

Completing Form 8885 involves several key steps:

- Gather necessary documents, including proof of health insurance coverage and income statements.

- Fill out personal information, including name, address, and Social Security number.

- Provide details about the health insurance plan, including the coverage period and premium amounts.

- Calculate the credit amount based on the provided information and eligibility criteria.

- Review the form for accuracy before submission.

Ensuring that all information is complete and accurate is crucial for a successful claim.

How to obtain the Form 8885 Health Insurance Credit For Eligible Recipients

Form 8885 can be obtained through various means:

- Downloading it directly from the official IRS website.

- Requesting a physical copy from the IRS by mail.

- Accessing it through tax preparation software that includes IRS forms.

It is recommended to use the most current version of the form to ensure compliance with the latest tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for Form 8885 align with the general tax filing deadlines. Typically, the deadline for submitting your tax return, including Form 8885, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to these dates annually.

Form Submission Methods (Online / Mail / In-Person)

Form 8885 can be submitted through several methods:

- Electronically via tax preparation software that supports e-filing.

- By mailing a paper copy to the appropriate IRS address.

- In-person at designated IRS offices, though this option may be limited.

Choosing the right submission method can help ensure timely processing of the credit claim.

Quick guide on how to complete form 8885 health insurance credit for eligible recipients

Complete [SKS] seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, edit, and electronically sign your documents swiftly and without complications. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] easily

- Obtain [SKS] and then select Get Form to begin.

- Utilize the tools we offer to complete your document submission.

- Emphasize pertinent sections of your documents or conceal sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to finalize your edits.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns over lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8885 Health Insurance Credit For Eligible Recipients

Create this form in 5 minutes!

How to create an eSignature for the form 8885 health insurance credit for eligible recipients

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8885 Health Insurance Credit For Eligible Recipients?

The Form 8885 Health Insurance Credit For Eligible Recipients is a tax form used to claim a credit for eligible health insurance coverage. This form helps individuals and businesses understand their entitlement to benefits under health care programs. Completing this form correctly can lead to signNow tax savings.

-

Who qualifies for the Form 8885 Health Insurance Credit?

To qualify for the Form 8885 Health Insurance Credit For Eligible Recipients, an individual must meet specific criteria regarding their health insurance coverage and income level. Typically, those who purchased health insurance through state exchanges or qualifying employer-sponsored plans may be eligible. It's essential to check the IRS guidelines for the most accurate and up-to-date eligibility requirements.

-

How can I submit my Form 8885 through airSlate SignNow?

You can submit your Form 8885 Health Insurance Credit For Eligible Recipients through airSlate SignNow by uploading your completed form directly to the platform. Our user-friendly interface allows for eSigning and quick submission to the IRS or relevant entities. This streamlines the process, ensuring your forms are submitted accurately and on time.

-

What features does airSlate SignNow offer for managing Form 8885 submissions?

airSlate SignNow offers various features for managing your Form 8885 Health Insurance Credit For Eligible Recipients submissions, including customizable templates, secure eSigning, and automatic reminders. With integrations to popular applications, tracking your submission status becomes effortless. Our platform ensures easy access to all your documents in one centralized location.

-

Is there a cost associated with using airSlate SignNow for Form 8885 submissions?

Yes, there is a cost associated with using airSlate SignNow; however, our pricing is designed to be affordable and scalable for businesses of all sizes. The subscription includes access to features that simplify the completion and submission of essential forms like the Form 8885 Health Insurance Credit For Eligible Recipients. Evaluate our pricing plans to find one that best suits your needs.

-

What are the benefits of using airSlate SignNow for Form 8885 submissions?

Using airSlate SignNow for your Form 8885 Health Insurance Credit For Eligible Recipients submissions brings efficiency and reliability. Our solution minimizes paperwork and errors, saving you time on tedious administrative tasks. Additionally, secure eSigning ensures your information is protected throughout the process.

-

Can I track the status of my Form 8885 submissions through airSlate SignNow?

Yes, you can easily track the status of your Form 8885 Health Insurance Credit For Eligible Recipients submissions with airSlate SignNow. Our platform provides real-time updates and notifications, allowing you to stay informed about your document's journey. This transparency helps you manage your submissions effectively.

Get more for Form 8885 Health Insurance Credit For Eligible Recipients

Find out other Form 8885 Health Insurance Credit For Eligible Recipients

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe