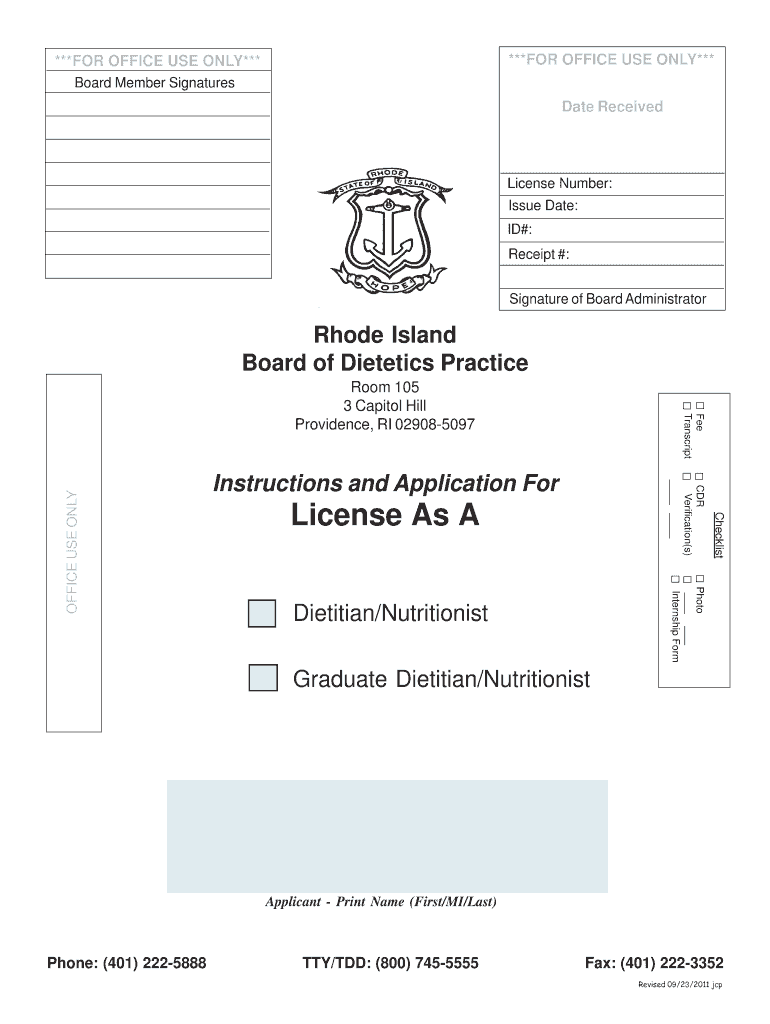

***FOR OFFICE USE ONLY*** Date Received Ri Form

What is the ***FOR OFFICE USE ONLY*** Date Received Ri

The ***FOR OFFICE USE ONLY*** Date Received Ri is a specific notation used in various forms to indicate the date on which a document was received by an office or organization. This notation is crucial for tracking submissions and ensuring that documents are processed in a timely manner. It serves as a reference point for both the submitting party and the receiving entity, helping to maintain an organized record of incoming documents.

How to use the ***FOR OFFICE USE ONLY*** Date Received Ri

To effectively use the ***FOR OFFICE USE ONLY*** Date Received Ri, follow these steps:

- Locate the designated area on the form where this notation is required.

- Clearly write the date in a standard format, typically MM/DD/YYYY, to avoid confusion.

- Ensure that the date is legible and accurately reflects when the document was received.

- Keep a copy of the document for your records, noting the date for future reference.

Steps to complete the ***FOR OFFICE USE ONLY*** Date Received Ri

Completing the ***FOR OFFICE USE ONLY*** Date Received Ri involves a straightforward process. Here are the steps:

- Review the form to identify the section for the date received.

- Use a pen or digital tool to enter the date clearly.

- Double-check the date for accuracy before submitting the form.

- Submit the form to the appropriate office or department.

Key elements of the ***FOR OFFICE USE ONLY*** Date Received Ri

Understanding the key elements of the ***FOR OFFICE USE ONLY*** Date Received Ri is essential for proper documentation. These elements include:

- The date format, which should be consistent across all documents.

- The location on the form where the date should be entered.

- The importance of accuracy to ensure proper processing.

- How this notation interacts with other parts of the form, such as submission deadlines.

Legal use of the ***FOR OFFICE USE ONLY*** Date Received Ri

The legal use of the ***FOR OFFICE USE ONLY*** Date Received Ri is significant in various contexts, particularly in compliance and record-keeping. It helps organizations maintain a timeline of submissions, which can be critical in legal situations where proof of submission is required. Accurate dating can also affect compliance with regulations and deadlines, making it a vital component of many formal processes.

Form Submission Methods (Online / Mail / In-Person)

When submitting forms that require the ***FOR OFFICE USE ONLY*** Date Received Ri, there are several methods available:

- Online Submission: Many organizations offer a digital platform for submitting forms, where the date is automatically recorded upon submission.

- Mail: If submitting by mail, ensure the date is clearly marked on the form before sending it to avoid processing delays.

- In-Person: When delivering forms in person, confirm that the receiving office records the date received accurately.

Quick guide on how to complete for office use only date received ri

Easily prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with the specific tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method of document delivery, whether by email, text message (SMS), invite link, or download to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ***FOR OFFICE USE ONLY*** Date Received Ri

Create this form in 5 minutes!

How to create an eSignature for the for office use only date received ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the ***FOR OFFICE USE ONLY*** Date Received Ri field in airSlate SignNow?

The ***FOR OFFICE USE ONLY*** Date Received Ri field in airSlate SignNow is designed to streamline document management within your organization. This feature allows users to track when documents are received, ensuring that all necessary records are maintained for compliance and audit purposes.

-

How does airSlate SignNow assist with document signing and management?

airSlate SignNow simplifies the process of document signing and management by providing a user-friendly interface that allows businesses to send and eSign documents electronically. With features like the ***FOR OFFICE USE ONLY*** Date Received Ri field, users can easily monitor the status of documents while ensuring quick turnaround times.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. Each plan provides access to essential features, including the ***FOR OFFICE USE ONLY*** Date Received Ri field, empowering users to manage their documents effectively without breaking the bank.

-

Can I integrate airSlate SignNow with other business applications?

Yes, airSlate SignNow can be seamlessly integrated with various business applications such as CRMs and project management tools. This integration helps ensure that information, including the ***FOR OFFICE USE ONLY*** Date Received Ri data, flows smoothly between platforms, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for document workflows?

Using airSlate SignNow enhances document workflows by reducing the time spent on manual processes and improving accuracy. The inclusion of features like the ***FOR OFFICE USE ONLY*** Date Received Ri field allows you to maintain precise records while facilitating faster and more efficient document handling.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security with robust encryption and data protection measures. The platform also allows you to track documents, including those marked with the ***FOR OFFICE USE ONLY*** Date Received Ri, ensuring that sensitive information is handled with care and confidentiality.

-

How user-friendly is the airSlate SignNow interface for new users?

The airSlate SignNow interface is designed to be intuitive and user-friendly, making it easy for new users to get started. The presence of features like the ***FOR OFFICE USE ONLY*** Date Received Ri field simplifies navigation and usage, allowing users to quickly adapt to the system.

Get more for ***FOR OFFICE USE ONLY*** Date Received Ri

- Property lien form

- Board directors appointment form

- Stipulation and order form

- Sexual assault evidence certification form

- Zahlungsauftrag im auslandsverkehr netbank ag form

- Land division application latah county latah id form

- Orthocarolina online forms

- Condominiumpud questionnaire not to be used for nyshcr form

Find out other ***FOR OFFICE USE ONLY*** Date Received Ri

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure