Form 720X Rev January Amended Quarterly Federal Excise Tax Return

What is the Form 720X Rev January Amended Quarterly Federal Excise Tax Return

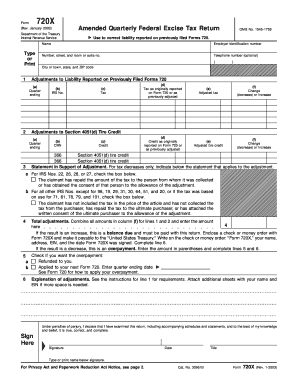

The Form 720X Rev January Amended Quarterly Federal Excise Tax Return is a specific tax form used by businesses to amend previously filed quarterly excise tax returns. This form allows taxpayers to correct errors or make adjustments to amounts reported in earlier filings. It is essential for ensuring accurate tax reporting and compliance with federal tax regulations. The form is particularly relevant for businesses that are subject to federal excise taxes, which may include manufacturers, importers, and retailers of certain goods and services.

How to use the Form 720X Rev January Amended Quarterly Federal Excise Tax Return

Using the Form 720X Rev January Amended Quarterly Federal Excise Tax Return involves several steps. First, gather all relevant documentation related to the original return you are amending. This includes previous returns and any supporting documents that justify the changes. Next, fill out the form accurately, ensuring that you provide the correct information for the amended periods. After completing the form, review it thoroughly to avoid any further errors before submission. Finally, submit the amended return according to the guidelines provided by the IRS.

Steps to complete the Form 720X Rev January Amended Quarterly Federal Excise Tax Return

Completing the Form 720X Rev January involves a systematic approach:

- Review the original Form 720 filed for the relevant quarter.

- Identify the specific errors or changes that need to be corrected.

- Obtain the Form 720X from the IRS website or authorized sources.

- Fill in the required fields, including your business information and the adjustments being made.

- Attach any necessary documentation that supports your amendments.

- Double-check all entries for accuracy.

- Submit the completed form to the IRS by the appropriate deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720X Rev January are crucial for compliance. Typically, amended returns must be filed within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later. It is important to keep track of these deadlines to avoid penalties. Additionally, specific deadlines may vary based on the type of excise tax being amended, so consulting the IRS guidelines is recommended.

Key elements of the Form 720X Rev January Amended Quarterly Federal Excise Tax Return

The Form 720X Rev January includes several key elements that are essential for accurate completion:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Amendment Details: Specific changes being made to the original return.

- Tax Calculation: Adjusted tax amounts based on the amendments.

- Signature: Required signature of the taxpayer or authorized representative.

Legal use of the Form 720X Rev January Amended Quarterly Federal Excise Tax Return

The legal use of the Form 720X Rev January is governed by IRS regulations. It is intended solely for amending previously filed excise tax returns. Filing this form correctly ensures that taxpayers remain compliant with federal tax laws. Failure to use the form appropriately can result in penalties or additional scrutiny from the IRS. Therefore, it is important to understand the legal implications and requirements associated with this form.

Quick guide on how to complete form 720x rev january amended quarterly federal excise tax return

Complete [SKS] effortlessly on any device

Online document handling has gained traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the resources needed to create, adjust, and eSign your documents promptly without unnecessary delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant sections of the documents or redact sensitive information using tools available from airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Thoroughly review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 720X Rev January Amended Quarterly Federal Excise Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 720x rev january amended quarterly federal excise tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 720X Rev January Amended Quarterly Federal Excise Tax Return?

The Form 720X Rev January Amended Quarterly Federal Excise Tax Return is a specialized tax form used by businesses to amend previously filed quarterly excise tax returns. It allows for corrections and adjustments, ensuring accurate tax compliance. By utilizing airSlate SignNow, you can easily prepare and file this form online, streamlining the process.

-

How can airSlate SignNow help with the Form 720X Rev January Amended Quarterly Federal Excise Tax Return?

airSlate SignNow provides a user-friendly platform that simplifies the preparation and signing process for the Form 720X Rev January Amended Quarterly Federal Excise Tax Return. With secure e-signature features and easy document management, you can efficiently complete and submit your amended return without hassle.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers a range of pricing plans to suit different business needs, including options for individuals and enterprises. These plans provide access to features specifically designed for managing tax forms like the Form 720X Rev January Amended Quarterly Federal Excise Tax Return. You can choose a plan that fits your budget while ensuring compliance.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow includes features such as customizable templates, secure e-signatures, and automated workflows specifically designed for tax documents like the Form 720X Rev January Amended Quarterly Federal Excise Tax Return. These tools enhance efficiency and accuracy in managing your tax obligations.

-

Is airSlate SignNow compliant with federal regulations for tax submissions?

Yes, airSlate SignNow is fully compliant with federal regulations, ensuring that the e-signatures used for the Form 720X Rev January Amended Quarterly Federal Excise Tax Return are legally valid. This compliance provides peace of mind that your tax submissions will meet all required legal standards.

-

Can airSlate SignNow integrate with other accounting software for tax preparation?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax preparation software, enabling users to efficiently manage the Form 720X Rev January Amended Quarterly Federal Excise Tax Return alongside other financial documents. These integrations enhance workflow and data accuracy.

-

What are the benefits of using airSlate SignNow for the Form 720X Rev January Amended Quarterly Federal Excise Tax Return?

Using airSlate SignNow for the Form 720X Rev January Amended Quarterly Federal Excise Tax Return offers signNow benefits, such as saving time, reducing paperwork, and ensuring accurate submissions. Its intuitive interface and powerful features make it easier for businesses to stay compliant with tax regulations while managing their documents efficiently.

Get more for Form 720X Rev January Amended Quarterly Federal Excise Tax Return

Find out other Form 720X Rev January Amended Quarterly Federal Excise Tax Return

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online