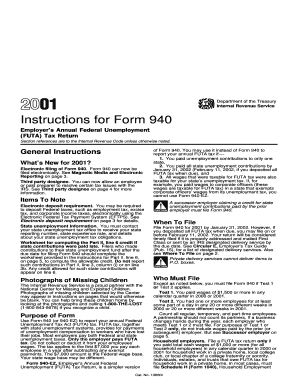

Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

Understanding Form 940: Employer's Annual Federal Unemployment Tax Return

The Instructions For Form 940 Employer's Annual Federal Unemployment FUTA Tax Return provide essential guidance for employers in the United States regarding their federal unemployment tax obligations. This form is specifically designed for reporting and paying the Federal Unemployment Tax Act (FUTA) tax, which funds unemployment compensation for workers who have lost their jobs. Employers must file this form annually if they meet certain criteria, including having paid wages of $1,500 or more in any calendar quarter or having at least one employee for some part of a day in any 20 or more weeks during the current or preceding calendar year.

Steps to Complete the Instructions For Form 940

Completing Form 940 involves several key steps to ensure accurate reporting of unemployment taxes. First, employers need to gather relevant payroll information, including total wages paid and the amount of FUTA tax owed. Next, they should fill out the form, providing details such as the employer's identification number, the total taxable wages, and the amount of tax calculated. It is crucial to review the form for accuracy before submission. Employers should also ensure they are aware of any state-specific unemployment tax obligations that may affect their federal filing.

Filing Deadlines for Form 940

Employers must adhere to specific deadlines when filing Form 940 to avoid penalties. The form is due by January 31 of the year following the tax year being reported. If an employer has deposited all FUTA tax owed on time, they may have until February 10 to file the form. Understanding these deadlines is essential for compliance and to avoid incurring unnecessary fees or interest charges.

Required Documents for Filing Form 940

When preparing to file Form 940, employers should have several documents ready. This includes payroll records that detail wages paid to employees, any previous tax filings, and documentation of any state unemployment taxes paid. Having these documents organized will facilitate a smoother filing process and help ensure that all necessary information is accurately reported on the form.

Penalties for Non-Compliance with Form 940

Failure to file Form 940 on time or accurately can result in significant penalties for employers. The IRS imposes a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, if the form is not filed at all, the employer may face further penalties and interest on the unpaid tax. Understanding these consequences emphasizes the importance of timely and accurate filing.

Obtaining the Instructions For Form 940

Employers can obtain the Instructions For Form 940 from the IRS website or through various accounting resources. The instructions provide detailed guidance on how to complete the form, including definitions of terms, explanations of calculations, and examples of common scenarios. Having access to these instructions is essential for ensuring compliance with federal unemployment tax requirements.

Legal Use of Form 940

The legal use of Form 940 is governed by federal tax laws, which require employers to report and pay federal unemployment taxes. This form serves as a declaration of the employer's tax liability and is crucial for maintaining compliance with the IRS. Employers should ensure they understand their legal obligations regarding the form to avoid potential legal issues or penalties.

Quick guide on how to complete instructions for form 940 employers annual federal unemployment futa tax return

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any holdups. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Method to Alter and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 940 employers annual federal unemployment futa tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return?

The Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return provide detailed guidance on how employers can report their federal unemployment tax liability. This form is essential for businesses to ensure compliance with the federal requirements regarding unemployment taxes. Familiarizing yourself with these instructions can help avoid costly penalties.

-

How can airSlate SignNow help with the Instructions for Form 940?

airSlate SignNow simplifies the process by allowing users to electronically sign and send the Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return. Our platform enhances efficiency and ensures that all necessary documents are completed accurately and on time. Using SignNow helps reduce the stress involved in tax compliance.

-

What features does airSlate SignNow offer for managing business documents related to Form 940?

airSlate SignNow offers robust features including eSigning, document templates, and secure cloud storage for managing documents related to the Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return. These features streamline the documentation process, making it easy to update and access your information from anywhere. This ensures that you always have the latest version at your fingertips.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit various business sizes and needs, starting with a free trial to explore our services. Our pricing is cost-effective, especially for businesses that need to manage the Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return efficiently. We provide scalable solutions, so you only pay for what your business requires.

-

How does airSlate SignNow ensure the security of documents related to my tax filings?

Security is a top priority for airSlate SignNow. We use advanced encryption protocols and compliance with industry standards to protect your documents, including the Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return. Our secure platform ensures that your sensitive information remains confidential and safe from unauthorized access.

-

Can I integrate airSlate SignNow with my existing accounting software for handling Form 940?

Yes, airSlate SignNow offers seamless integrations with popular accounting and payroll software to streamline your workflow, including managing the Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return. This integration allows you to easily transfer data and ensure accuracy across all your business documentation. It simplifies the management of tax filings.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including the Instructions for Form 940 Employer's Annual Federal Unemployment FUTA Tax Return, provides numerous benefits such as increased efficiency, reduced errors, and improved compliance. The platform simplifies the eSignature process, accelerating document turnaround time. This means you can focus on growing your business rather than worrying about paperwork.

Get more for Instructions For Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

Find out other Instructions For Form 940 Employer's Annual Federal Unemployment FUTA Tax Return

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form