Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA

What is the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA

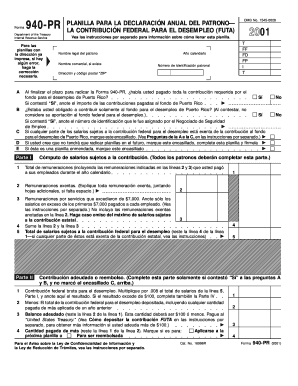

The Form 940 PR, also known as Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA, is a crucial document for employers in Puerto Rico. This form is utilized to report and pay federal unemployment taxes under the Federal Unemployment Tax Act (FUTA). Employers must file this form annually to ensure compliance with federal regulations regarding unemployment contributions. It provides a summary of the employer's liability for unemployment taxes and is essential for maintaining eligibility for federal unemployment benefits.

Steps to complete the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA

Completing the Form 940 PR involves several key steps to ensure accurate reporting. First, gather all necessary financial records, including payroll data and previous tax filings. Next, fill in the employer identification information, including the business name and address. It is essential to report the total wages paid to employees and the corresponding unemployment tax liability. After entering all required information, review the form for accuracy. Finally, submit the completed form by the designated deadline to avoid penalties.

How to obtain the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA

Employers can obtain the Form 940 PR from the Internal Revenue Service (IRS) website or through authorized tax preparation services. It is available in both digital and printable formats, allowing for easy access and completion. Additionally, local IRS offices may provide physical copies of the form. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal use of the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA

The legal use of the Form 940 PR is integral for employers to fulfill their federal tax obligations. Filing this form accurately ensures compliance with federal laws governing unemployment taxes. Employers must understand that failure to file or inaccuracies in reporting can lead to penalties and interest charges. It is advisable to consult with a tax professional to ensure that all legal requirements are met when submitting this form.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the Form 940 PR to avoid penalties. The form is typically due by January 31 of the year following the tax year being reported. If payments are made on time, employers may have until February 10 to file the form without incurring penalties. It is crucial to keep track of these dates to ensure timely submission and compliance with federal regulations.

Penalties for Non-Compliance

Failure to file the Form 940 PR or inaccuracies in the submitted information can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, underreporting unemployment taxes may lead to further financial liabilities. Employers should prioritize accurate and timely filing to avoid these penalties and maintain good standing with federal tax authorities.

Quick guide on how to complete form 940 pr fill in version planilla para la declaracion anual del patrono la contribcion federal para el desempleo futa

Manage [SKS] seamlessly on any device

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the proper template and store it securely online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 940 pr fill in version planilla para la declaracion anual del patrono la contribcion federal para el desempleo futa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA?

The Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA is a crucial document for employers in Puerto Rico. It allows them to report their annual federal unemployment tax contributions. Utilizing airSlate SignNow simplifies the process of completing and submitting this form, ensuring compliance with federal regulations.

-

How does airSlate SignNow help me complete the Form 940 PR Fill in Version?

airSlate SignNow provides an intuitive interface that guides users through the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA. With features like auto-fill and customizable templates, businesses can efficiently gather all necessary information, thereby saving time and reducing errors in their filings.

-

Is there a cost associated with using airSlate SignNow for the Form 940 PR Fill in Version?

Yes, airSlate SignNow offers various pricing plans, tailored to meet the needs of different businesses. Each plan provides access to essential features required for completing the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA. To find the perfect fit, it’s best to explore our pricing page for detailed information.

-

What features make airSlate SignNow essential for processing the Form 940 PR?

AirSlate SignNow includes essential features such as eSignature, easy document sharing, and real-time tracking. These capabilities streamline the submission process for the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA. Additionally, user-friendly access ensures you can complete your forms efficiently and securely.

-

Can I integrate airSlate SignNow with other software for filing the Form 940 PR?

Absolutely! AirSlate SignNow offers integrations with various popular business applications, enhancing your ability to manage documents. By integrating with payroll and accounting software, you can seamlessly access the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA, making the filing process even smoother.

-

What are the benefits of using airSlate SignNow for Form 940 PR?

Using airSlate SignNow for the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA provides numerous benefits. You’ll enjoy a user-friendly experience, enhanced accuracy, and faster submission times. Additionally, our secure platform ensures that your sensitive information is protected at all times.

-

How can I ensure my Form 940 PR is filed correctly using airSlate SignNow?

To ensure accurate filing of the Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA with airSlate SignNow, take advantage of our templates and automatic validation checks. These features help prevent common mistakes. It’s also recommended to review the completed form before submission to ensure all information is correct.

Get more for Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA

- Inspection checklist complete this inventory checklist as soon as you sign the lease to your apartment form

- Land lease agreement in bangladesh form

- Deeg com form

- Fit to fly certificate pregnancy pdf form

- Mystery of history volume 2 pdf form

- Printable behavior observation forms

- Music academy registration form 20426014

- Ebmud recreation area private boat launch inspection form

Find out other Form 940 PR Fill in Version Planilla Para La Declaracion Anual Del Patrono La Contribcion Federal Para El Desempleo FUTA

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe