Income Tax Return for Real Estate Investment Trusts for Calendar Year or Tax Year Beginning , , Ending , 20 OMB No Form

What is the Income Tax Return for Real Estate Investment Trusts?

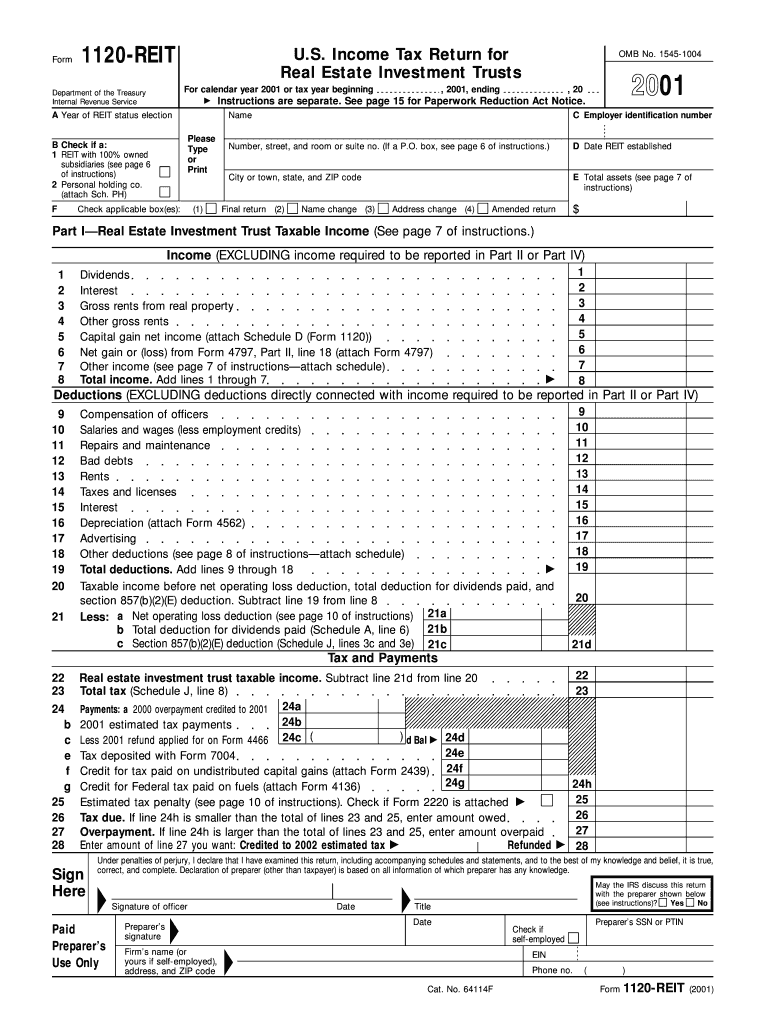

The Income Tax Return for Real Estate Investment Trusts (REITs) is a specific tax form that REITs in the United States must file annually. This form is designed to report the income, deductions, and credits of the trust for the calendar year or tax year specified. It ensures that REITs comply with the Internal Revenue Service (IRS) regulations, allowing them to maintain their tax-exempt status on certain types of income. The form typically includes detailed information about the trust's operations, income sources, and distributions to shareholders.

Steps to Complete the Income Tax Return for Real Estate Investment Trusts

Completing the Income Tax Return for REITs involves several key steps. First, gather all necessary financial records, including income statements, balance sheets, and details of distributions made to shareholders. Next, fill out the form accurately, ensuring that all income sources and deductions are reported correctly. It is essential to pay attention to the specific sections of the form that require detailed information about asset holdings and liabilities. After completing the form, review it for accuracy and ensure that all required signatures are included before submission.

Filing Deadlines and Important Dates

REITs must adhere to specific filing deadlines to avoid penalties. Generally, the Income Tax Return for REITs is due on the fifteenth day of the third month following the end of the tax year. For calendar year filers, this means the due date is March fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for REITs to mark these dates on their calendars to ensure timely filing and compliance with IRS regulations.

Required Documents for Filing

To successfully file the Income Tax Return for REITs, several documents are essential. These include financial statements that detail the trust's income and expenses, records of distributions made to shareholders, and any supporting documentation for deductions claimed. Additionally, any prior year tax returns may be useful for reference. Having these documents organized and readily available can streamline the filing process and help ensure accuracy in reporting.

IRS Guidelines for Real Estate Investment Trusts

The IRS provides specific guidelines that govern the operation and taxation of REITs. These guidelines outline the requirements for qualifying as a REIT, including asset composition, income sources, and distribution mandates. Understanding these guidelines is vital for REITs to maintain their tax-exempt status. The IRS also offers resources and publications that provide detailed information on compliance, which can be beneficial when preparing the Income Tax Return.

Penalties for Non-Compliance

Failure to file the Income Tax Return for REITs on time or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, if a REIT does not meet the requirements for maintaining its tax-exempt status, it may face further financial repercussions, including taxation on its income. It is essential for REITs to understand the importance of compliance to avoid these penalties.

Quick guide on how to complete income tax return for real estate investment trusts for calendar year or tax year beginning ending 20 omb no

Prepare [SKS] easily on any device

Online document management has become popular with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No

Create this form in 5 minutes!

How to create an eSignature for the income tax return for real estate investment trusts for calendar year or tax year beginning ending 20 omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No.?

The Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No. is a specific IRS form that REITs must file to report their income, deductions, and tax liabilities. This form ensures transparency in real estate investment operations and compliance with federal tax regulations. Understanding this form is essential for businesses in the real estate sector.

-

How can airSlate SignNow assist with filing the Income Tax Return For Real Estate Investment Trusts?

airSlate SignNow offers a user-friendly platform that allows businesses to electronically sign and send documents necessary for filing the Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No. With our solution, ensuring timely submissions and maintaining proper records becomes effortless.

-

What are the key features of airSlate SignNow for handling tax-related documents?

Key features of airSlate SignNow include document eSigning, secure storage, and compliance tracking, which are critical when preparing the Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No. Our platform streamlines the document workflow, making it easier to manage crucial tax documentation.

-

Is airSlate SignNow cost-effective for small firms handling tax documents?

Yes, airSlate SignNow offers competitive pricing tailored to small firms, providing cost-effective solutions for managing tax documents, including the Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No. Our flexible plans cater to businesses of all sizes, ensuring affordability without compromising on features.

-

What benefits does eSigning provide for tax documentation?

eSigning through airSlate SignNow speeds up the document signing process, allowing for quicker submission of the Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No. Additionally, it enhances security, helps reduce paper waste, and ensures that all save documents are legally binding, which is crucial for tax compliance.

-

Can airSlate SignNow integrate with accounting software to manage tax filings?

Absolutely! airSlate SignNow seamlessly integrates with various accounting platforms, making it easier to handle the Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No. This integration ensures that your documents are automatically updated and linked to your financial data, simplifying your overall tax filing process.

-

How does airSlate SignNow ensure compliance with tax regulations?

airSlate SignNow is designed with compliance in mind, ensuring that all aspects of document signing and storage meet legal standards. By using our solution for the Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No., businesses can rest assured that they are adhering to IRS regulations and maintaining proper records.

Get more for Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No

Find out other Income Tax Return For Real Estate Investment Trusts For Calendar Year Or Tax Year Beginning , , Ending , 20 OMB No

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word