Instructions for Form 2106 Rev March

What is the Instructions For Form 2106 Rev March

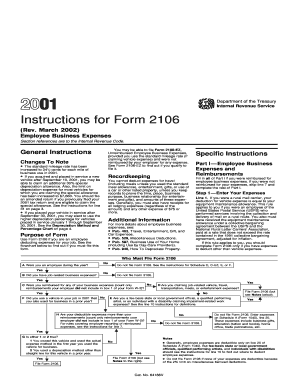

The Instructions For Form 2106 Rev March are guidelines provided by the IRS for taxpayers who need to report their employee business expenses. This form is primarily used by employees who incur unreimbursed expenses related to their job. These expenses may include costs for travel, meals, entertainment, and other business-related activities. Understanding these instructions is crucial for accurately completing the form and ensuring compliance with tax regulations.

Steps to complete the Instructions For Form 2106 Rev March

Completing the Instructions For Form 2106 involves several key steps:

- Gather all relevant documentation, including receipts and records of expenses.

- Review the specific categories of expenses that can be claimed, such as travel, meals, and lodging.

- Fill out the form by entering your total expenses in the appropriate sections.

- Ensure that you have correctly calculated any reimbursements from your employer, as these need to be deducted from your total expenses.

- Double-check your entries for accuracy and completeness before submission.

Key elements of the Instructions For Form 2106 Rev March

Several key elements are essential to understand when working with the Instructions For Form 2106:

- Expense Categories: Familiarize yourself with the various categories of expenses that can be claimed, such as transportation, meals, and lodging.

- Record Keeping: Maintain thorough records of all expenses, including receipts and invoices, to substantiate your claims.

- Employer Reimbursements: Understand how to report any reimbursements received from your employer, as these will affect your total deductible amount.

- Filing Requirements: Be aware of the filing requirements and deadlines associated with Form 2106 to avoid penalties.

Legal use of the Instructions For Form 2106 Rev March

The legal use of the Instructions For Form 2106 is governed by IRS regulations. Taxpayers must adhere to the guidelines provided to ensure compliance with federal tax laws. Misreporting expenses or failing to provide adequate documentation can lead to audits or penalties. Therefore, it is vital to use the instructions as a reference to accurately report business expenses and maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for Form 2106 typically align with the annual tax return deadlines. Generally, taxpayers must submit their forms by April fifteenth of the following year. If additional time is needed, taxpayers can file for an extension, but it is important to ensure that Form 2106 is submitted by the extended deadline to avoid penalties.

Who Issues the Form

The IRS, or Internal Revenue Service, is the issuing authority for Form 2106. This federal agency is responsible for tax administration and ensuring compliance with tax laws in the United States. The IRS provides the form and accompanying instructions to assist taxpayers in accurately reporting their business expenses.

Quick guide on how to complete instructions for form 2106 rev march

Effortlessly prepare [SKS] on any device

Online document management has gained widespread popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select key sections of the documents or redact confidential information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your amendments.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2106 rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 2106 Rev March?

The Instructions For Form 2106 Rev March guide users on how to report employee business expenses on their tax returns. This form is crucial for employees to claim reimbursements and ensure compliance with IRS regulations regarding business expenses. Understanding these instructions can maximize tax deductions for eligible expenses.

-

How does airSlate SignNow assist with the Instructions For Form 2106 Rev March?

AirSlate SignNow streamlines the process of filling out the Instructions For Form 2106 Rev March by allowing users to easily eSign and send documents securely. Our platform ensures that all necessary fields are completed correctly to meet IRS requirements. This helps reduce errors and speeds up the filing process.

-

What features does airSlate SignNow offer for managing tax-related documents?

AirSlate SignNow offers features such as customizable templates, unlimited signing, and secure cloud storage for your tax-related documents, including the Instructions For Form 2106 Rev March. Additionally, our platform allows you to track document status in real-time, enhancing overall efficiency. These features ensure that you can manage your tax documents effortlessly.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Form 2106 Rev March?

Yes, airSlate SignNow provides a cost-effective solution for managing the Instructions For Form 2106 Rev March. Our pricing plans are designed to suit businesses of all sizes, offering various features based on your needs. We also provide a free trial so you can explore our services before committing.

-

Can airSlate SignNow integrate with other tools for tax management?

Absolutely! AirSlate SignNow offers seamless integrations with various tax management tools and software, making it easy to import and export data related to the Instructions For Form 2106 Rev March. This compatibility ensures that all your documentation processes are streamlined and centralized, saving you time and effort.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, including the Instructions For Form 2106 Rev March, offers numerous benefits such as enhanced security, ease of use, and quick turnaround times. Our platform simplifies the signing process, ensuring that documents are processed efficiently and securely. This results in greater accuracy and peace of mind when managing your tax filings.

-

How can I ensure my documents comply with the Instructions For Form 2106 Rev March?

To ensure compliance with the Instructions For Form 2106 Rev March, it is essential to use accurate templates and follow the outlined guidelines. AirSlate SignNow provides access to pre-designed templates tailored to meet IRS requirements, reducing the risk of errors. Additionally, our platform provides prompts and tips to assist in filling out the form correctly.

Get more for Instructions For Form 2106 Rev March

Find out other Instructions For Form 2106 Rev March

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF