Arkansas W2 Form 2003

What is the Arkansas W2 Form

The Arkansas W2 form is a crucial document for employees and employers in the state of Arkansas. It reports an employee's annual wages and the amount of taxes withheld from their paycheck. Employers are required to provide this form to their employees by January thirty-first of each year, detailing earnings from the previous calendar year. This form is essential for employees when filing their state and federal tax returns, as it provides the necessary information to accurately report income and calculate tax liabilities.

How to obtain the Arkansas W2 Form

To obtain the Arkansas W2 form, employees can request it directly from their employer. Employers are responsible for generating and distributing these forms to their staff. Additionally, many employers utilize payroll software that automatically generates W2 forms at the end of the tax year. Employees should ensure that their employer has their current address to receive the form promptly. If an employee does not receive their W2 by mid-February, they should follow up with their employer to ensure it has been issued.

Steps to complete the Arkansas W2 Form

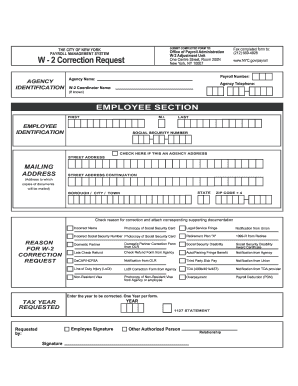

Completing the Arkansas W2 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Social Security number, employer's identification number, and total wages earned. Next, accurately fill out each section of the form, including the amounts for federal and state taxes withheld. It is crucial to double-check all entries for accuracy to avoid potential issues with tax filings. Once completed, retain a copy for your records and submit the form as required by your employer or the IRS.

Key elements of the Arkansas W2 Form

The Arkansas W2 form contains several key elements that are essential for both employers and employees. These include:

- Employee Information: This section includes the employee's name, address, and Social Security number.

- Employer Information: The employer's name, address, and Employer Identification Number (EIN) are listed here.

- Wages and Tips: This section reports the total wages, tips, and other compensation paid to the employee during the year.

- Taxes Withheld: The form details the federal and state income taxes withheld from the employee's earnings.

- State Information: Specific information related to state taxes, including the state wages and state tax withheld, is provided.

Legal use of the Arkansas W2 Form

The legal use of the Arkansas W2 form is governed by both federal and state tax laws. Employers are legally obligated to provide this form to their employees to ensure accurate reporting of income and tax obligations. Failure to issue the W2 form can result in penalties for employers. Employees must also use the information on the W2 form when filing their tax returns, as it serves as official documentation of their earnings and taxes paid. Proper completion and submission of the Arkansas W2 form are essential for compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Arkansas W2 form can be done through various methods, depending on the employer's preferences and the employee's needs. Common submission methods include:

- Online Submission: Many employers offer electronic versions of the W2 form, allowing employees to access and download it directly from their payroll systems.

- Mail: Employers typically mail physical copies of the W2 form to employees' addresses, ensuring they receive their forms by the required deadline.

- In-Person: In some cases, employees may be able to obtain their W2 forms in person from their employer's HR or payroll department.

Quick guide on how to complete arkansas w2 form

Complete Arkansas W2 Form with ease on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to obtain the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Arkansas W2 Form on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to edit and eSign Arkansas W2 Form effortlessly

- Locate Arkansas W2 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Arkansas W2 Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas w2 form

Create this form in 5 minutes!

How to create an eSignature for the arkansas w2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Arkansas W2 form?

The Arkansas W2 form is an official document that employers use to report an employee's annual wages and the amount of taxes withheld. This form is essential for employees to accurately file their state and federal tax returns. At airSlate SignNow, we assist businesses in managing these documents effectively.

-

How can airSlate SignNow help with Arkansas W2 forms?

airSlate SignNow offers an efficient platform for businesses to create, send, and eSign Arkansas W2 forms securely. Our easy-to-use solution simplifies the process, ensuring that employers and employees can handle their documents seamlessly and avoid common pitfalls associated with tax forms.

-

Is there a cost associated with using airSlate SignNow for Arkansas W2 forms?

Yes, airSlate SignNow operates on a subscription-based pricing model that is both cost-effective and tailored to your business needs. We provide various plans to accommodate different volumes and functionalities, ensuring you can manage your Arkansas W2 forms efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing Arkansas W2 forms?

Absolutely! airSlate SignNow offers integrations with numerous software platforms, including payroll and accounting tools, making it easy to manage Arkansas W2 forms alongside your existing systems. This integration ensures a smooth workflow, reducing duplication of effort and time.

-

What features does airSlate SignNow offer for handling Arkansas W2 forms?

airSlate SignNow includes features like customizable templates, secure eSigning, and automated workflow management for Arkansas W2 forms. These features enable organizations to streamline their document processes, improve compliance, and enhance overall efficiency.

-

How does eSigning work for Arkansas W2 forms using airSlate SignNow?

eSigning Arkansas W2 forms with airSlate SignNow is straightforward. Users can request signatures from employees via email, allowing them to review and sign the forms electronically in just a few clicks — saving time and minimizing paperwork.

-

Is airSlate SignNow user-friendly for managing Arkansas W2 forms?

Yes, airSlate SignNow is designed with user experience in mind, making it simple for businesses of all sizes to manage Arkansas W2 forms. Our intuitive interface ensures that even those unfamiliar with eSigning can navigate the platform with ease.

Get more for Arkansas W2 Form

- Revoking ferpa consent to release student information formdocx

- Employee tuition assistance application no employee form

- Vcu response form

- Mhq ucla form

- Failure to complete any of these blinnedu form

- Workload reassignment request form stephen f austin state sfasu

- Healthcare leadership and administration hla form

- Health profile form

Find out other Arkansas W2 Form

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile