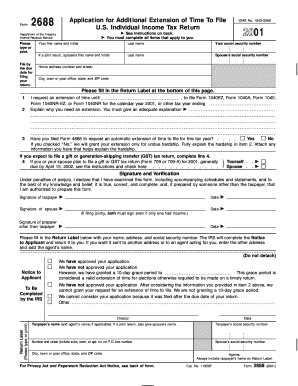

Form 2688 Application for Additional Extension of Time to File U

What is the Form 2688 Application For Additional Extension Of Time To File U

The Form 2688, known as the Application For Additional Extension Of Time To File U, is a document used by taxpayers in the United States to request an extension beyond the standard filing deadline for their tax returns. This form is essential for individuals or entities that require additional time to gather necessary financial documentation or complete their tax filings accurately. It is particularly relevant for those who may face unforeseen circumstances that hinder their ability to file on time.

How to use the Form 2688 Application For Additional Extension Of Time To File U

To use the Form 2688 effectively, taxpayers must first ensure they meet the eligibility criteria for requesting an extension. After confirming eligibility, the form should be filled out with accurate personal and financial information. It is crucial to provide a valid reason for the extension request, as this helps the IRS understand the taxpayer's situation. Once completed, the form can be submitted through the appropriate channels, ensuring compliance with IRS guidelines.

Steps to complete the Form 2688 Application For Additional Extension Of Time To File U

Completing the Form 2688 involves several key steps:

- Gather necessary documentation, including your previous tax returns and any relevant financial statements.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Provide details about your tax situation, including the reason for requesting an extension.

- Review the form for accuracy and completeness before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 2688. Generally, the application must be submitted before the original tax return due date to be considered valid. Taxpayers should also keep track of any specific deadlines set by the IRS for the current tax year, as these can vary. Missing the deadline may result in penalties or denial of the extension request.

Eligibility Criteria

To qualify for the Form 2688, taxpayers must meet specific eligibility criteria. This includes being unable to file their tax return by the original deadline due to valid reasons, such as illness, natural disasters, or other unforeseen circumstances. Additionally, the request must be made before the due date of the return. Taxpayers should ensure they have a legitimate reason for the extension to avoid complications with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Form 2688 can be submitted through various methods, depending on the taxpayer's preference and circumstances. Options include:

- Online submission through the IRS e-file system, if applicable.

- Mailing the completed form to the appropriate IRS address based on the taxpayer's location.

- In-person submission at designated IRS offices, if necessary.

Quick guide on how to complete form 2688 application for additional extension of time to file u

Finalize [SKS] effortlessly on any device

Digital document management has become widely embraced by organizations and individuals alike. It serves as a remarkable environmentally friendly alternative to conventional printed and signed papers, as you can easily find the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details carefully and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign [SKS] and maintain flawless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2688 Application For Additional Extension Of Time To File U

Create this form in 5 minutes!

How to create an eSignature for the form 2688 application for additional extension of time to file u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2688 Application For Additional Extension Of Time To File U?

The Form 2688 Application For Additional Extension Of Time To File U is a request made to the IRS for an extension to file your tax return. This form provides taxpayers with the opportunity to submit their tax documents at a later date without incurring penalties. Utilizing airSlate SignNow can streamline the signing and submission process of this form.

-

How can airSlate SignNow help with the Form 2688 Application For Additional Extension Of Time To File U?

airSlate SignNow simplifies the process of completing and submitting the Form 2688 Application For Additional Extension Of Time To File U through its easy-to-use electronic signature platform. You can fill out, sign, and send the form securely, ensuring timely submission. This helps taxpayers stay compliant and avoid filing delays.

-

Is there a cost associated with using airSlate SignNow for the Form 2688 application?

Yes, airSlate SignNow offers various pricing plans for businesses that include access to features for electronically signing documents, including the Form 2688 Application For Additional Extension Of Time To File U. The pricing is competitive, making it a cost-effective solution for individuals and businesses seeking to manage their paperwork efficiently.

-

What features does airSlate SignNow offer to assist with the Form 2688 application?

airSlate SignNow provides a range of features, including customizable templates and a secure signing process for documents like the Form 2688 Application For Additional Extension Of Time To File U. Users can also track document status, set reminders, and access documents from any device, making it a flexible tool for managing tax forms.

-

Are there any integrations available with airSlate SignNow for form management?

Yes, airSlate SignNow integrates with several applications and platforms that streamline document management and e-signature capabilities, making it easy to work with the Form 2688 Application For Additional Extension Of Time To File U. These integrations enhance workflow efficiency and ensure that tax documents can be managed alongside other business tools.

-

How secure is the airSlate SignNow platform for submitting a Form 2688 application?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and security protocols to protect sensitive information while processing the Form 2688 Application For Additional Extension Of Time To File U. This ensures that your data remains confidential and secure throughout the signing and submission process.

-

What benefits do I gain by using airSlate SignNow for my Form 2688 application?

Using airSlate SignNow for your Form 2688 Application For Additional Extension Of Time To File U allows for faster processing and easier document management. The platform enhances the user experience by enabling electronic signatures and reducing the need for physical paperwork. This leads to improved efficiency and less stress during tax season.

Get more for Form 2688 Application For Additional Extension Of Time To File U

Find out other Form 2688 Application For Additional Extension Of Time To File U

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation