March 4562 Depreciation and Amortization Including Information on Listed Property See Separate Instructions

Understanding the March 4562 Depreciation and Amortization Form

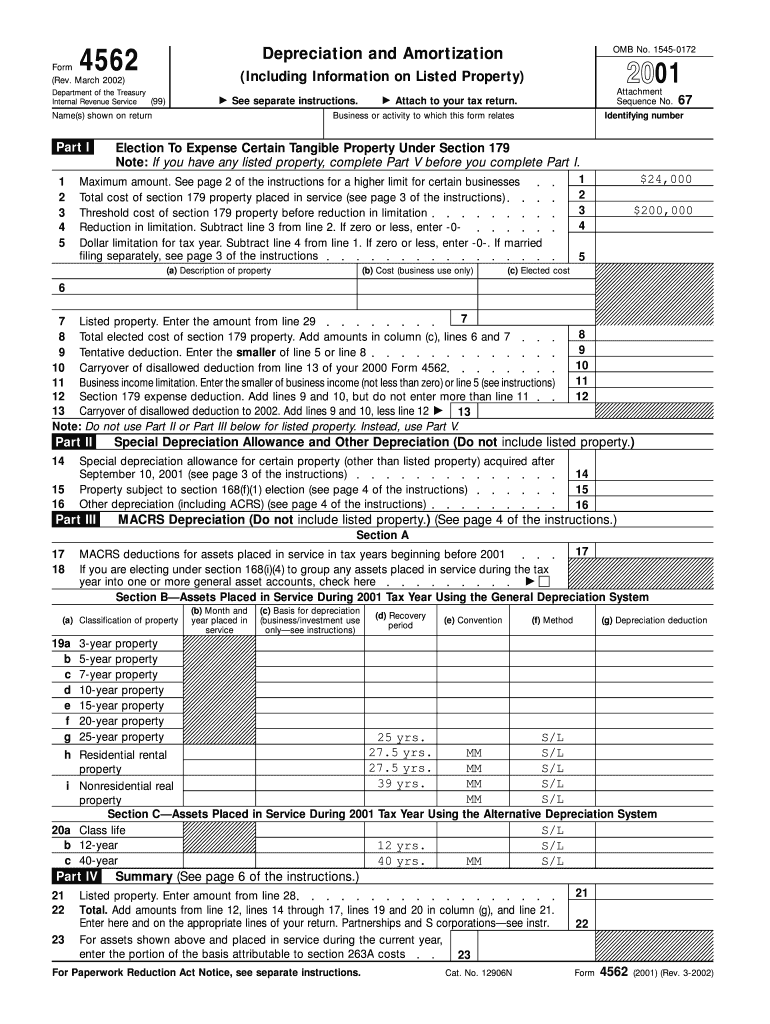

The March 4562 form is essential for businesses and individuals who need to report depreciation and amortization for tax purposes. This form is particularly important for those who own listed property, which includes assets such as vehicles and equipment used for both personal and business purposes. The form requires detailed information about the assets, including their acquisition date, cost, and the method of depreciation being used. Understanding the nuances of this form helps ensure compliance with IRS regulations and accurate reporting of financial information.

Steps to Complete the March 4562 Form

Completing the March 4562 form involves several key steps:

- Gather necessary information about your assets, including purchase dates and costs.

- Determine the appropriate depreciation method, such as straight-line or declining balance.

- Fill out the relevant sections of the form, ensuring all data is accurate and complete.

- Review the form for any errors before submission.

Each of these steps is crucial for ensuring that the form is filled out correctly, which can help avoid potential issues with the IRS.

IRS Guidelines for the March 4562 Form

The IRS provides specific guidelines for completing the March 4562 form. These guidelines include instructions on how to calculate depreciation, the types of property that qualify, and any special considerations for listed property. It's important to refer to the IRS instructions to ensure compliance with the latest tax laws and regulations. Keeping abreast of these guidelines can help taxpayers maximize their deductions and avoid penalties.

Required Documents for Filing the March 4562 Form

When preparing to file the March 4562 form, certain documents are necessary:

- Purchase receipts or invoices for listed property.

- Prior year tax returns, if applicable, to reference previous depreciation claims.

- Documentation of any improvements made to the property.

Having these documents ready can streamline the process and ensure that all information reported is accurate.

Filing Deadlines for the March 4562 Form

Filing deadlines for the March 4562 form typically align with the annual tax return deadlines. For most taxpayers, this means the form should be submitted by April fifteenth of the following year. However, businesses operating on a fiscal year may have different deadlines. It is essential to be aware of these dates to avoid late filing penalties.

Penalties for Non-Compliance with the March 4562 Form

Failure to comply with the requirements of the March 4562 form can result in significant penalties. These may include fines for incorrect reporting, interest on unpaid taxes, and potential audits by the IRS. Understanding the importance of accurate and timely submission can help mitigate these risks and ensure compliance with tax laws.

Quick guide on how to complete march 4562 depreciation and amortization including information on listed property see separate instructions

Complete [SKS] effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and safely store them online. airSlate SignNow equips you with all the resources required to create, modify, and digitally sign your documents rapidly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and digitally sign [SKS] with ease

- Obtain [SKS] and click Get Form to initiate.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions

Create this form in 5 minutes!

How to create an eSignature for the march 4562 depreciation and amortization including information on listed property see separate instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions?

The March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions is crucial for businesses to accurately report their depreciation and amortization of assets. This form helps ensure compliance with IRS regulations and avoids potential penalties. Understanding this form allows companies to maximize their tax benefits effectively.

-

How can airSlate SignNow assist with filling out the March 4562 Depreciation And Amortization form?

airSlate SignNow offers easy eSigning and document management features that streamline the process of filling out the March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions. Our platform allows users to upload, edit, and share documents securely, ensuring all information is accurate and compliant. This can signNowly reduce the time spent on routine tax tasks.

-

What are the costs associated with using airSlate SignNow for the March 4562 form?

airSlate SignNow provides a range of pricing plans to fit different business needs, making it a cost-effective solution for managing the March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions. Pricing depends on the features chosen, which can include advanced analytics and integrations. We offer a free trial so you can evaluate the platform before committing to a plan.

-

What features does airSlate SignNow offer that are beneficial for managing depreciation documentation?

airSlate SignNow includes features such as secure eSigning, document templates, and automated reminders for deadlines associated with the March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions. These functionalities help save time and improve accuracy in document handling and signing. Users can also track document progress to ensure efficient collaboration.

-

Can airSlate SignNow integrate with accounting software to assist with the March 4562 filing?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms, enhancing the workflow for managing the March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions. This integration allows users to import financial data directly into their documents, reducing manual entry errors. The result is a more streamlined and reliable filing process.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with depreciation forms?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an ideal solution for handling the March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions. Whether you're a small business or a large enterprise, our platform provides the tools needed to manage documents efficiently and effectively. Our scalability ensures that all companies can benefit from our services.

-

What support does airSlate SignNow offer for users needing help with the March 4562 form?

We provide comprehensive support for all users of airSlate SignNow, especially those dealing with the March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions. Our support team is available via chat and email to assist with any questions or concerns. Additionally, we offer a knowledge base with FAQs, tutorials, and other resources to empower users with the information they need.

Get more for March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions

Find out other March 4562 Depreciation And Amortization Including Information On Listed Property See Separate Instructions

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure