Form 4970 Fill in Version Tax on Accumulation Distribution of Trusts

What is the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts

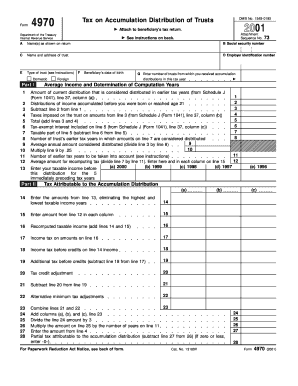

The Form 4970 is a tax form used in the United States to report the tax on accumulation distributions from trusts. This form is specifically designed for beneficiaries who receive distributions from a trust that has accumulated income. The tax implications can be complex, as the form addresses the taxation of amounts that are distributed after being retained by the trust for a certain period. Understanding this form is crucial for ensuring compliance with IRS regulations and accurately reporting income on tax returns.

How to use the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts

Using the Form 4970 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the trust and the distributions received. This includes the trust's name, the amount of distribution, and the year in which the distribution occurred. Next, fill in the required fields on the form, providing details about the trust and the beneficiary. Once completed, the form must be submitted to the IRS as part of your tax return. It is essential to keep copies for your records.

Steps to complete the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts

Completing the Form 4970 involves a systematic approach:

- Start by entering the trust's name and identifying information at the top of the form.

- Provide details about the distribution, including the amount and the tax year.

- Calculate the tax owed based on the accumulated distribution using the provided IRS guidelines.

- Review the form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

Key elements of the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts

The Form 4970 contains several key elements that are crucial for its function:

- Identification of the trust and beneficiary information.

- Details of the distribution amount and the year it was received.

- Calculation of the tax on the accumulated distribution.

- Signature and date fields for the beneficiary.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4970. These guidelines include instructions on how to report the accumulated distributions accurately and the tax rates applicable to different income levels. It is important to refer to the latest IRS publications to ensure compliance and stay updated on any changes in tax laws that may affect the form's completion.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4970 align with the general tax return deadlines in the United States. Typically, the form must be submitted by April 15 of the year following the tax year in which the distribution was received. If additional time is needed, beneficiaries may file for an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Quick guide on how to complete form 4970 fill in version tax on accumulation distribution of trusts

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as it allows you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the information carefully and then click the Done button to save your changes.

- Select your preferred method to share your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts

Create this form in 5 minutes!

How to create an eSignature for the form 4970 fill in version tax on accumulation distribution of trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts?

The Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts is a tax form designed to report and calculate the tax obligations related to distributions from trusts that accumulate income. This form helps trustees correctly identify the taxable amounts for beneficiaries, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with the Form 4970 Fill in Version?

airSlate SignNow streamlines the process of completing the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts by allowing users to easily fill in, sign, and send the document securely. Our intuitive platform simplifies form management, ensuring you can focus on compliance and accuracy without unnecessary hassle.

-

Is there a cost associated with using airSlate SignNow for the Form 4970 Fill in Version?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, including features for handling the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts. We provide a user-friendly experience and excellent value, with a variety of subscription options to suit every budget.

-

What features does airSlate SignNow offer for managing trust documents?

airSlate SignNow offers several features to manage trust documents effectively, including customizable templates, automated workflows, and secure eSigning for the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts. This enhances efficiency and accuracy when dealing with important financial documents.

-

Can I integrate airSlate SignNow with other software when filling out the Form 4970 Fill in Version?

Yes, airSlate SignNow integrates seamlessly with various applications like accounting software and CRM systems, enhancing your workflow when working on the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts. This allows for a more cohesive approach to managing your financial documentation.

-

What are the benefits of using airSlate SignNow for the Form 4970?

Using airSlate SignNow for the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts provides benefits such as ease of use, enhanced security, and time-saving automation. Our platform ensures that your documents are accurate and compliant, reducing the risk of errors and improving efficiency.

-

How secure is the airSlate SignNow platform when handling tax forms?

The airSlate SignNow platform employs advanced security measures, including encryption and secure storage, to ensure the safety of your documents like the Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts. We prioritize your privacy and the integrity of your sensitive information, giving you peace of mind.

Get more for Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts

Find out other Form 4970 Fill in Version Tax On Accumulation Distribution Of Trusts

- eSign Hawaii Construction Emergency Contact Form Computer

- eSign Hawaii Construction Emergency Contact Form Online

- eSign Hawaii Construction Emergency Contact Form Mobile

- eSign Doctors Word Connecticut Computer

- eSign Hawaii Construction Emergency Contact Form Now

- eSign Hawaii Construction Emergency Contact Form Later

- eSign Hawaii Construction Emergency Contact Form Myself

- eSign Doctors Document Connecticut Computer

- eSign Doctors Word Connecticut Mobile

- eSign Hawaii Construction Emergency Contact Form Free

- eSign Hawaii Construction Emergency Contact Form Secure

- eSign Doctors Word Connecticut Now

- eSign Hawaii Construction Emergency Contact Form Fast

- eSign Doctors Document Connecticut Mobile

- eSign Hawaii Construction Emergency Contact Form Simple

- eSign Hawaii Construction Emergency Contact Form Easy

- eSign Doctors Word Connecticut Later

- eSign Hawaii Construction Emergency Contact Form Safe

- eSign Doctors Document Connecticut Now

- eSign Doctors Word Connecticut Myself