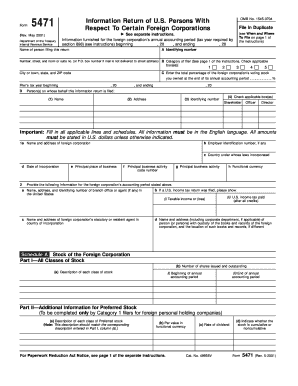

Form 5471 Information Return of U

What is the Form 5471 Information Return Of U

The Form 5471 Information Return of U.S. Persons With Respect to Certain Foreign Corporations is a tax form required by the Internal Revenue Service (IRS) for U.S. citizens and residents who have certain interests in foreign corporations. This form is primarily used to report information regarding the foreign corporation's financial activities, ownership structure, and transactions with related parties. It helps the IRS monitor compliance with U.S. tax laws and ensures that U.S. taxpayers are accurately reporting their foreign income and investments.

How to use the Form 5471 Information Return Of U

To effectively use the Form 5471, taxpayers must first determine if they meet the criteria for filing. This typically includes having control over a foreign corporation or owning a significant share of it. Once eligibility is established, the taxpayer should gather all necessary financial information regarding the foreign corporation, including balance sheets, income statements, and details of any transactions. The form must be filled out accurately, providing comprehensive details as required by the IRS. After completion, it should be submitted alongside the taxpayer's annual tax return.

Steps to complete the Form 5471 Information Return Of U

Completing the Form 5471 involves several key steps:

- Determine your filing requirement based on ownership and control of the foreign corporation.

- Gather financial statements and relevant documentation from the foreign corporation.

- Fill out the form, ensuring all sections are completed accurately, including information about shareholders and financial transactions.

- Review the form for completeness and accuracy before submission.

- Submit the form with your annual tax return by the appropriate deadline.

Filing Deadlines / Important Dates

The filing deadline for Form 5471 typically aligns with the due date of the taxpayer's annual income tax return, including any extensions. For most U.S. taxpayers, this means the form is due on April 15. However, if an extension is filed, the deadline may be extended to October 15. It is crucial to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 5471 when required can result in significant penalties. The IRS imposes a penalty of $10,000 for each form that is not filed on time. Additionally, if the failure to file is deemed intentional, the penalties can increase substantially. It is important for taxpayers to understand their filing obligations to avoid these costly repercussions.

Required Documents

When preparing to file Form 5471, taxpayers should have the following documents on hand:

- Financial statements of the foreign corporation, including balance sheets and income statements.

- Details of ownership, including names and addresses of shareholders.

- Records of any transactions between the U.S. taxpayer and the foreign corporation.

- Tax identification numbers for both the U.S. taxpayer and the foreign corporation.

Legal use of the Form 5471 Information Return Of U

The legal use of Form 5471 is mandated by U.S. tax law, specifically for U.S. persons who have control or significant ownership in foreign corporations. Filing this form ensures compliance with the IRS regulations and helps prevent tax evasion. It is essential for taxpayers to understand the legal implications of their foreign investments and the necessity of reporting them accurately.

Quick guide on how to complete form 5471 information return of u

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure seamless communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5471 Information Return Of U

Create this form in 5 minutes!

How to create an eSignature for the form 5471 information return of u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5471 Information Return Of U. used for?

The Form 5471 Information Return Of U. is a crucial document for U.S. citizens and residents who are shareholders in foreign corporations. It helps the IRS gather information regarding foreign income and financial interests. Filing this form ensures compliance with U.S. tax laws and can help prevent penalties.

-

How can airSlate SignNow assist with the Form 5471 Information Return Of U.?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Form 5471 Information Return Of U. With user-friendly features, you can easily manage and track your forms, ensuring timely submission and compliance with IRS regulations.

-

What are the pricing options for using airSlate SignNow for Form 5471 Information Return Of U.?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. Whether you require basic features or advanced solutions for managing the Form 5471 Information Return Of U., there's a plan suitable for you. Explore the pricing page to find the best fit for your requirements.

-

What features does airSlate SignNow offer for handling the Form 5471 Information Return Of U.?

With airSlate SignNow, you can enjoy features such as customizable templates, electronic signatures, and secure document storage. These features simplify the process of preparing and submitting the Form 5471 Information Return Of U., making your workflow more efficient and effective.

-

Can airSlate SignNow integrate with other software for Form 5471 Information Return Of U. submissions?

Yes, airSlate SignNow seamlessly integrates with various accounting and business management applications. This allows for easy import of data necessary for the Form 5471 Information Return Of U., making the process smoother and enhancing your overall productivity.

-

How does airSlate SignNow ensure the security of my Form 5471 Information Return Of U. data?

Security is a priority at airSlate SignNow. We employ industry-standard encryption and compliance measures to protect your Form 5471 Information Return Of U. data. You can trust us to keep your sensitive information secure while you focus on your business.

-

Is there customer support available for questions about the Form 5471 Information Return Of U. with airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive customer support to assist you with any questions regarding the Form 5471 Information Return Of U. Our dedicated support team is available via chat, email, or phone to ensure you have a smooth experience.

Get more for Form 5471 Information Return Of U

- Title 4 letter form

- Rem application form

- Cit 0010 f confirmation de la citoyennet canadienne du ou des cic gc form

- Certification of existing sanitary residential suffolk county suffolkcountyny form

- Downloadable form ls 57

- Play cafe business plan form

- Bkj bor daf apc 04 pin 1 17 form

- Deposit money notice form

Find out other Form 5471 Information Return Of U

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself