Form 8288 Rev August , Fill in Version U S Withholding Tax Return for Dispositions by Foreign Persons of U S Real Property Inter

What is the Form 8288 Rev August

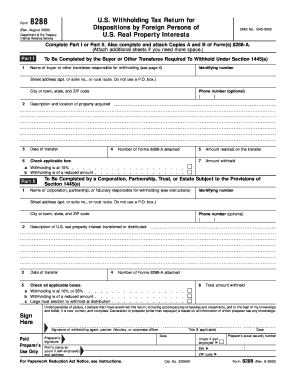

The Form 8288 Rev August, officially known as the U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests, is a tax form used by foreign individuals or entities that sell or dispose of U.S. real property interests. This form is essential for reporting and remitting the withholding tax that is required under U.S. tax law. The purpose of this form is to ensure compliance with the Foreign Investment in Real Property Tax Act (FIRPTA), which mandates that buyers withhold a percentage of the sales price when purchasing U.S. real estate from foreign sellers.

Steps to complete the Form 8288 Rev August

Completing the Form 8288 Rev August involves several key steps:

- Gather necessary information, including details about the seller, the buyer, and the property being sold.

- Complete the form by accurately filling in all required fields, such as the sales price, withholding amount, and identification numbers.

- Review the form for accuracy, ensuring that all information is correct and complete.

- Submit the form along with the payment of the withholding tax to the IRS by the specified deadline.

How to obtain the Form 8288 Rev August

The Form 8288 Rev August can be obtained directly from the IRS website. It is available for download in PDF format, allowing users to fill it out electronically or print it for manual completion. Additionally, tax professionals and accountants may have copies available for their clients. It is important to ensure that you are using the most current version of the form to comply with IRS regulations.

Key elements of the Form 8288 Rev August

Key elements of the Form 8288 include:

- Identification of the seller: Information about the foreign seller, including name, address, and taxpayer identification number.

- Details of the transaction: The sales price of the property and the amount of tax withheld.

- Buyer information: Name and address of the buyer, along with their taxpayer identification number.

- Signature and date: The form must be signed and dated by the buyer or their authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8288 are critical to avoid penalties. The form must be filed within twenty days of the date of the sale or disposition of the U.S. real property interest. It is essential to ensure that the withholding tax is also paid to the IRS by this deadline to maintain compliance with U.S. tax laws.

Penalties for Non-Compliance

Failure to file the Form 8288 Rev August or to remit the required withholding tax can result in significant penalties. The IRS may impose a penalty equal to the amount of tax that should have been withheld, in addition to interest on any unpaid amounts. It is crucial for foreign sellers and buyers to understand these obligations to avoid costly repercussions.

Quick guide on how to complete form 8288 rev august fill in version u s withholding tax return for dispositions by foreign persons of u s real property

Complete [SKS] effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8288 Rev August , Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Inter

Create this form in 5 minutes!

How to create an eSignature for the form 8288 rev august fill in version u s withholding tax return for dispositions by foreign persons of u s real property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests?

Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests is used by foreign persons to report and pay withholding tax on the sale of U.S. real property interests. It is essential for compliance with U.S. tax regulations and ensures that foreign sellers understand their tax obligations.

-

How does airSlate SignNow simplify the process of completing Form 8288 Rev August?

airSlate SignNow streamlines the process of completing Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests by offering an easy-to-use platform for form filling and eSigning. Users can quickly navigate through the required fields and electronically sign documents, making the submission process efficient.

-

What are the pricing options for airSlate SignNow when using Form 8288 Rev August?

airSlate SignNow offers flexible pricing plans to meet different needs, whether you are a small business or a large corporation. Each plan provides access to essential features for handling Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests, ensuring you find a suitable option for your requirements.

-

What features does airSlate SignNow provide for handling Form 8288 Rev August?

With airSlate SignNow, users benefit from features like customizable templates, automatic reminders, and secure storage. These tools enhance the experience of filling out Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests, helping users manage their documents efficiently and securely.

-

Is airSlate SignNow compatible with other software for managing Form 8288 Rev August?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing the overall experience of managing Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests. Popular integrations include CRM systems, cloud storage solutions, and project management tools.

-

What are the benefits of using airSlate SignNow for Form 8288 Rev August submissions?

Using airSlate SignNow for Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests ensures that your documents are handled securely and efficiently. The platform helps streamline compliance with tax requirements while providing a user-friendly interface for both filling out and eSigning documents.

-

How does airSlate SignNow ensure the security of my Form 8288 Rev August data?

airSlate SignNow prioritizes the security of your documents, including Form 8288 Rev August, Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests. The platform employs advanced encryption, secure data storage, and access controls to protect your sensitive information and ensure confidentiality.

Get more for Form 8288 Rev August , Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Inter

- State tax registration application the payroll center form

- Hac rrisd form

- African alliance investment instruction form swaziland

- Curriculum vitae et studiorum template form

- Va irp 1 form

- Personal recovery outcome measure pdf form

- Application for watercraft certificate of title va fillable form

- Mesopotamia timeline pdf form

Find out other Form 8288 Rev August , Fill in Version U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Inter

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form