Form 8810 Fill in Version Corporate Passive Activity Loss and Credit Limitations

Understanding Form 8810

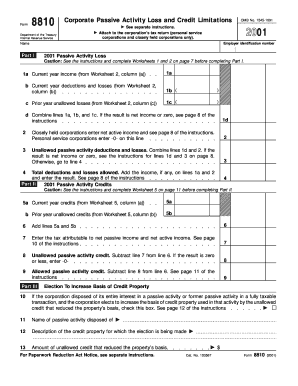

Form 8810, also known as the Corporate Passive Activity Loss and Credit Limitations, is a crucial document for corporations that engage in passive activities. This form is used to calculate the limitations on passive activity losses and credits for corporate taxpayers. It helps ensure compliance with IRS regulations regarding passive activities, which can include rental properties, limited partnerships, and other investments where the taxpayer does not materially participate. Understanding the purpose and requirements of Form 8810 is essential for accurate tax reporting.

Steps to Complete Form 8810

Completing Form 8810 involves several key steps to ensure accurate reporting of passive activity losses and credits. First, gather all relevant financial documents related to passive activities. Next, fill out the form by providing information about the corporation, including its name, address, and Employer Identification Number (EIN). Then, report the passive activity income and losses, ensuring that all calculations align with IRS guidelines. Finally, review the form for accuracy before submission to avoid potential penalties.

Obtaining Form 8810

Form 8810 can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, tax professionals and accounting software may provide access to the form, allowing for easier completion and submission. It is important to ensure that you are using the most current version of the form to comply with the latest IRS regulations.

Legal Use of Form 8810

The legal use of Form 8810 is essential for corporations that have passive activities. Filing this form accurately helps corporations adhere to IRS regulations, thereby avoiding potential audits or penalties. It is important for taxpayers to understand the legal implications of passive activity losses and credits, as improper reporting can lead to significant tax liabilities. Consulting with a tax professional can provide guidance on the legal requirements associated with Form 8810.

Key Elements of Form 8810

Key elements of Form 8810 include sections for reporting passive activity income, losses, and any applicable credits. The form requires detailed information about each passive activity, including the type of activity and the amounts involved. Additionally, it includes calculations to determine the allowable passive activity losses and credits that can be claimed. Understanding these key elements is vital for accurate completion and compliance with tax obligations.

Filing Deadlines for Form 8810

Filing deadlines for Form 8810 align with the corporate tax return deadlines. Corporations typically must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For most corporations operating on a calendar year, this means the deadline is April fifteenth. It is crucial to file Form 8810 on time to avoid penalties and ensure that all passive activity losses and credits are appropriately accounted for.

Quick guide on how to complete form 8810 instructions

Complete form 8810 instructions effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious substitute to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage form 8810 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest method to modify and eSign form 8810 instructions with ease

- Obtain 8810 form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign form 8810 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 8810 form

Create this form in 5 minutes!

How to create an eSignature for the form 8810

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 8810 form

-

What is Form 8810 and how is it used?

Form 8810 is a tax form used by businesses to report certain tax credits and is crucial for compliance. Utilizing airSlate SignNow allows you to securely eSign Form 8810, streamlining your document workflow and reducing the time spent on paperwork.

-

How can I eSign Form 8810 using airSlate SignNow?

You can eSign Form 8810 with airSlate SignNow by uploading the document, adding your signature fields, and inviting others to sign electronically. Our platform ensures that your Form 8810 is signed securely and is legally binding.

-

What pricing plans does airSlate SignNow offer for signing Form 8810?

airSlate SignNow offers a variety of pricing plans tailored to meet your business needs for signing Form 8810. You can choose from monthly or annual subscriptions, allowing you to find the most cost-effective solution for your eSigning needs.

-

Are there any specific features for managing Form 8810 documents?

Yes, airSlate SignNow provides specific features designed to assist you in managing Form 8810 documents efficiently. These features include document templates, status tracking, and automated reminders, ensuring that your Form 8810 process runs smoothly.

-

Can I integrate airSlate SignNow with other software for Form 8810 processing?

Absolutely! airSlate SignNow seamlessly integrates with various software applications to enhance your Form 8810 processing capabilities. Whether you're using CRM systems or cloud storage, our integrations make it easy to manage your documents.

-

What are the benefits of using airSlate SignNow for eSigning Form 8810?

The benefits of using airSlate SignNow for eSigning Form 8810 include increased efficiency, improved security, and reduced turnaround times. Our platform ensures that your documents are signed quickly and stored securely, making your workflow more productive.

-

Is it easy to create a new Form 8810 in airSlate SignNow?

Yes, creating a new Form 8810 in airSlate SignNow is straightforward. You can easily upload an existing document or utilize our intuitive templates to start your Form 8810 process with minimal effort.

Get more for form 8810

- Elite dangerous key bindings pdf form

- Conversion chart chemistry form

- Ictap form

- Travel itinerary form alberta gaming and liquor commission

- Kerala syllabus 9th standard onam exam question papers and answers form

- Biointeractive the p53 gene and cancer answer key form

- Release of liability form

- Po box 2510 rockville md 20847 form

Find out other form 8810 instructions

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure