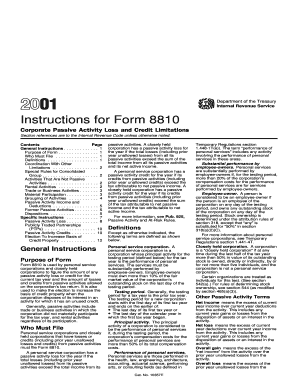

Instructions for Form 8810 Corporate Passive Activity Loss and Credit Limitations

Understanding Form 8810 Corporate Passive Activity Loss and Credit Limitations

The Instructions for Form 8810 provide essential guidance for corporations regarding passive activity loss and credit limitations. This form is specifically designed for corporate entities that have passive activities, which are generally defined as trade or business activities in which the taxpayer does not materially participate. The instructions outline how to report these activities accurately, ensuring compliance with IRS regulations.

Form 8810 is particularly relevant for corporations that wish to claim passive activity credits or losses, which can significantly impact their tax liabilities. Understanding the nuances of this form is crucial for maximizing potential tax benefits while adhering to legal requirements.

Steps to Complete Form 8810

Completing Form 8810 involves several key steps that ensure accurate reporting of passive activity losses and credits. The process typically includes:

- Gathering necessary documentation related to passive activities, including income statements and expense records.

- Reviewing the IRS guidelines to understand eligibility criteria for passive activity losses and credits.

- Filling out the form with precise details, including the identification of passive activities and the calculation of losses and credits.

- Double-checking the completed form for accuracy before submission.

Following these steps helps in avoiding common mistakes that could lead to penalties or delays in processing.

Obtaining Form 8810 and Its Instructions

Form 8810 and its accompanying instructions can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form, as updates may occur annually. Additionally, printed copies may be available at local IRS offices or through tax professionals.

Key Elements of Form 8810

Several key elements must be included when completing Form 8810:

- Identification Information: This includes the corporation's name, address, and Employer Identification Number (EIN).

- Passive Activity Information: Details regarding each passive activity, including income, losses, and credits associated with those activities.

- Calculations: Accurate calculations of passive activity losses and credits, which may involve complex tax rules.

Each of these elements plays a crucial role in ensuring that the form is filled out correctly and complies with IRS requirements.

IRS Guidelines for Form 8810

The IRS provides specific guidelines for completing Form 8810, which include definitions of passive activities, instructions for calculating losses and credits, and examples of common scenarios. It is essential to refer to these guidelines to understand the implications of passive activity rules on your corporation's tax situation. Adhering to IRS guidelines helps prevent errors that could lead to audits or penalties.

Filing Deadlines for Form 8810

Form 8810 must be filed along with the corporation's tax return, typically due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying aware of these deadlines is crucial to avoid late filing penalties.

Quick guide on how to complete instructions for form 8810 corporate passive activity loss and credit limitations 1664470

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as an original wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8810 corporate passive activity loss and credit limitations 1664470

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations?

airSlate SignNow offers unique features such as document eSigning, automated workflows, and secure cloud storage. These tools can streamline the process of managing the Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations, making it easier for businesses to handle their compliance needs efficiently.

-

How can airSlate SignNow help with understanding Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations?

With airSlate SignNow, businesses can easily create and manage documents, allowing them to focus on the essential aspects of the Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations. Additionally, the platform provides helpful resources and support to ensure users can fully grasp this intricate process.

-

What pricing plans does airSlate SignNow offer for users needing Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations?

airSlate SignNow offers various pricing plans that cater to different business needs, including options that are ideal for companies focusing on Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations. These plans are cost-effective and designed to provide maximum value with essential features included.

-

Is airSlate SignNow user-friendly for those unfamiliar with Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations?

Yes, airSlate SignNow is designed with user experience in mind. Even if you are not familiar with the Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations, the intuitive interface and accessible support resources make it easy for anyone to get started and manage their documents effectively.

-

What benefits can businesses expect from using airSlate SignNow for Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations?

Businesses can expect several benefits from using airSlate SignNow, including improved efficiency, reduced document processing times, and enhanced security for sensitive information related to the Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations. This solution streamlines collaboration and can signNowly simplify compliance.

-

Does airSlate SignNow integrate with other platforms to assist with Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations?

Absolutely! airSlate SignNow offers integrations with popular tools like CRMs, email platforms, and more. This facilitates a seamless workflow when dealing with the Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations and enhances overall productivity.

-

How does airSlate SignNow ensure the security of documents related to Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations?

airSlate SignNow utilizes advanced security measures, including data encryption and compliance with industry standards. This safeguards all documents, including those concerning the Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations, ensuring sensitive information remains protected.

Get more for Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations

Find out other Instructions For Form 8810 Corporate Passive Activity Loss And Credit Limitations

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History