Form 8878 Department of the Treasury Internal Revenue Service IRS E File Signature Authorization Application for Extension of Ti

What is the Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization Application For Extension Of Time To File OMB No

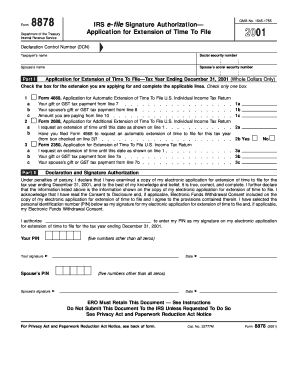

The Form 8878 is a document issued by the Department of the Treasury, Internal Revenue Service (IRS), specifically designed for taxpayers who wish to authorize an electronic return originator (ERO) to file their tax return electronically. This form is essential for individuals seeking an extension of time to file their federal income tax return. By completing Form 8878, taxpayers can ensure that their request for an extension is processed efficiently while maintaining compliance with IRS regulations.

How to use the Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization Application For Extension Of Time To File OMB No

To use Form 8878, taxpayers must first complete the form with accurate information, including their name, Social Security number, and the tax year for which they are requesting an extension. Once the form is filled out, it should be provided to the ERO, who will use it to electronically file the extension request on behalf of the taxpayer. It is important to ensure that the ERO is authorized to file the return electronically to avoid any issues with the IRS.

Steps to complete the Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization Application For Extension Of Time To File OMB No

Completing Form 8878 involves several straightforward steps:

- Gather necessary information, including your name, Social Security number, and the tax year.

- Fill out the form accurately, ensuring all details are correct.

- Sign and date the form to authorize the ERO to file your extension request.

- Submit the completed form to your ERO, who will then file it electronically with the IRS.

Key elements of the Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization Application For Extension Of Time To File OMB No

Key elements of Form 8878 include:

- Taxpayer Information: This section requires the taxpayer's name and Social Security number.

- Tax Year: The specific tax year for which the extension is requested must be indicated.

- Signature and Date: The taxpayer must sign and date the form to validate the authorization.

- ERO Information: Details about the electronic return originator must be included, confirming their role in the filing process.

Filing Deadlines / Important Dates

Filing deadlines for Form 8878 are critical for taxpayers seeking an extension. Generally, the form must be submitted by the original due date of the tax return, which is typically April 15 for individual taxpayers. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to adhere to these deadlines to avoid penalties and ensure that the IRS processes the extension request in a timely manner.

Digital vs. Paper Version

Form 8878 can be completed and submitted electronically, which is often more efficient and faster than using a paper version. The digital version allows for immediate processing by the IRS, reducing the risk of delays associated with mail delivery. However, taxpayers may also choose to fill out a paper form if they prefer. Regardless of the method chosen, it is important to ensure that all information is accurate and submitted by the deadline.

Quick guide on how to complete form 8878 department of the treasury internal revenue service irs e file signature authorization application for extension of

Easily Manage [SKS] on Any Device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to locate the right template and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without hassle. Manage [SKS] on any system with the airSlate SignNow mobile apps for Android or iOS and streamline any document-related task today.

The Simplest Way to Modify and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure clear communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization Application For Extension Of Ti

Create this form in 5 minutes!

How to create an eSignature for the form 8878 department of the treasury internal revenue service irs e file signature authorization application for extension of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization?

Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization is a critical document that allows taxpayers to electronically file their tax returns while authorizing the use of electronic signatures. This form facilitates the extension of time to file, ensuring that taxpayers remain compliant with IRS requirements.

-

How can airSlate SignNow help me manage Form 8878?

With airSlate SignNow, you can efficiently send, manage, and eSign Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization. Our platform streamlines the eSignature process, ensuring that you can submit your application for an extension of time to file with ease and security.

-

Is there a cost associated with using airSlate SignNow for Form 8878?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different user needs. By investing in our platform, you gain access to a cost-effective solution for managing Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization and other essential documents.

-

What features does airSlate SignNow offer for electronic signatures?

airSlate SignNow provides a robust set of features including customizable templates, in-person signing, automatic reminders, and secure storage. These features enhance your experience while working with Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization, making the entire signing process seamless.

-

How does airSlate SignNow ensure the security of my Form 8878 submissions?

Security is paramount at airSlate SignNow. We utilize advanced encryption methods and comply with the highest industry standards to protect your Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization submissions, ensuring that your sensitive information is securely handled throughout the process.

-

Can I integrate airSlate SignNow with other applications for my Form 8878 processing?

Absolutely! airSlate SignNow offers integration capabilities with various applications and platforms, allowing you to streamline your process. This means you can easily connect your existing tools to manage Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization efficiently.

-

How quickly can I get started with airSlate SignNow for Form 8878?

Getting started with airSlate SignNow is quick and easy. You can sign up for an account, and within minutes, begin sending and eSigning your Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization without any hassle.

Get more for Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization Application For Extension Of Ti

- Please fill out the attached form and send it back to me email

- Spa questionnaire for clients form

- Firefighter letter of recommendation form

- Americo cancel policy form

- Document control form

- Butler county probate court forms

- City of berkelely hazaedous waste and substances statement form

- Seth mias form

Find out other Form 8878 Department Of The Treasury Internal Revenue Service IRS E file Signature Authorization Application For Extension Of Ti

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast