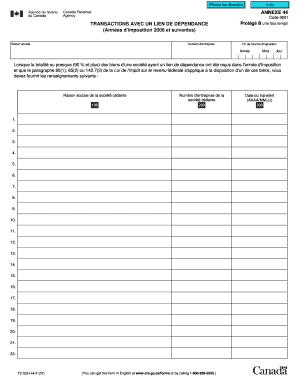

TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes Form

What is the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes

The TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes is a specific form used in the context of tax reporting and compliance. It is designed to document various transactions that may have tax implications, particularly those involving dependencies or relationships that affect tax liabilities. This form is essential for ensuring that all relevant financial activities are reported accurately to the IRS, which helps in maintaining compliance with federal tax laws.

How to use the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes

Using the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes involves accurately filling out the required information regarding your financial transactions. Users should gather all necessary documentation related to the transactions, including receipts, contracts, and any relevant correspondence. Once the form is completed, it should be submitted according to the guidelines provided by the IRS, ensuring that all information is accurate and submitted by the appropriate deadlines.

Steps to complete the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes

Completing the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes involves several key steps:

- Gather all relevant financial documents related to the transactions.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Submit the form as instructed, either online or via mail, depending on IRS guidelines.

Legal use of the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes

The TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes serves a legal purpose in documenting financial transactions that may impact tax obligations. It is crucial for individuals and businesses to use this form correctly to avoid legal repercussions, such as penalties or audits. Ensuring compliance with tax laws through proper use of this form is essential for maintaining good standing with the IRS.

Key elements of the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes

Key elements of the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes include:

- Identification of the taxpayer and any related entities.

- Details of the transactions being reported, including dates and amounts.

- Information regarding dependencies or relationships that may affect tax implications.

- Signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes are critical to ensure compliance with IRS regulations. Typically, these forms must be submitted by specific dates, which may vary based on the type of transaction or the taxpayer's filing status. It is important to stay informed about these deadlines to avoid penalties and ensure timely processing of your tax documents.

Required Documents

To complete the TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes, certain documents are required. These may include:

- Receipts or invoices related to the transactions.

- Contracts or agreements that outline the terms of the transactions.

- Any correspondence that may provide context or additional information about the transactions.

Quick guide on how to complete transactions avec un lien de d pendance ann es d imposition et suivantes

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained immense traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign [SKS] With Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your edits.

- Select your preferred method for sharing the form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transactions avec un lien de d pendance ann es d imposition et suivantes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes?

TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes' refer to the specific procedures and legal requirements surrounding transactions that involve dependency links for tax years. Understanding these transactions is crucial for compliance and effective tax management.

-

How does airSlate SignNow facilitate TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes'?

airSlate SignNow streamlines the signing and documentation of TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes' by providing a user-friendly platform for eSignatures. This ensures that all agreements are legally binding and easily retrievable for future reference.

-

What features does airSlate SignNow offer for managing transactions?

airSlate SignNow includes features such as document templates, automated workflows, and comprehensive signing tracking which greatly assist in managing TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes'. These functionalities enhance efficiency and compliance in transaction management.

-

Is airSlate SignNow suitable for businesses of all sizes?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, making it ideal for handling TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes'. Whether you are a small startup or a large enterprise, SignNow offers scalable pricing plans and features that fit your needs.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow provides flexible pricing options that accommodate various business needs for managing TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes'. You can choose from monthly or annual subscriptions with different tiers based on required features.

-

Can airSlate SignNow integrate with other tools?

Absolutely! airSlate SignNow offers a variety of integrations with popular business applications, enhancing your ability to manage TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes'. This means you can seamlessly connect with CRM systems, document storage solutions, and more.

-

What benefits can I expect from using airSlate SignNow for transactions?

Using airSlate SignNow for TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes' comes with several benefits, including improved turnaround times, reduced paperwork, and enhanced security. It's an efficient way to ensure compliance while saving time and resources.

Get more for TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes

- Macomb county circuit court fax filing form

- Recommended percentages form 6 a1611 g akamai

- Form 72a007 kentucky department of revenue revenue ky

- Where can i purchase a jbcc s2102 contract form

- First grade spelling words week 1 k12 reader form

- Human rights complaint form

- En del av landets smfretagsliv form

- Internship waiver form

Find out other TRANSACTIONS AVEC UN LIEN DE D PENDANCE Ann Es D 'imposition Et Suivantes

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors