Inclusion Exclusion Core Form

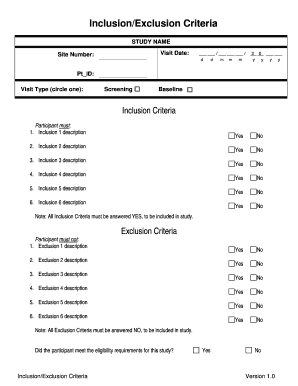

What is the Inclusion Exclusion Core Form

The Inclusion Exclusion Core Form is a crucial document used primarily in the context of tax compliance and reporting. This form assists businesses and individuals in declaring their eligibility for certain tax benefits, deductions, or exemptions. It specifically addresses the inclusion and exclusion of various income types, ensuring that taxpayers accurately report their financial activities in accordance with IRS guidelines.

How to use the Inclusion Exclusion Core Form

Using the Inclusion Exclusion Core Form involves several key steps. First, gather all necessary financial documents, including income statements and any relevant tax records. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the instructions provided with the form to understand the specific requirements for each section. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the guidelines set forth by the IRS.

Steps to complete the Inclusion Exclusion Core Form

Completing the Inclusion Exclusion Core Form requires attention to detail. Follow these steps for a smooth process:

- Start by obtaining the most recent version of the form from the IRS website or your tax professional.

- Gather all necessary documents, including income records and previous tax returns.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail your income sources, indicating which are to be included or excluded as per the form's guidelines.

- Double-check all entries for accuracy before submission.

Key elements of the Inclusion Exclusion Core Form

The Inclusion Exclusion Core Form contains several key elements that are essential for accurate reporting. Important sections include:

- Personal Information: This section requires basic identifying details about the taxpayer.

- Income Reporting: Here, taxpayers must categorize their income into included and excluded amounts.

- Signature Section: A signature is required to validate the information provided on the form.

Legal use of the Inclusion Exclusion Core Form

The legal use of the Inclusion Exclusion Core Form is governed by IRS regulations. It is essential for taxpayers to use the form correctly to ensure compliance with federal tax laws. Misuse of the form can lead to penalties or audits. Therefore, understanding the legal implications and requirements is critical for all individuals and businesses filing this form.

Filing Deadlines / Important Dates

Filing deadlines for the Inclusion Exclusion Core Form can vary depending on the taxpayer's situation. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines to avoid late filing penalties.

Quick guide on how to complete inclusion exclusion core form

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adapt, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and select Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize signNow parts of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Inclusion Exclusion Core Form

Create this form in 5 minutes!

How to create an eSignature for the inclusion exclusion core form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Inclusion Exclusion Core Form?

The Inclusion Exclusion Core Form is a crucial document for businesses that helps define the scope of coverage and exclusions in contracts. It enables organizations to clearly outline what is included and excluded in their service offerings. By using this form, businesses can enhance transparency and minimize misunderstandings.

-

How can airSlate SignNow help with the Inclusion Exclusion Core Form?

airSlate SignNow simplifies the process of completing and eSigning the Inclusion Exclusion Core Form. Our platform provides an intuitive interface that allows users to fill out, customize, and send the form quickly and securely. This enhances efficiency and ensures that all parties can easily review and sign the document.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including packages for teams looking to manage the Inclusion Exclusion Core Form efficiently. Our plans allow users to choose the features they need, making it a cost-effective solution for document management. Visit our pricing page for detailed information on each plan.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing its functionality when managing documents like the Inclusion Exclusion Core Form. This means you can connect with popular tools like Google Drive, Salesforce, and more. These integrations streamline workflows and increase productivity.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow provides a comprehensive suite of features for managing documents, including templates, bulk sending, and real-time tracking. For the Inclusion Exclusion Core Form, users can create reusable templates to ensure consistency. Additionally, our platform supports secure eSigning to keep your documents safe.

-

How does airSlate SignNow ensure document security?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Inclusion Exclusion Core Form. We employ industry-standard encryption and secure storage to protect all user data. Moreover, features like access controls and audit trails provide added peace of mind for businesses.

-

Can I customize the Inclusion Exclusion Core Form?

Absolutely! airSlate SignNow allows you to customize the Inclusion Exclusion Core Form to meet your specific business needs. You can add your branding, modify sections, and include additional clauses as required. This flexibility ensures the form accurately reflects your organization’s requirements.

Get more for Inclusion Exclusion Core Form

Find out other Inclusion Exclusion Core Form

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile