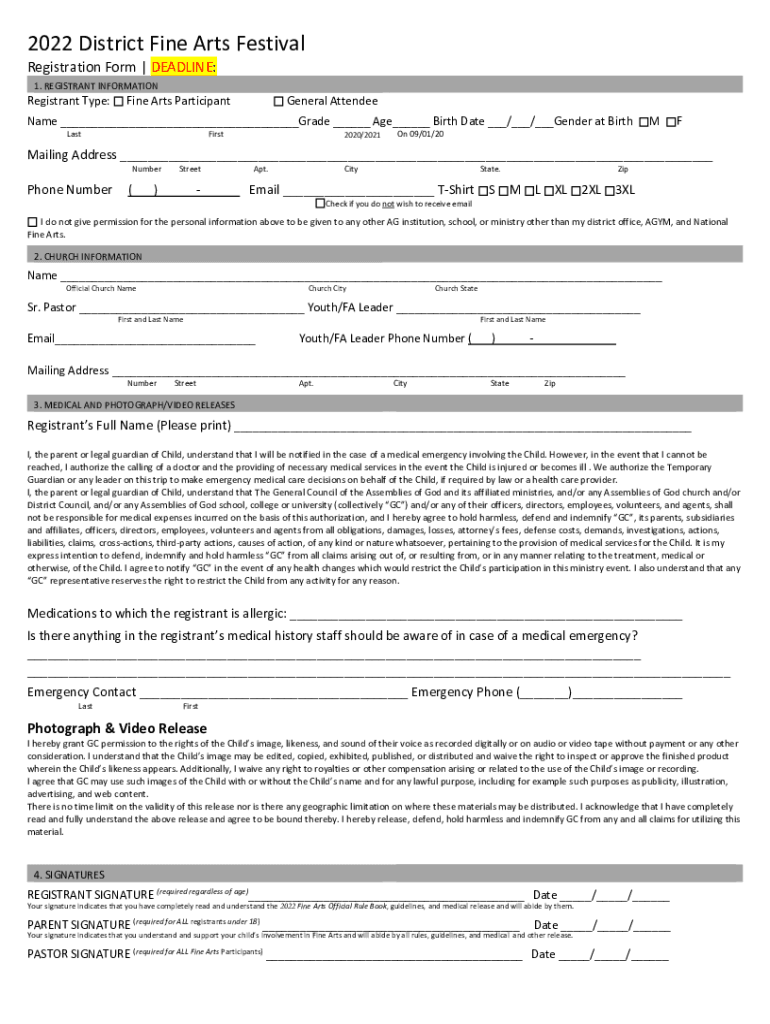

Registration Form DEADLINE

What is the Registration Form DEADLINE

The Registration Form DEADLINE is a crucial document that individuals or businesses must submit by a specific date to ensure compliance with regulatory requirements. This form is often used for various purposes, including tax registrations, business licenses, or other legal obligations. Understanding the significance of this form and its deadlines is essential for avoiding penalties and ensuring smooth operations.

Steps to complete the Registration Form DEADLINE

Completing the Registration Form DEADLINE involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal or business details, tax identification numbers, and any supporting documentation required. Next, fill out the form carefully, ensuring all fields are completed accurately. Review the form for any errors or omissions before submitting it. Finally, submit the form by the specified deadline, using the appropriate submission method, whether online, by mail, or in person.

Legal use of the Registration Form DEADLINE

The legal use of the Registration Form DEADLINE is essential for individuals and businesses to meet their obligations under U.S. law. This form may be required by federal, state, or local authorities, depending on the specific context. Failure to submit the form on time can lead to legal repercussions, including fines or the inability to conduct business legally. It is important to understand the legal implications of this form and to ensure timely submission to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the Registration Form DEADLINE vary depending on the type of registration and the governing authority. It is crucial to be aware of these important dates to ensure compliance. Generally, deadlines may fall at the end of the fiscal year, the beginning of a new tax season, or specific dates set by regulatory agencies. Keeping a calendar of these dates can help individuals and businesses stay organized and avoid missing critical deadlines.

Required Documents

When completing the Registration Form DEADLINE, specific documents may be required to support the application. Commonly required documents include proof of identity, tax identification numbers, business licenses, and any relevant financial statements. It is essential to review the requirements carefully and gather all necessary documentation before submitting the form to ensure a smooth processing experience.

Form Submission Methods (Online / Mail / In-Person)

The Registration Form DEADLINE can typically be submitted through various methods, including online platforms, traditional mail, or in-person delivery. Online submission is often the most efficient method, allowing for immediate processing and confirmation. If submitting by mail, it is advisable to use a reliable service and to send the form well in advance of the deadline. In-person submissions may be required in certain situations, such as when additional documentation needs to be presented.

Penalties for Non-Compliance

Failing to comply with the Registration Form DEADLINE can result in significant penalties. These may include fines, late fees, or even legal action depending on the nature of the form and the governing authority. Additionally, non-compliance can hinder business operations, restrict access to certain benefits, or lead to negative impacts on credit ratings. Understanding these potential penalties underscores the importance of timely and accurate submissions.

Quick guide on how to complete registration form deadline

Complete Registration Form DEADLINE effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Registration Form DEADLINE on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and eSign Registration Form DEADLINE without hassle

- Obtain Registration Form DEADLINE and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to store your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Registration Form DEADLINE and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the registration form deadline

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Registration Form DEADLINE for airSlate SignNow?

The Registration Form DEADLINE for airSlate SignNow varies based on the specific plan you select. It's crucial to adhere to this deadline to ensure uninterrupted access to our services for document signing and management. Check our website for the latest updates on Registration Form DEADLINE.

-

Are there any fees associated with the Registration Form DEADLINE?

No additional fees are associated with the Registration Form DEADLINE itself, but selecting the right plan before this date is essential to utilize all features effectively. Ensure your registration is completed before the deadline to avoid any inconvenience.

-

What features are included if I register before the Registration Form DEADLINE?

Registering before the Registration Form DEADLINE allows you to access all core features such as eSigning, document templates, and collaboration tools. Additionally, you’ll benefit from premium customer support and integration capabilities with other tools.

-

What are the benefits of signing up before the Registration Form DEADLINE?

By signing up before the Registration Form DEADLINE, you gain immediate access to our full suite of features, ensuring a smooth onboarding process. Early registration also helps avoid any potential disruption in service and allows you to start optimizing your document workflows right away.

-

Can I integrate airSlate SignNow with other platforms before the Registration Form DEADLINE?

Yes, airSlate SignNow offers various integrations with popular platforms like Google Workspace, Salesforce, and Microsoft. Registering before the Registration Form DEADLINE ensures you can take full advantage of these integrations without any delays.

-

What if I miss the Registration Form DEADLINE?

If you miss the Registration Form DEADLINE, you may experience delays in accessing the features and services of airSlate SignNow. We recommend that you register as soon as possible to take full advantage of our offerings without interruptions.

-

Are there different pricing tiers before the Registration Form DEADLINE?

Yes, airSlate SignNow provides several pricing tiers based on your business needs, which are available to review before the Registration Form DEADLINE. Each tier includes a diverse range of features, and you can choose the one that best aligns with your requirements.

Get more for Registration Form DEADLINE

Find out other Registration Form DEADLINE

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now