Dr0104ad Form

What is the Dr0104ad

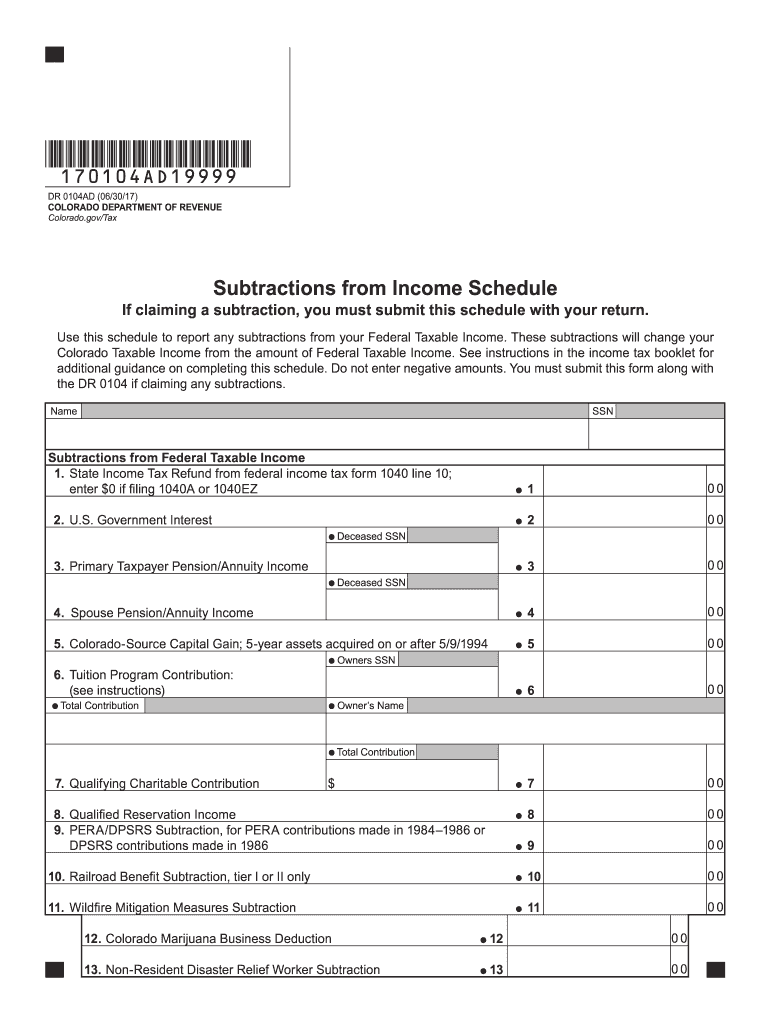

The Dr0104ad is a specific tax form used in Colorado, primarily for reporting certain types of income and calculating tax liabilities. It is essential for individuals and businesses that need to report their financial activities to the state. This form is particularly relevant for those who may have unique tax situations, such as self-employed individuals or those with specific deductions and credits. Understanding the purpose and requirements of the Dr0104ad is crucial for ensuring compliance with state tax regulations.

How to use the Dr0104ad

Using the Dr0104ad involves several steps that ensure accurate reporting of income and tax calculations. First, gather all necessary financial documents, including income statements and records of deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors before submission. Utilizing digital tools can streamline this process, allowing for easier completion and eSigning of the document.

Steps to complete the Dr0104ad

Completing the Dr0104ad requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including W-2s and 1099s.

- Download the Dr0104ad form from the Colorado Department of Revenue website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income as instructed, ensuring to include all sources of income.

- Calculate any deductions or credits you are eligible for.

- Review all entries for accuracy before finalizing the form.

- Submit the completed form either electronically or via mail, following the state’s submission guidelines.

Legal use of the Dr0104ad

The Dr0104ad must be completed and submitted in accordance with Colorado state tax laws. This form serves as a legal document, and any inaccuracies or omissions can lead to penalties. To ensure compliance, it is important to understand the legal requirements associated with the form, including deadlines and necessary supporting documents. Utilizing an eSignature solution can enhance the legal validity of your submission by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

Filing deadlines for the Dr0104ad are crucial for avoiding penalties. Typically, the form is due on the same date as the federal tax return, which is usually April fifteenth. However, it is essential to check for any changes or extensions that may apply. Keeping track of important dates ensures that you submit your form on time, maintaining compliance with state regulations.

Required Documents

To complete the Dr0104ad, you will need several documents that support your income and deductions. Required documents typically include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Records of any other income sources.

Having these documents ready will facilitate a smoother completion of the form and help ensure accuracy in reporting.

Quick guide on how to complete dr0104ad 101145256

Prepare Dr0104ad effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal sustainable substitute for traditional printed and signed documents, allowing you to locate the right template and safely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Dr0104ad on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Dr0104ad without any hassle

- Locate Dr0104ad and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Dr0104ad and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr0104ad 101145256

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the colorado 104ad and how does airSlate SignNow help with it?

The colorado 104ad is a document crucial for tax reporting in Colorado. With airSlate SignNow, you can easily create, send, and eSign the colorado 104ad, streamlining the process and ensuring compliance with state regulations.

-

How much does it cost to use airSlate SignNow for colorado 104ad management?

airSlate SignNow offers competitive pricing plans tailored to your needs, starting with a free trial. Depending on your requirements for handling documents like the colorado 104ad, you can choose a plan that fits your budget while providing robust features.

-

What features does airSlate SignNow offer for the colorado 104ad?

airSlate SignNow provides essential features including eSigning, document templates, and real-time tracking specifically for documents like the colorado 104ad. These features ensure you can manage and process your state tax documents efficiently, saving time and reducing errors.

-

Can airSlate SignNow integrate with other tools for filing the colorado 104ad?

Yes, airSlate SignNow integrates seamlessly with various CRM and accounting software, enabling you to manage your colorado 104ad alongside your other business processes. Integrating these tools enhances productivity and ensures all your documents are managed in one place.

-

Is it easy to eSign the colorado 104ad with airSlate SignNow?

Absolutely! airSlate SignNow makes eSigning the colorado 104ad very straightforward. The intuitive interface allows users to sign documents electronically in just a few clicks, making the process quick and efficient.

-

What are the benefits of using airSlate SignNow for the colorado 104ad?

Using airSlate SignNow for the colorado 104ad can signNowly enhance efficiency and accuracy in document handling. Benefits include reduced paperwork, faster turnaround times, and a secure method for obtaining necessary signatures without the hassle of physical documents.

-

How secure is airSlate SignNow when handling the colorado 104ad?

airSlate SignNow prioritizes security with advanced encryption protocols to protect your documents, including the colorado 104ad. Our platform ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Dr0104ad

Find out other Dr0104ad

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy