Business License Tax Fee ScheduleVariable Flat Rate Form

Understanding the Business License Tax Fee Schedule

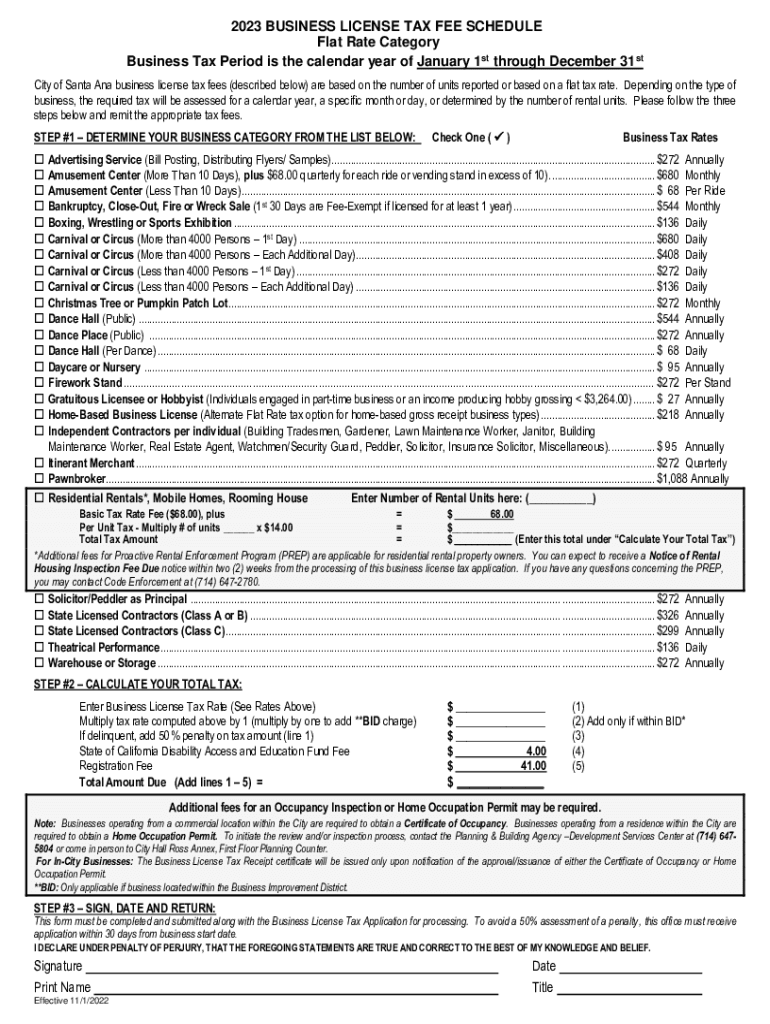

The business license tax fee schedule outlines the specific fees that businesses must pay to operate legally within a jurisdiction. These fees can vary based on factors such as the type of business, its size, and its location. Typically, municipalities establish these schedules, and they may include a variable flat rate that adjusts based on the business's revenue or number of employees. Understanding this schedule is crucial for compliance and budgeting purposes.

How to Use the Business License Tax Fee Schedule

Utilizing the business license tax fee schedule involves several steps. First, identify your business type and location, as these factors influence the applicable fees. Next, consult your local government’s website or office to access the fee schedule. Once you have the relevant information, calculate your fees based on the provided rates. This process ensures that you meet your financial obligations and maintain your business's legal status.

Steps to Complete the Business License Tax Fee Schedule

Completing the business license tax fee schedule requires careful attention to detail. Start by gathering necessary documentation, such as your business registration and financial statements. Next, fill out the required forms accurately, ensuring all information aligns with your business operations. After completing the forms, submit them along with the calculated fees to the appropriate local authority. Keep copies of all submitted documents for your records.

State-Specific Rules for the Business License Tax Fee Schedule

Each state in the U.S. has unique regulations regarding business license tax fees. These rules can dictate the fee structure, payment deadlines, and compliance requirements. It is essential to familiarize yourself with your state’s specific guidelines to avoid penalties. Local chambers of commerce or state business offices can provide valuable resources and assistance in navigating these regulations.

Penalties for Non-Compliance

Failure to comply with the business license tax fee requirements can result in significant penalties. These may include fines, interest on unpaid fees, or even the suspension of your business license. Understanding the consequences of non-compliance underscores the importance of timely payments and accurate filings. Regularly reviewing your obligations can help you avoid these costly repercussions.

Required Documents for the Business License Tax Fee Schedule

When preparing to submit your business license tax fee schedule, certain documents are typically required. These may include your business registration certificate, proof of address, financial statements, and any previous tax filings. Ensuring that you have all necessary documentation ready can streamline the application process and reduce the likelihood of errors or delays.

Examples of Using the Business License Tax Fee Schedule

Understanding practical examples of how to apply the business license tax fee schedule can enhance your comprehension. For instance, a small retail store may calculate its fees based on its annual revenue, while a service-based business might have a flat fee regardless of income. By examining these scenarios, business owners can better grasp how to navigate their specific tax obligations effectively.

Quick guide on how to complete business license tax fee schedulevariable flat rate

Effortlessly Prepare Business License Tax Fee ScheduleVariable Flat Rate on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Business License Tax Fee ScheduleVariable Flat Rate on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Business License Tax Fee ScheduleVariable Flat Rate with Ease

- Obtain Business License Tax Fee ScheduleVariable Flat Rate and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Business License Tax Fee ScheduleVariable Flat Rate to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business license tax fee schedulevariable flat rate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business license tax fee and why is it important?

A business license tax fee is a charge imposed by local or state authorities for the privilege of operating a business. It is important because it ensures that your business is compliant with local regulations and helps avoid potential fines. Understanding the implications of the business license tax fee can aid in better budgeting for your operational costs.

-

How can airSlate SignNow help with managing business license tax fee documents?

airSlate SignNow offers a streamlined solution for managing documents related to your business license tax fee. With features such as eSignature capabilities and document storage, you can easily manage and track all necessary paperwork. This not only saves time but also ensures that you remain compliant with your business licensing requirements.

-

What are the pricing options for airSlate SignNow in relation to managing business license tax fee documents?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes, allowing you to efficiently manage your business license tax fee documents within your budget. The plans are cost-effective, ensuring that you get comprehensive features without breaking the bank. Check our pricing page for more details on the most suitable plan for you.

-

What features does airSlate SignNow offer for handling business license tax fee forms?

airSlate SignNow includes several features tailored for handling business license tax fee forms. You can utilize templates, electronic signatures, and automated workflows to simplify your filing process. These features collectively enhance your document management efficiency, making it easier to comply with business licensing requirements.

-

How secure is airSlate SignNow for handling business license tax fee documents?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents related to your business license tax fee. We employ advanced encryption and compliance with industry standards to protect your data. You can rest assured that your documents are secure while using our platform.

-

Can I integrate airSlate SignNow with other software to manage business license tax fee processes?

Yes, airSlate SignNow offers integrations with various software to enhance your workflow for managing business license tax fee processes. By connecting with tools such as CRM systems and accounting software, you can streamline your operations and ensure a smooth handling of all business licensing tasks.

-

How does airSlate SignNow improve the efficiency of managing business license tax fee-related tasks?

By utilizing airSlate SignNow, you can improve the efficiency of managing tasks related to your business license tax fee signNowly. Our user-friendly interface and automated processes minimize the time spent on document handling, allowing you to focus on growing your business. This efficiency leads to better compliance and management of licensing documentation.

Get more for Business License Tax Fee ScheduleVariable Flat Rate

- Washington papers form

- Deferred prosecution contract form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497429933 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497429934 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497429935 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497429936 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497429937 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497429938 form

Find out other Business License Tax Fee ScheduleVariable Flat Rate

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast