Prospective Client Questionnaire Mary Walker Tax Services Form

What is the Prospective Client Questionnaire Mary Walker Tax Services

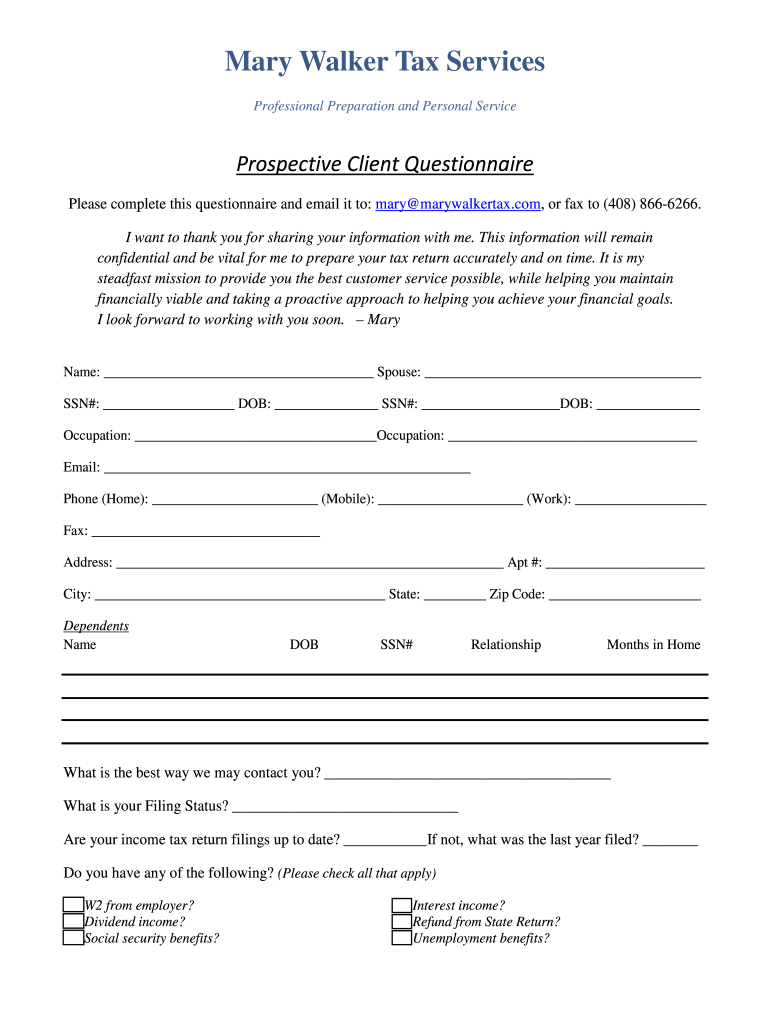

The Prospective Client Questionnaire from Mary Walker Tax Services is a comprehensive document designed to gather essential information from potential clients. This form aims to understand the financial situation, tax history, and specific needs of individuals or businesses seeking tax-related services. By collecting this information, Mary Walker Tax Services can tailor their approach and provide personalized tax strategies, ensuring that clients receive the most effective assistance for their unique circumstances.

How to use the Prospective Client Questionnaire Mary Walker Tax Services

Using the Prospective Client Questionnaire is straightforward. Clients can fill out the form either digitally or on paper, depending on their preference. It is important to provide accurate and complete information to ensure that the tax services offered align with the client's needs. Clients should review each section carefully, answering all questions to the best of their ability. Once completed, the form can be submitted to Mary Walker Tax Services for review and follow-up.

Steps to complete the Prospective Client Questionnaire Mary Walker Tax Services

Completing the Prospective Client Questionnaire involves several key steps:

- Begin by gathering necessary financial documents, such as previous tax returns, income statements, and any relevant financial records.

- Carefully read each section of the questionnaire, ensuring a clear understanding of the questions being asked.

- Provide detailed responses, particularly in areas concerning income sources, deductions, and any special tax situations.

- Review the completed questionnaire for accuracy and completeness before submission.

- Submit the form to Mary Walker Tax Services via the preferred method, whether online, by mail, or in person.

Key elements of the Prospective Client Questionnaire Mary Walker Tax Services

The Prospective Client Questionnaire includes several key elements that are crucial for effective tax planning:

- Personal Information: Basic details such as name, address, and contact information.

- Income Details: Information regarding all sources of income, including wages, investments, and business earnings.

- Deductions and Credits: A section to identify potential deductions and tax credits applicable to the client.

- Tax History: Questions regarding previous tax filings and any outstanding tax obligations.

- Special Circumstances: Areas to disclose any unique financial situations, such as self-employment or retirement.

Legal use of the Prospective Client Questionnaire Mary Walker Tax Services

The Prospective Client Questionnaire is legally used to collect personal and financial information necessary for tax preparation and planning. It complies with relevant privacy laws and regulations, ensuring that client information is handled securely and confidentially. Clients are encouraged to read the privacy policy associated with the questionnaire to understand how their information will be used and protected.

Required Documents

To accurately complete the Prospective Client Questionnaire, clients should prepare several required documents, including:

- Previous years' tax returns.

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Statements of any other income, such as rental or investment income.

- Documentation for potential deductions, such as mortgage interest statements or medical expenses.

Quick guide on how to complete prospective client questionnaire mary walker tax services

Execute Prospective Client Questionnaire Mary Walker Tax Services effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Prospective Client Questionnaire Mary Walker Tax Services on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to alter and electronically sign Prospective Client Questionnaire Mary Walker Tax Services with ease

- Locate Prospective Client Questionnaire Mary Walker Tax Services and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require reprinting forms. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Prospective Client Questionnaire Mary Walker Tax Services to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prospective client questionnaire mary walker tax services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Prospective Client Questionnaire for Mary Walker Tax Services?

The Prospective Client Questionnaire for Mary Walker Tax Services is a comprehensive form designed to gather essential information from potential clients. It helps streamline the onboarding process, ensuring that all necessary data is collected efficiently and accurately.

-

How does the Prospective Client Questionnaire benefit my tax preparation?

Utilizing the Prospective Client Questionnaire for Mary Walker Tax Services allows for a thorough understanding of your financial situation. This detailed gathering of information leads to more accurate tax preparation and personalized advice, thus optimizing your tax outcomes.

-

Is there a cost associated with the Prospective Client Questionnaire for Mary Walker Tax Services?

The Prospective Client Questionnaire for Mary Walker Tax Services is typically provided as part of our service package. There may be additional fees depending on the complexity of your financial needs, but the questionnaire itself is a valuable tool included in our offerings.

-

How do I access the Prospective Client Questionnaire for Mary Walker Tax Services?

You can easily access the Prospective Client Questionnaire for Mary Walker Tax Services online through our secure platform. Once you engage our services, you will receive a link to complete the questionnaire at your convenience.

-

Can I save my progress on the Prospective Client Questionnaire before submitting?

Yes, the Prospective Client Questionnaire for Mary Walker Tax Services allows you to save your progress. This means you can return to complete it later without losing any information, making the process more flexible and user-friendly.

-

What types of questions are included in the Prospective Client Questionnaire?

The Prospective Client Questionnaire for Mary Walker Tax Services includes various questions regarding your income, deductions, and financial goals. These inquiries help us tailor our services to meet your specific tax preparation needs effectively.

-

Can the Prospective Client Questionnaire be integrated with other tools I use?

Yes, the Prospective Client Questionnaire for Mary Walker Tax Services can often be integrated with various accounting and financial management software. This integration enhances workflow efficiency and ensures that all data is consolidated seamlessly.

Get more for Prospective Client Questionnaire Mary Walker Tax Services

- 1st 52 week period board and room cost encumbrance washington form

- 2nd 52 weeks training washington form

- 1st 52 week transportation washington form

- 2nd 52 week transportation washington form

- Functional progress washington form

- Washington disclosure form

- Notice of dishonored check civil keywords bad check bounced check washington form

- Appearance child support 497429743 form

Find out other Prospective Client Questionnaire Mary Walker Tax Services

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple