NON TAXABLE BADGE APPLICATION Directions Form

What is the NON TAXABLE BADGE APPLICATION Directions

The NON TAXABLE BADGE APPLICATION Directions provide essential guidance for individuals and organizations seeking to apply for a non-taxable badge. This badge is often required for specific activities or professions that are exempt from certain tax obligations. Understanding the directions is crucial for ensuring compliance with relevant regulations and successfully obtaining the badge.

Steps to complete the NON TAXABLE BADGE APPLICATION Directions

Completing the NON TAXABLE BADGE APPLICATION requires careful attention to detail. Here are the key steps:

- Gather necessary information, including personal identification and any relevant business details.

- Review the specific eligibility criteria to ensure you qualify for the non-taxable status.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach any required documentation that supports your application, such as proof of eligibility.

- Submit the application through the designated method, whether online, by mail, or in person.

Required Documents

To successfully complete the NON TAXABLE BADGE APPLICATION, applicants must provide specific documents. These typically include:

- Government-issued identification, such as a driver's license or passport.

- Proof of eligibility for non-taxable status, which may include tax-exempt certificates or letters.

- Any additional documentation requested in the application directions.

Eligibility Criteria

Understanding the eligibility criteria for the NON TAXABLE BADGE APPLICATION is vital. Generally, applicants must meet specific conditions related to their profession or the nature of their activities. Common criteria include:

- Engagement in a profession that qualifies for non-taxable status.

- Compliance with local, state, and federal regulations.

- Submission of valid documentation proving eligibility.

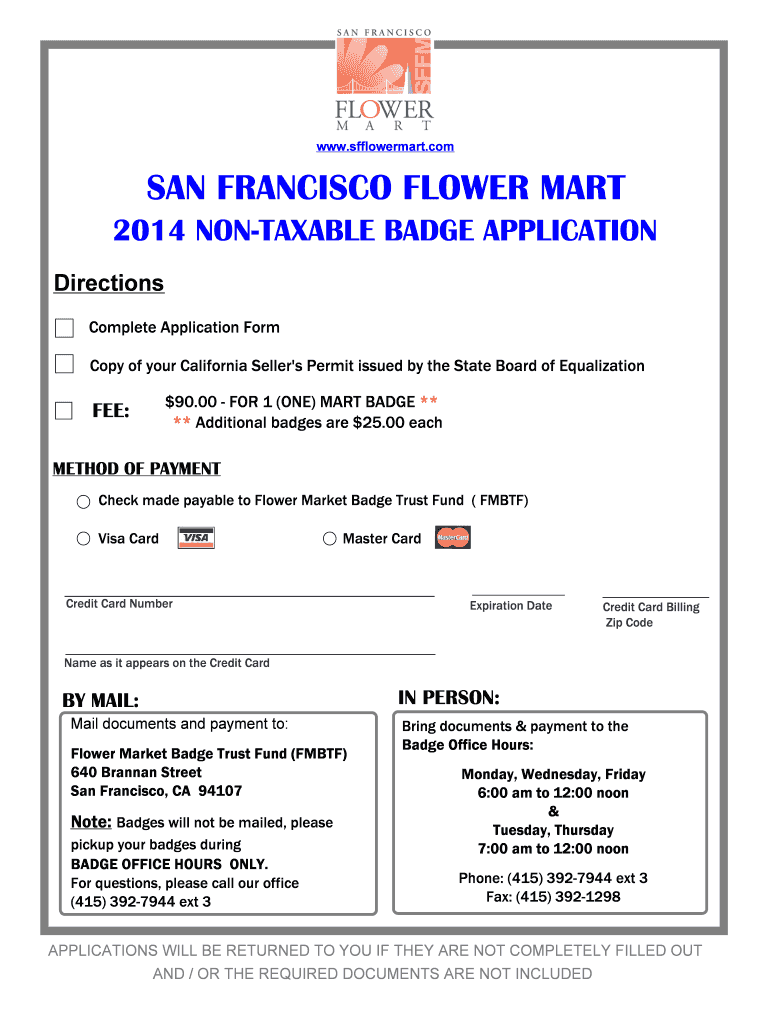

Form Submission Methods

Applicants have several options for submitting the NON TAXABLE BADGE APPLICATION. These methods typically include:

- Online submission through the designated government or organizational portal.

- Mailing the completed application to the appropriate office.

- In-person submission at specified locations, such as government offices or authorized agencies.

Application Process & Approval Time

The application process for the NON TAXABLE BADGE can vary in duration based on several factors. Generally, applicants can expect the following:

- Initial processing time, which may take several weeks depending on the volume of applications.

- Potential follow-up requests for additional information or documentation.

- Notification of approval or denial, typically communicated via the contact information provided in the application.

Quick guide on how to complete non taxable badge application directions

Effortlessly Create [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Select your preferred method to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and electronically sign [SKS], ensuring outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NON TAXABLE BADGE APPLICATION Directions

Create this form in 5 minutes!

How to create an eSignature for the non taxable badge application directions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the NON TAXABLE BADGE APPLICATION Directions?

The NON TAXABLE BADGE APPLICATION Directions provide step-by-step guidance on how to apply for a non-taxable badge. This process ensures that you understand the necessary requirements and documentation needed to successfully complete your application.

-

How much does the NON TAXABLE BADGE APPLICATION cost?

The cost associated with the NON TAXABLE BADGE APPLICATION varies depending on the specific requirements of your application. It’s best to review the official guidelines or consult customer support to obtain accurate pricing details related to any fees involved.

-

What features does airSlate SignNow offer for the NON TAXABLE BADGE APPLICATION?

airSlate SignNow offers features such as eSignature capabilities, document templates, and integration with various applications that simplify the NON TAXABLE BADGE APPLICATION process. This ensures a smooth and efficient way to manage documentation and submissions.

-

How can airSlate SignNow benefit businesses applying for a NON TAXABLE BADGE?

Businesses can benefit signNowly from using airSlate SignNow for the NON TAXABLE BADGE APPLICATION through streamlined workflows and enhanced collaboration. The platform’s user-friendly interface helps reduce paperwork and processing time, making it easier to focus on core operations.

-

Are there integrations available for the NON TAXABLE BADGE APPLICATION process?

Yes, airSlate SignNow supports multiple integrations that can enhance the NON TAXABLE BADGE APPLICATION process. These integrations allow for seamless data transfer between different platforms, improving overall efficiency and accuracy in handling applications.

-

What security measures are in place for the NON TAXABLE BADGE APPLICATION using airSlate SignNow?

airSlate SignNow prioritizes security for the NON TAXABLE BADGE APPLICATION by employing advanced encryption and compliance protocols. All your documents and sensitive information are securely stored and transmitted, ensuring they remain protected throughout the application process.

-

Can I track the status of my NON TAXABLE BADGE APPLICATION with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your NON TAXABLE BADGE APPLICATION in real-time. You will receive notifications and updates regarding your application’s progress, so you are always informed.

Get more for NON TAXABLE BADGE APPLICATION Directions

Find out other NON TAXABLE BADGE APPLICATION Directions

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy