St 130 Form

What is the St 130

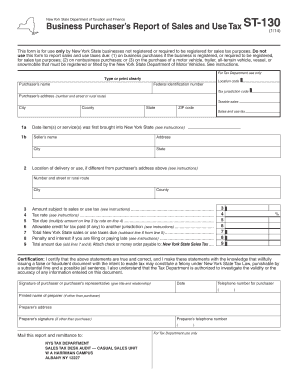

The St 130 form is a tax document used primarily in the United States for specific tax-related purposes. It is essential for individuals or businesses to accurately report their financial information to the Internal Revenue Service (IRS). The form collects various data points, including income, deductions, and credits, which are necessary for calculating tax liabilities. Understanding the purpose of the St 130 is crucial for ensuring compliance with federal tax regulations.

How to use the St 130

Using the St 130 form involves several key steps to ensure accurate completion. First, gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Next, carefully read the instructions accompanying the form to understand the requirements for each section. Fill in the form with precise information, ensuring that all calculations are correct. After completing the form, review it for any errors before submission. Utilizing digital tools can simplify this process and enhance accuracy.

Steps to complete the St 130

Completing the St 130 form requires a systematic approach. Follow these steps for effective completion:

- Gather all relevant financial documents.

- Review the instructions for the form thoroughly.

- Fill out personal information, including name, address, and Social Security number.

- Enter income details from various sources accurately.

- List any deductions and credits applicable to your situation.

- Double-check all entries for accuracy.

- Submit the form electronically or via mail, as per IRS guidelines.

Legal use of the St 130

The St 130 form must be used in accordance with IRS regulations to maintain its legal validity. This includes ensuring that all information provided is truthful and complete. Misrepresentation or errors can lead to penalties or audits. It is advisable to retain copies of the completed form and any supporting documents for your records. Additionally, using a trusted electronic signature platform can enhance the legal standing of your submission by providing a secure and verifiable method of signing.

Filing Deadlines / Important Dates

Filing deadlines for the St 130 form are crucial for compliance and avoiding penalties. Typically, the IRS sets an annual deadline for tax submissions, which is usually April fifteenth. However, specific circumstances may allow for extensions. It is essential to stay informed about any changes in deadlines and to mark your calendar accordingly. Missing the deadline can result in late fees and interest on any taxes owed.

Required Documents

To successfully complete the St 130 form, certain documents are required. These include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any other relevant financial statements.

Having these documents ready will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete st 130

Effortlessly Prepare St 130 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Handle St 130 on any platform using the airSlate SignNow apps available for Android and iOS, and streamline any document-related task today.

The Easiest Way to Edit and eSign St 130 with Ease

- Locate St 130 and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for such tasks.

- Create your eSignature using the Sign feature, which requires only seconds and carries the same legal validity as a traditional written signature.

- Review all details thoroughly and then select the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and eSign St 130 and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 130

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST130 tax form and why is it important?

The ST130 tax form is used for sales tax exemption in various states, allowing eligible purchasers to make tax-free purchases. Understanding how to properly fill in the ST130 tax form is crucial for businesses to ensure compliance with tax regulations and avoid penalties.

-

How can I easily fill in the ST130 tax form using airSlate SignNow?

With airSlate SignNow, filling in the ST130 tax form is streamlined and user-friendly. Our platform allows you to edit, sign, and send the form electronically, ensuring accuracy and efficiency in the form-filling process.

-

Are there any costs associated with using airSlate SignNow for ST130 tax form fill in?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, including options suitable for individual users and larger teams. The cost-effective solution ensures that you can complete your ST130 tax form fill in without breaking the bank.

-

What features does airSlate SignNow offer for filling out the ST130 tax form?

airSlate SignNow provides features such as customizable templates, electronic signatures, and cloud storage, making it easy to manage your ST130 tax form fill in. These tools enhance collaboration and streamline your document workflows.

-

Can I integrate airSlate SignNow with other tools to help with ST130 tax form fill in?

Yes, airSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and many CRM platforms. These integrations simplify the process of accessing and filling in the ST130 tax form from your preferred applications.

-

What are the benefits of using airSlate SignNow for ST130 tax form fill in?

Using airSlate SignNow for your ST130 tax form fill in saves time and increases accuracy. The platform’s electronic signature capability speeds up the approval process, allowing you to focus on your core business activities without the hassle of paperwork.

-

Is my data secure when filling in the ST130 tax form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes your data security, employing encryption and advanced security protocols to protect your information. You can confidently fill in your ST130 tax form, knowing that your data is safe and secure.

Get more for St 130

- Unconditional waiver and release of lien upon progress payment new hampshire form

- Quitclaim deed from individual to llc new hampshire form

- Warranty deed from individual to llc new hampshire form

- Nh lien form

- New hampshire deed 497318611 form

- Warranty deed from husband and wife to corporation new hampshire form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form new hampshire

- New hampshire lien form

Find out other St 130

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT