Request for Student S or Borrower S Taxpayer Form

What is the Request For Student S Or Borrower S Taxpayer

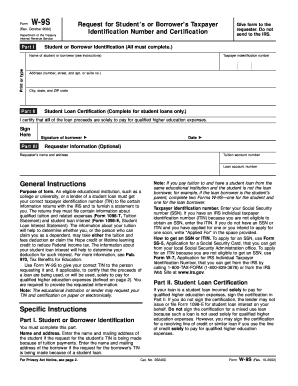

The Request For Student S Or Borrower S Taxpayer is a specific form used primarily in the context of federal student aid and tax reporting. It enables students or borrowers to provide their taxpayer identification information to educational institutions or lenders. This form is essential for ensuring that the correct tax information is associated with student loans, grants, or other financial aid. By completing this form, individuals can facilitate the processing of their financial aid applications and ensure compliance with federal regulations.

How to use the Request For Student S Or Borrower S Taxpayer

Using the Request For Student S Or Borrower S Taxpayer involves several straightforward steps. First, individuals should obtain the form from the appropriate educational institution or lender. Once in possession of the form, fill it out by providing accurate personal information, including your name, address, and taxpayer identification number. After completing the form, review it for accuracy, then submit it according to the instructions provided by the institution or lender, either online or via mail.

Steps to complete the Request For Student S Or Borrower S Taxpayer

Completing the Request For Student S Or Borrower S Taxpayer requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the relevant source.

- Fill in your personal details, including your full name and address.

- Provide your taxpayer identification number, ensuring it is accurate.

- Double-check all entries for any errors or omissions.

- Submit the form according to the specified method, either electronically or by mail.

Legal use of the Request For Student S Or Borrower S Taxpayer

The legal use of the Request For Student S Or Borrower S Taxpayer is primarily to ensure compliance with federal tax laws and regulations regarding financial aid. Educational institutions and lenders utilize this form to collect necessary taxpayer information, which is crucial for reporting purposes. Failure to provide accurate information can lead to complications in the processing of financial aid and potential legal ramifications for both the borrower and the institution.

Key elements of the Request For Student S Or Borrower S Taxpayer

Key elements of the Request For Student S Or Borrower S Taxpayer include:

- Your full name and contact information.

- Your taxpayer identification number, which may be a Social Security number or Employer Identification Number.

- Signature and date, confirming the accuracy of the information provided.

- Instructions for submission, detailing how and where to send the completed form.

Filing Deadlines / Important Dates

Filing deadlines for the Request For Student S Or Borrower S Taxpayer are typically aligned with the academic calendar and federal financial aid timelines. It is crucial to submit the form by the specified deadlines set by your educational institution or lender to avoid delays in processing your financial aid. Keep track of important dates, such as the start of the academic year and specific deadlines for financial aid applications, to ensure timely submission.

Quick guide on how to complete request for student s or borrower s taxpayer

Prepare [SKS] effortlessly on any device

Digital document administration has become widely adopted by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Request For Student S Or Borrower S Taxpayer

Create this form in 5 minutes!

How to create an eSignature for the request for student s or borrower s taxpayer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Request For Student S Or Borrower S Taxpayer through airSlate SignNow?

To Request For Student S Or Borrower S Taxpayer using airSlate SignNow, simply upload your document, add signature fields, and send it out for eSigning. The platform guides you through each step, ensuring a smooth process for both senders and recipients. You'll get notifications when the document is signed, making tracking easy.

-

Is there a cost associated with using airSlate SignNow for Request For Student S Or Borrower S Taxpayer?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different user needs. Each plan includes features for efficiently managing your Request For Student S Or Borrower S Taxpayer processes, with the flexibility to scale as your requirements grow. You can start with a free trial to explore the features before committing.

-

What features does airSlate SignNow offer for managing Request For Student S Or Borrower S Taxpayer documents?

airSlate SignNow provides several features to enhance your experience with Request For Student S Or Borrower S Taxpayer, including document templates, customizable workflows, and in-app signature capture. These tools streamline the eSigning process and ensure compliance with industry standards, making it easy to manage important paperwork.

-

How can airSlate SignNow improve the efficiency of Request For Student S Or Borrower S Taxpayer?

Using airSlate SignNow signNowly reduces the time spent on document management for Request For Student S Or Borrower S Taxpayer. The platform automates notifications, reminders, and the tracking of signed documents, which means you can focus on more important tasks rather than administrative work. This leads to faster turnaround times and improved workflow efficiency.

-

Can I integrate airSlate SignNow with other tools for Request For Student S Or Borrower S Taxpayer?

Absolutely! airSlate SignNow seamlessly integrates with various productivity tools such as Google Workspace, Salesforce, and Zapier. This allows you to automate processes related to Request For Student S Or Borrower S Taxpayer and ensure that your documents flow smoothly through your existing workflows.

-

What security measures are in place for Request For Student S Or Borrower S Taxpayer documents in airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and compliance with major data protection regulations. When you Request For Student S Or Borrower S Taxpayer through our platform, you can be assured that your documents are stored securely and access is tightly controlled. Regular security audits ensure our system standards remain top-notch.

-

What benefits can I expect from using airSlate SignNow for Request For Student S Or Borrower S Taxpayer?

With airSlate SignNow, you can expect numerous benefits, including reduced document turnaround times, lower operational costs, and enhanced user experience. The intuitive platform allows anyone to easily Request For Student S Or Borrower S Taxpayer digitally, which eliminates the hassle of physical paperwork and contributes to a more sustainable business model.

Get more for Request For Student S Or Borrower S Taxpayer

Find out other Request For Student S Or Borrower S Taxpayer

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors