Roth IRA Taxability of Distributions Form

Understanding the Taxability of Roth IRA Distributions

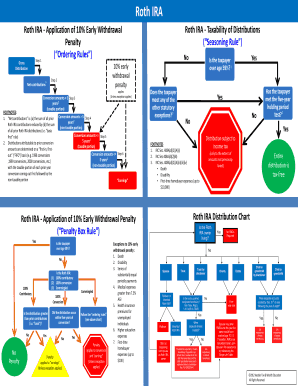

The taxability of distributions from a Roth IRA is a crucial aspect for account holders to understand. Generally, qualified distributions from a Roth IRA are tax-free. A qualified distribution occurs when the account holder has met two primary conditions: the account must be open for at least five years, and the account holder must be at least 59 and a half years old at the time of withdrawal. Other qualifying events include the account holder's death, disability, or the purchase of a first home, allowing for a distribution of up to $10,000 without incurring taxes.

Steps to Determine Taxability of Distributions

To ascertain whether a distribution from a Roth IRA is taxable, follow these steps:

- Verify the age of the account holder at the time of withdrawal.

- Check the duration the Roth IRA has been open, ensuring it meets the five-year rule.

- Identify the reason for the withdrawal, such as first-time home purchase or disability.

- If the distribution is non-qualified, assess whether it consists of contributions or earnings, as contributions can be withdrawn tax-free.

IRS Guidelines on Roth IRA Distributions

The Internal Revenue Service (IRS) provides specific guidelines regarding Roth IRA distributions. According to IRS rules, contributions to a Roth IRA can be withdrawn at any time without tax or penalty. However, earnings are subject to taxes and penalties if withdrawn before the account holder reaches the age of 59 and a half and does not meet the five-year requirement. It is essential to keep accurate records of contributions and distributions to ensure compliance with IRS regulations.

Eligibility Criteria for Tax-Free Distributions

To qualify for tax-free distributions from a Roth IRA, account holders must meet specific eligibility criteria. The primary criteria include:

- The account must be held for at least five years.

- The account holder must be at least 59 and a half years old, or meet other qualifying conditions.

Additionally, if the account holder passes away, their beneficiaries may also access tax-free distributions, provided the account was established for the required duration.

Examples of Taxable and Non-Taxable Distributions

Understanding the difference between taxable and non-taxable distributions can clarify the implications of withdrawing funds from a Roth IRA. For instance:

- A withdrawal of $10,000 in contributions made over several years is non-taxable, as contributions can be withdrawn anytime.

- A withdrawal of $15,000 in earnings before the age of 59 and a half, without meeting the five-year rule, is taxable and may incur a penalty.

These examples illustrate how the nature of the withdrawal affects tax obligations.

Required Documents for Roth IRA Distributions

When preparing to withdraw funds from a Roth IRA, certain documents may be required to ensure a smooth process. These documents typically include:

- Proof of age, such as a birth certificate or government-issued ID.

- Account statements demonstrating the duration the account has been open.

- Documentation supporting the reason for withdrawal, if applicable, such as proof of first-time home purchase.

Having these documents ready can help facilitate the distribution process and ensure compliance with tax regulations.

Quick guide on how to complete roth ira taxability of distributions

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it onto your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Roth IRA Taxability Of Distributions

Create this form in 5 minutes!

How to create an eSignature for the roth ira taxability of distributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do I have to report my Roth IRA distributions on my tax return?

Contributions to a Roth IRA aren't deductible (and you don't report the contributions on your tax return), but qualified distributions or distributions that are a return of contributions aren't subject to tax.

-

Does a Roth IRA distribution count as income?

Earnings that you withdraw from a Roth IRA don't count as income as long as you meet the rules for qualified distributions. Typically, you will need to have had a Roth IRA for at least five years and be at least 59½ years old for a distribution to count as qualified, but there are some exceptions.

-

Do you have to report a Roth IRA withdrawal on taxes?

Note: You are required to report your withdrawals and file Form 8606 with your tax return, even if you take a nontaxable distribution that is equal to or less than your total contributions to all of your Roth IRAs.

-

Are Roth IRA distributions taxable to beneficiaries?

Generally, inherited Roth IRA accounts are subject to the same RMD requirements as inherited traditional IRA accounts. Withdrawals of contributions from an inherited Roth are tax free. Most withdrawals of earnings from an inherited Roth IRA account are also tax-free.

-

Are Roth IRA distributions taxed as capital gains?

But the fact that you don't have to pay capital gains tax is also worth noting. With both a traditional IRA and a Roth IRA, buying and selling stocks or other investments is not considered a taxable event. That means that you will not owe capital gains tax when you sell investments inside your IRA.

-

Does Roth IRA need to be reported on tax return?

Roth IRA accounts are funded with after-tax dollars—meaning you will pay taxes on it when you deposit the funds. Roth contributions aren't tax-deductible, and qualified distributions aren't taxable income. So you won't report them on your return.

-

Do you get a 1099 when you withdraw from a Roth IRA?

You will receive a Form 1099-R when you make a withdrawal from a IRA, 401(k) or other retirement account. This form includes information such as: the amount you withdrew, how much is taxable (if that was determined), any taxes that were withheld, and a code that shows what type of distribution it was.

-

How much of Roth IRA distribution is taxable?

A Roth individual retirement account (Roth IRA) offers a tax-advantaged way to save in addition to—or in place of—an employer-sponsored retirement plan. While there's no deduction for Roth IRA contributions, qualified distributions from a Roth account are tax free.

Get more for Roth IRA Taxability Of Distributions

- To all of our patients and family members re long term planning cumc columbia form

- Sample form sample form sample form

- Psychological services patient history form pdf

- Chapter apd form

- California advance directives form

- Living will kentucky form

- Sample living will pdf the heart centre heartcentre form

- Patient handbook ochsner org ochsner form

Find out other Roth IRA Taxability Of Distributions

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney