IRA DISTRIBUTION REQUEST FORM for Sit Mutual Funds

What is the IRA Distribution Request Form for Sit Mutual Funds

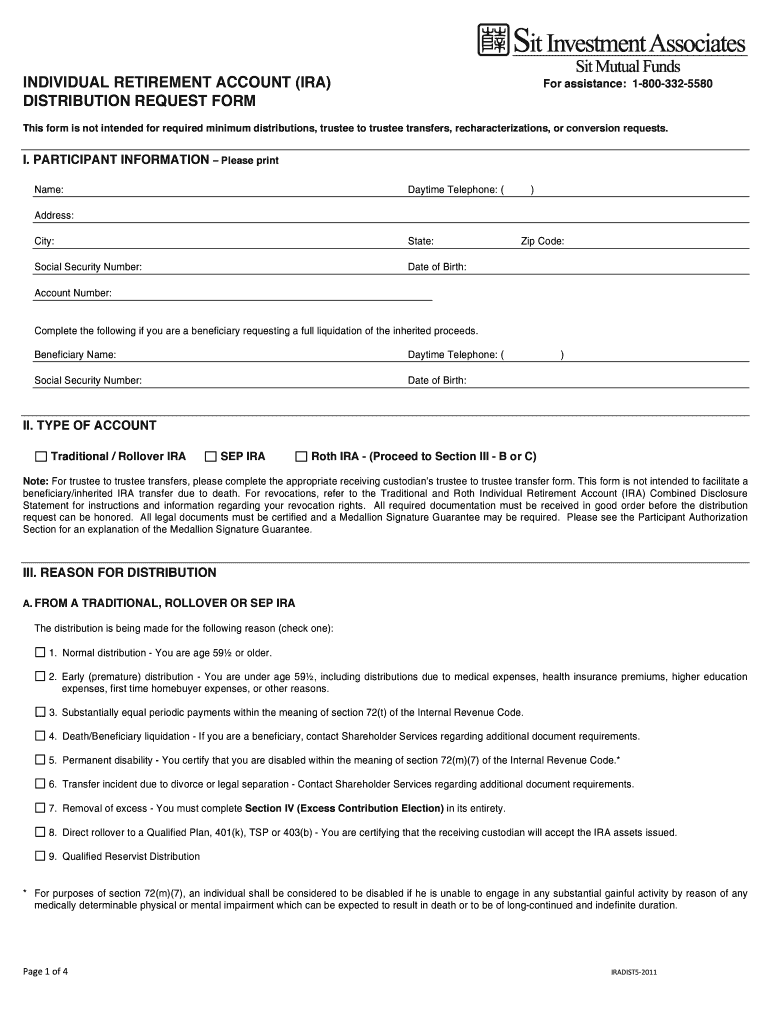

The IRA Distribution Request Form for Sit Mutual Funds is a formal document used by individuals to request distributions from their Individual Retirement Accounts (IRAs) that are invested in Sit Mutual Funds. This form is essential for managing retirement funds, allowing account holders to withdraw money in a structured manner while adhering to IRS regulations. It is designed to ensure that the distribution process is clear, compliant, and efficient, facilitating the transfer of funds while maintaining the integrity of the retirement account.

How to Use the IRA Distribution Request Form for Sit Mutual Funds

To use the IRA Distribution Request Form for Sit Mutual Funds, individuals should first download the form from the appropriate source, ensuring they have the latest version. After obtaining the form, users need to fill in their personal information, including their name, account number, and the amount they wish to withdraw. It is important to specify the type of distribution, whether it is a regular withdrawal, a hardship withdrawal, or a rollover. Once completed, the form should be submitted according to the provided instructions, which may include options for online submission, mailing, or in-person delivery.

Steps to Complete the IRA Distribution Request Form for Sit Mutual Funds

Completing the IRA Distribution Request Form involves several key steps:

- Download the form from the official source.

- Provide your personal details, including your full name and account number.

- Select the type of distribution you are requesting.

- Indicate the amount you wish to withdraw.

- Review the form for accuracy and completeness.

- Submit the form via the specified method, ensuring you retain a copy for your records.

Key Elements of the IRA Distribution Request Form for Sit Mutual Funds

The key elements of the IRA Distribution Request Form include:

- Personal Information: Name, address, and account number of the account holder.

- Distribution Type: Options for regular withdrawals, hardship withdrawals, or rollovers.

- Withdrawal Amount: The specific amount being requested for distribution.

- Signature: Required for authorization of the distribution request.

- Date: The date when the form is completed and submitted.

Legal Use of the IRA Distribution Request Form for Sit Mutual Funds

The IRA Distribution Request Form is legally binding and must be used in accordance with IRS regulations governing retirement accounts. Proper completion and submission of this form ensure that the distribution is processed correctly and in compliance with tax laws. Failure to adhere to these legal requirements may result in penalties or tax implications for the account holder. It is advisable to consult with a financial advisor or tax professional if there are uncertainties regarding the form's use.

Required Documents

When submitting the IRA Distribution Request Form for Sit Mutual Funds, certain documents may be required to support the request. These can include:

- A copy of a government-issued ID to verify identity.

- Proof of eligibility for the type of distribution requested.

- Any additional forms that may be necessary based on the specific circumstances of the withdrawal.

Quick guide on how to complete ira distribution request form for sit mutual funds

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, edit, and electronically sign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or censor confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Verify the details and click on the Done button to finalize your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds

Create this form in 5 minutes!

How to create an eSignature for the ira distribution request form for sit mutual funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds?

The IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds is a crucial document that allows investors to request distributions from their IRA accounts. This form streamlines the process, ensuring that funds are withdrawn efficiently and in compliance with regulatory requirements. It is designed to simplify the management of your retirement assets.

-

How do I access the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds?

You can easily access the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and locate the IRA distribution request form. Once there, you can fill it out electronically and eSign it for a hassle-free submission.

-

Are there any fees associated with the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds?

There may be fees depending on your specific mutual fund policies and the financial institution managing your IRA. However, using the airSlate SignNow solution to complete the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds typically incurs minimal charges, making it a cost-effective choice for handling your distribution requests.

-

What are the benefits of using airSlate SignNow for the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds?

Using airSlate SignNow for your IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds offers several benefits, including enhanced security and ease of use. The platform allows for quick electronic signatures, ensuring faster processing of your requests. Additionally, its user-friendly interface makes it ideal for individuals of all tech skill levels.

-

Can I track the status of my IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds?

Yes, airSlate SignNow provides a tracking feature that allows you to monitor the status of your IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds. You will receive notifications when your form is completed, and you can easily check its progress through your account dashboard. This transparency helps you stay informed about your distribution requests.

-

Is the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds compliant with FCA regulations?

Absolutely! The IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds available through airSlate SignNow is designed to comply with FCA regulations. By utilizing our platform, you can be confident that your distribution requests are managed in accordance with all necessary legal standards. This compliance helps ensure a smooth transaction process.

-

What integrations does airSlate SignNow offer for the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds?

airSlate SignNow offers a wide range of integrations that can be beneficial while completing the IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds. These include popular CRMs, document management systems, and cloud storage solutions. This flexibility allows you to seamlessly incorporate the form into your existing workflows.

Get more for IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds

- Motion to show cause cuyahoga county domestic relations court domestic cuyahogacounty form

- Structured abc antecedent behavior consequence analysis form

- Abc antecedent behavior consequence analysis form nsseo

- Reo vendor reference guide safeguard properties form

- Operating engineers local 3 time cards form

- Ndal status form

- Form app900 approved manager approval independent liquor

- Pbh hipaaconfidentiality incident report form ecbhlme

Find out other IRA DISTRIBUTION REQUEST FORM For Sit Mutual Funds

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free