Distribution Request for Excess Contributions from Coverdell Education Savings Accounts Form

What is the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

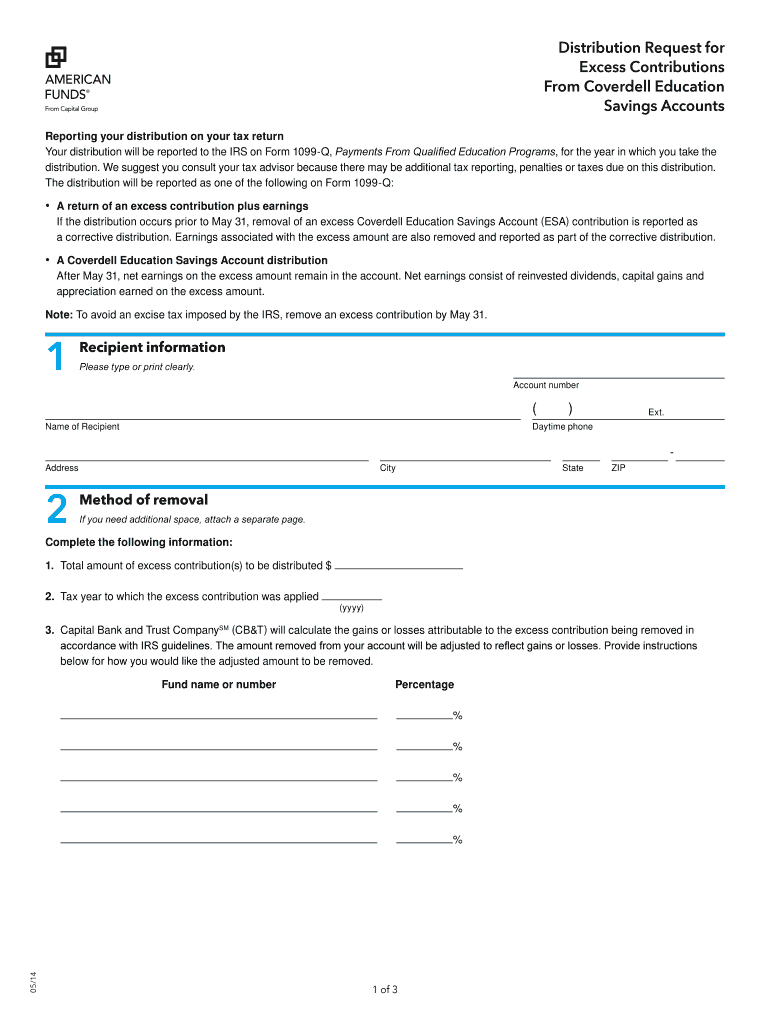

The Distribution Request For Excess Contributions From Coverdell Education Savings Accounts is a formal document used to request the withdrawal of excess contributions made to a Coverdell Education Savings Account (ESA). This form is essential for account holders who have contributed more than the allowable limit set by the IRS. The purpose of this request is to ensure compliance with tax regulations and avoid potential penalties associated with excess contributions.

How to use the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

Steps to complete the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

Completing the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts involves several key steps:

- Gather necessary information, including your ESA account number and personal identification details.

- Determine the exact amount of excess contributions that need to be withdrawn.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your financial institution via the preferred method, whether online, by mail, or in person.

Legal use of the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

The legal use of the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts is governed by IRS regulations. It is crucial for account holders to understand that failing to withdraw excess contributions may result in penalties. The form serves as a protective measure, allowing individuals to rectify their contributions within the specified time frame to avoid adverse tax implications.

Key elements of the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

Key elements of the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts include:

- Account holder's personal information, including name and address.

- Account number associated with the Coverdell ESA.

- Specific amount of excess contributions being requested for withdrawal.

- Reason for the excess contribution, if required.

- Signature of the account holder to authorize the request.

Required Documents

When submitting the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts, certain documents may be required to support the request. These typically include:

- A copy of the account statement showing contributions made.

- Identification documents to verify the account holder's identity.

- Any additional forms or documentation requested by the financial institution.

Quick guide on how to complete distribution request for excess contributions from coverdell education savings accounts

Effortlessly Prepare [SKS] on Any Device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select your preferred method of sharing your form, whether by email, text (SMS), or a link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

Create this form in 5 minutes!

How to create an eSignature for the distribution request for excess contributions from coverdell education savings accounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Distribution Request For Excess Contributions From Coverdell Education Savings Accounts?

A Distribution Request For Excess Contributions From Coverdell Education Savings Accounts is a formal request to withdraw any excess contributions made beyond the annual limit for these education savings accounts. It ensures compliance with IRS regulations and helps avoid potential penalties. Using airSlate SignNow, you can easily generate and send these requests electronically.

-

How can airSlate SignNow assist with creating a Distribution Request For Excess Contributions From Coverdell Education Savings Accounts?

airSlate SignNow provides an intuitive platform for creating and managing a Distribution Request For Excess Contributions From Coverdell Education Savings Accounts. Our easy-to-use templates allow you to fill out the necessary information quickly and efficiently. Plus, you can eSign the document and send it securely, streamlining the process.

-

Is there a cost associated with using airSlate SignNow for managing excess contributions?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, allowing you to manage the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts efficiently. Our plans are designed to be cost-effective while providing excellent value, enabling you to send and eSign documents without hassle.

-

What features does airSlate SignNow offer for handling educational savings account requests?

AirSlate SignNow includes features like customizable templates, eSignature solutions, document tracking, and secure cloud storage. These features specifically aid in the preparation of a Distribution Request For Excess Contributions From Coverdell Education Savings Accounts. This makes it easier to manage and complete your requests promptly.

-

Can I integrate airSlate SignNow with other software for my financial documents?

Absolutely! airSlate SignNow supports various integrations with popular software and applications. This allows you to enhance your workflow and easily incorporate the Distribution Request For Excess Contributions From Coverdell Education Savings Accounts into your existing processes, making it even more efficient.

-

What are the benefits of using airSlate SignNow for educational savings account distribution requests?

Using airSlate SignNow simplifies the process of submitting a Distribution Request For Excess Contributions From Coverdell Education Savings Accounts. Benefits include time savings, reduced paperwork, enhanced security, and real-time status updates on your requests. This innovative solution helps ensure that your educational savings funds are handled properly and efficiently.

-

Is airSlate SignNow secure for handling sensitive financial documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for managing sensitive documents, including a Distribution Request For Excess Contributions From Coverdell Education Savings Accounts. We utilize encryption and advanced security measures to protect your data throughout the entire eSigning process.

Get more for Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

- Test competea descargar gratis form

- Casket sales report dhhs ne form

- Notice of termination not industrial storm water discharges permit form 3400 170 r 810 page 1 of 3 state of wisconsin

- Readers theater rubric pdf form

- Wex returns form

- Iht406 form

- Stormwater monitoring report form ct gov ct

- Af form 948

Find out other Distribution Request For Excess Contributions From Coverdell Education Savings Accounts

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe