Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

Understanding the Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

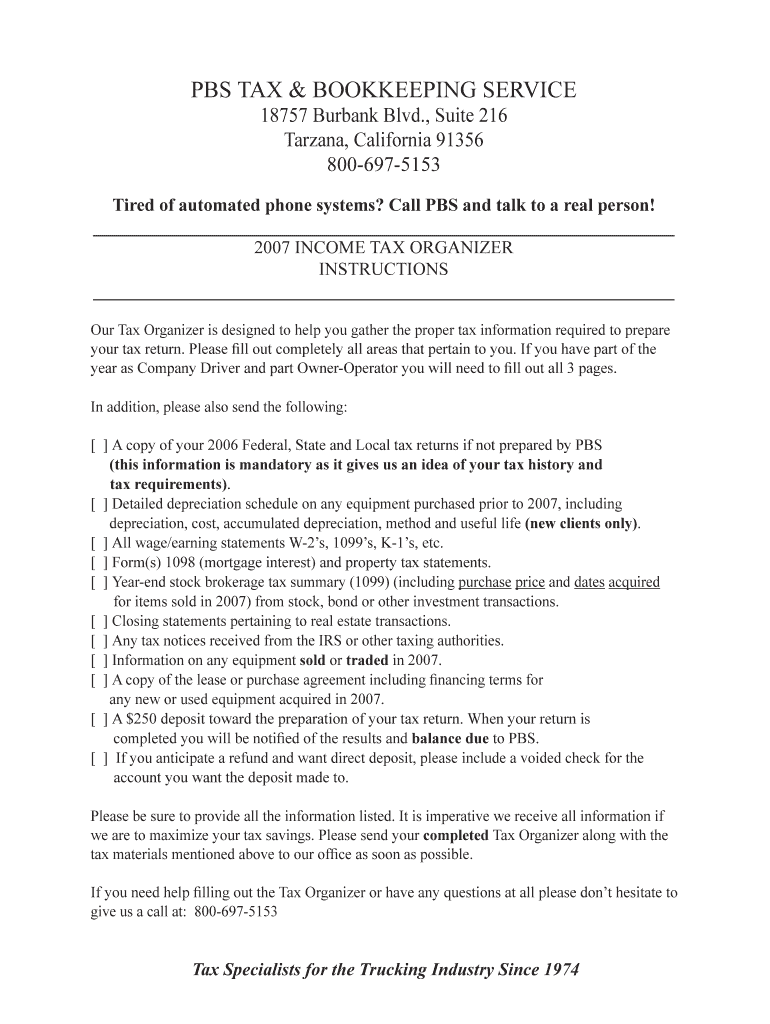

The Q4 PBS Forms Page 1 is a crucial document for individuals and businesses engaging with PBS Tax & Bookkeeping Service. This form is designed to capture essential financial information for the fourth quarter, ensuring accurate reporting and compliance with tax regulations. It serves as a comprehensive tool for documenting income, expenses, and other relevant financial data necessary for tax preparation and bookkeeping purposes.

Steps to Complete the Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

Completing the Q4 PBS Forms Page 1 involves several steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense receipts, and prior tax returns. Next, fill in the required fields on the form, ensuring that all information is accurate and up-to-date. Double-check calculations to avoid errors, and consult IRS guidelines if needed. Once completed, review the form for completeness before submission.

Legal Use of the Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

The Q4 PBS Forms Page 1 is legally recognized for tax reporting and bookkeeping purposes in the United States. It is essential for individuals and businesses to use this form correctly to comply with federal and state tax laws. Accurate completion of the form helps in avoiding penalties and ensures that all financial activities are documented appropriately. Understanding the legal implications of the information provided on this form is crucial for maintaining compliance.

Filing Deadlines for the Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

Timely submission of the Q4 PBS Forms Page 1 is vital to avoid penalties. The filing deadline typically aligns with the end of the fourth quarter, which is December 31. It is advisable to submit the form as soon as all financial information is compiled to ensure compliance with IRS deadlines. Mark your calendar for important dates related to tax submissions to ensure that you do not miss any critical deadlines.

Required Documents for the Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

To complete the Q4 PBS Forms Page 1, several documents are necessary. These include:

- Income statements

- Expense receipts

- Previous tax returns

- Bank statements

- Any relevant financial records

Having these documents ready will streamline the process and help ensure that all information is accurate and complete.

Examples of Using the Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

The Q4 PBS Forms Page 1 can be utilized in various scenarios. For instance, a self-employed individual may use this form to report quarterly earnings and expenses, ensuring that they accurately reflect their financial situation for tax purposes. Similarly, small businesses can leverage this form to summarize their quarterly financial performance, aiding in both tax preparation and strategic financial planning.

Quick guide on how to complete q4 pbs forms page 1 pbs tax amp bookkeeping service

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from a device of your preference. Edit and eSign [SKS] and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the q4 pbs forms page 1 pbs tax amp bookkeeping service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service?

The Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service includes essential tax forms that simplify your year-end reporting. It offers user-friendly templates, automatic calculations, and easy data integration, making tax season much more manageable for businesses.

-

How does pricing work for Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service?

Pricing for the Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service is designed to be budget-friendly for small to medium-sized businesses. A subscription model is available that includes full access to all tax forms, support, and regular updates to ensure compliance with the latest regulations.

-

What are the benefits of using Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service?

Utilizing the Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service streamlines your tax preparation process, reducing errors and saving time. It enhances efficiency by providing a centralized platform for all your tax documentation needs, allowing you to focus on growing your business.

-

Can Q4 PBS Forms Page 1 integrate with my existing accounting software?

Yes, the Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service can easily integrate with various accounting software platforms. This ensures you can seamlessly import data, reducing manual entry and potential for errors, making your tax preparation even more efficient.

-

Is technical support available for Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service?

Absolutely! The Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service provides dedicated customer support. Our team is readily available to assist you with any queries or issues, ensuring that you have a smooth experience throughout the tax season.

-

How user-friendly is the Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service?

The Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service is designed with user experience in mind. Its intuitive layout allows users of all skill levels to navigate easily, ensuring you can quickly find the forms you need without unnecessary frustration.

-

How often are the forms updated in Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service?

Forms within the Q4 PBS Forms Page 1 at PBS Tax & Bookkeeping Service are updated regularly to reflect the latest tax laws and compliance requirements. This commitment ensures that you are always prepared for any changes that may affect your tax filings.

Get more for Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

Find out other Q4 PBS Forms Page 1 PBS Tax & Bookkeeping Service

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document