Ontario Tax on Taxable Income Form ON428 2021-2026

What is the Ontario Tax On Taxable Income Form ON428

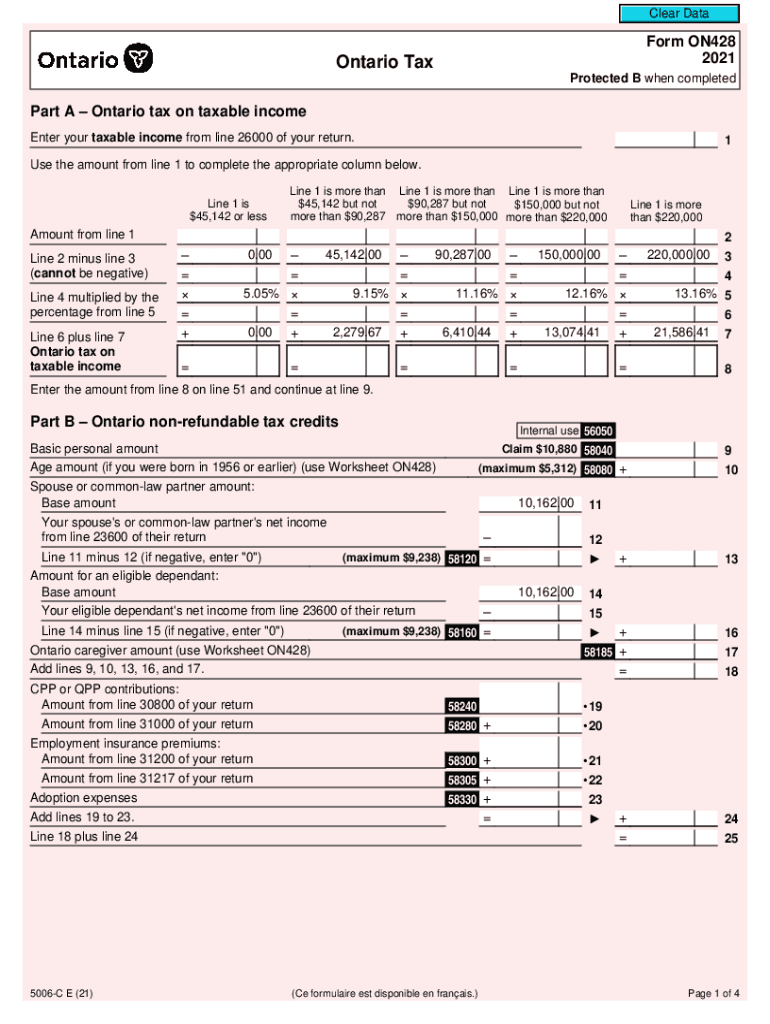

The Ontario Tax On Taxable Income Form ON428 is a crucial document for individuals residing in Ontario who need to report their taxable income for state tax purposes. This form is specifically designed to calculate the provincial tax owed based on the income earned during the tax year. The ON428 form includes various sections that allow taxpayers to detail their income, deductions, and applicable tax credits, ensuring accurate reporting and compliance with Ontario tax regulations.

How to use the Ontario Tax On Taxable Income Form ON428

Using the Ontario Tax On Taxable Income Form ON428 involves several steps that help taxpayers accurately report their income and calculate their tax liability. First, gather all necessary financial documents, including T4 slips, receipts for deductions, and any relevant tax credit information. Next, fill out the form by entering your total income, applicable deductions, and credits. It is essential to follow the instructions provided on the form carefully to ensure that all information is accurately reported. Once completed, the form can be submitted to the appropriate tax authority.

Steps to complete the Ontario Tax On Taxable Income Form ON428

Completing the Ontario Tax On Taxable Income Form ON428 requires careful attention to detail. Start by entering your personal information at the top of the form, including your name and address. Next, report your total income from all sources, including employment and investment income. After that, calculate your deductions, such as contributions to registered retirement savings plans (RRSPs) or other eligible expenses. Finally, apply any tax credits you qualify for, such as the Ontario Trillium Benefit. Review the completed form for accuracy before submission.

Required Documents

To effectively complete the Ontario Tax On Taxable Income Form ON428, several documents are required. These typically include:

- T4 slips from employers detailing income earned

- Receipts for any deductions claimed, such as medical expenses or charitable donations

- Documentation for tax credits, including proof of eligibility for programs like the Ontario Trillium Benefit

- Any other relevant financial statements that support your income and deductions

Filing Deadlines / Important Dates

Filing deadlines for the Ontario Tax On Taxable Income Form ON428 are critical to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 30 of the following year for individual taxpayers. If April 30 falls on a weekend, the deadline may be extended to the next business day. It is advisable to confirm specific dates each tax year, as they can vary.

Penalties for Non-Compliance

Failure to comply with the filing requirements of the Ontario Tax On Taxable Income Form ON428 can result in significant penalties. Taxpayers who do not file on time may face late fees, which can accumulate over time. Additionally, inaccuracies in reporting income or deductions can lead to reassessments by tax authorities, potentially resulting in further financial penalties or interest charges. It is essential to ensure that the form is completed accurately and submitted by the deadline to avoid these consequences.

Quick guide on how to complete ontario tax on taxable income form on428

Effortlessly Complete Ontario Tax On Taxable Income Form ON428 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Ontario Tax On Taxable Income Form ON428 on any platform with the airSlate SignNow mobile apps for Android or iOS and enhance any document-based task today.

How to Edit and eSign Ontario Tax On Taxable Income Form ON428 with Ease

- Find Ontario Tax On Taxable Income Form ON428 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of the documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Ontario Tax On Taxable Income Form ON428 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ontario tax on taxable income form on428

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 428 in Ontario?

Use Form 428 to calculate your provincial or territorial tax if one of the following applies: You were a resident of a province or territory in Canada (other than Quebec) at the end of the year.

-

What is my taxable income Ontario?

2023 Ontario provincial and federal income tax brackets Ontario tax bracketOntario tax rates $49,231 or less 5.05% $49,232 to $98,463 9.15% $98,464 to $150,000 11.16% $150,001 to $220,000 12.16%1 more row

-

How much income tax do I pay on $40,000 in Ontario?

Annual Income Tax by Province/Territory RegionTotal IncomeAvg. Tax Rate Ontario $40,000.00 11.87% Saskatchewan $40,000.00 12.52% New Brunswick $40,000.00 13.29% Newfoundland and Labrador $40,000.00 13.35%9 more rows

-

How much tax do I pay on $35,000 in Canada?

Annual Income Tax by Province/Territory RegionTotal IncomeNet Pay Alberta $35,000.00 $28,934.95 Ontario $35,000.00 $28,745.31 Saskatchewan $35,000.00 $28,526.28 New Brunswick $35,000.00 $28,201.039 more rows

-

How much income is tax free in Canada?

Tax-free basic personal amounts (BPA) This means that an individual Canadian taxpayer can earn up-to $15,000 in 2023 before paying any federal income tax. For the 2024 tax year, the federal basic personal amount is $15,705 (for taxpayers with a net income of $173,205 or less).

-

What is the federal tax rate for $40 000?

Take another example of someone single with a taxable income for the 2023 tax year of $40,000. You might think your tax would be $4,800 since $40,000 falls into the 12% federal bracket.

-

How much is $120,000 a year after taxes in Ontario?

Annual Income Tax by Province/Territory RegionTotal IncomeNet Pay Ontario $120,000.00 $85,954.73 Saskatchewan $120,000.00 $84,532.97 Manitoba $120,000.00 $82,955.00 New Brunswick $120,000.00 $82,823.579 more rows

-

What is the income tax rate in Ontario 2024?

2024 provincial and territorial income tax rates Tax rateTaxable income threshold 5.05% on the portion of taxable income that is $51,446 or less, plus 9.15% on the portion of taxable income over $51,446 up to $102,894, plus 11.16% on the portion of taxable income over $102,894 up to $150,000, plus2 more rows • Jan 23, 2024

Get more for Ontario Tax On Taxable Income Form ON428

- Caedrs 207592140 form

- Robinson contract addendum and carrier load confirmation 256525252 form

- Primary care physicians of atlanta form

- Fgcia form

- Emergency vaccine retrieval and storage plan worksheet vaccines form

- Vfw membership application pdf form

- Form it 230 separate tax on lump sum distributions tax year

- Managed it service contract template form

Find out other Ontario Tax On Taxable Income Form ON428

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer