DO NOT FILE March 30, DRAFT as of 1099 Software Form

Understanding the DO NOT FILE March 30, DRAFT AS OF 1099 Software

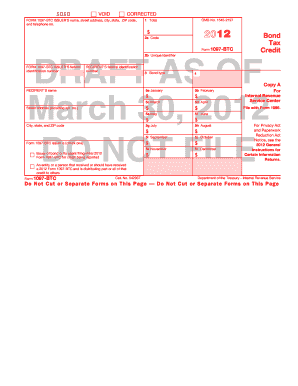

The DO NOT FILE March 30, DRAFT AS OF 1099 Software is a specialized tool designed to assist businesses and individuals in preparing and managing their 1099 forms. This software is particularly useful for those who need to report various types of income, such as payments to independent contractors or freelancers. The draft version indicates that it is not intended for submission to the IRS, allowing users to review and finalize their information before the official filing date. Utilizing this software helps ensure compliance with IRS regulations while simplifying the process of reporting income.

Steps to Utilize the DO NOT FILE March 30, DRAFT AS OF 1099 Software

To effectively use the DO NOT FILE March 30, DRAFT AS OF 1099 Software, follow these steps:

- Download and install the software on your computer or access it via a web-based platform.

- Begin by selecting the type of 1099 form you need to complete, such as 1099-MISC or 1099-NEC.

- Input the required information, including payer and recipient details, payment amounts, and any applicable tax identification numbers.

- Review the draft for accuracy, ensuring all fields are filled out correctly.

- Save your draft periodically to prevent data loss.

- Once satisfied with the information, prepare for the final version to be submitted before the deadline.

Key Features of the DO NOT FILE March 30, DRAFT AS OF 1099 Software

This software includes several key features that enhance the user experience:

- User-friendly interface: Designed for ease of use, making it accessible for users with varying levels of technical expertise.

- Data validation: Automatically checks for errors or missing information, reducing the risk of mistakes.

- Save and edit functionality: Users can save drafts and return to them later, allowing for thorough review and adjustments.

- Guidance and support: Provides helpful tips and explanations throughout the completion process, ensuring users understand each requirement.

Legal Considerations for the DO NOT FILE March 30, DRAFT AS OF 1099 Software

When using the DO NOT FILE March 30, DRAFT AS OF 1099 Software, it is essential to be aware of the legal implications:

- Ensure that all information entered is accurate and truthful to avoid potential penalties from the IRS.

- Understand that the draft version is not to be submitted to the IRS and is solely for internal review purposes.

- Be mindful of state-specific regulations that may affect how 1099 forms are completed and submitted.

Filing Deadlines for the DO NOT FILE March 30, DRAFT AS OF 1099 Software

While the draft version is not for filing, users should be aware of the following important deadlines:

- The official deadline for submitting 1099 forms to the IRS typically falls on January thirty-first of the following year.

- For forms submitted electronically, the deadline may extend to March second.

- It is advisable to complete the draft well in advance of these deadlines to allow for any necessary revisions.

Examples of Scenarios for Using the DO NOT FILE March 30, DRAFT AS OF 1099 Software

Various scenarios may necessitate the use of this software:

- A small business owner needs to report payments made to a freelance graphic designer throughout the year.

- An individual who hired a contractor for home renovations must report the total amount paid for services rendered.

- A non-profit organization needs to issue 1099 forms to volunteers who received stipends for their contributions.

Quick guide on how to complete do not file march 30 draft as of 1099 software

Prepare [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and select Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of browsing forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DO NOT FILE March 30, DRAFT AS OF 1099 Software

Create this form in 5 minutes!

How to create an eSignature for the do not file march 30 draft as of 1099 software

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the main purpose of DO NOT FILE March 30, DRAFT AS OF 1099 Software?

The DO NOT FILE March 30, DRAFT AS OF 1099 Software is designed to streamline the process of preparing and managing 1099 forms. It helps users create accurate drafts that can be easily edited and finalized before official filing, making tax season less stressful and more efficient.

-

How does airSlate SignNow ensure data security when using the DO NOT FILE March 30, DRAFT AS OF 1099 Software?

With airSlate SignNow, your data security is a priority. The DO NOT FILE March 30, DRAFT AS OF 1099 Software employs advanced encryption protocols and secure cloud storage to protect sensitive financial information, ensuring compliance with data protection regulations.

-

What are the pricing options for the DO NOT FILE March 30, DRAFT AS OF 1099 Software?

airSlate SignNow offers flexible pricing plans for the DO NOT FILE March 30, DRAFT AS OF 1099 Software that cater to various business sizes and needs. Prospective customers can select from monthly or annual subscriptions, with additional features available at different price points.

-

Can the DO NOT FILE March 30, DRAFT AS OF 1099 Software integrate with my current financial software?

Yes, the DO NOT FILE March 30, DRAFT AS OF 1099 Software seamlessly integrates with popular accounting and financial software. This allows businesses to synchronize their data effortlessly, reducing manual entry and minimizing errors during the 1099 preparation process.

-

What features should I expect from the DO NOT FILE March 30, DRAFT AS OF 1099 Software?

The DO NOT FILE March 30, DRAFT AS OF 1099 Software includes features such as form templates, bulk uploads, and e-signatures for easy approval. These features enable businesses to efficiently draft, review, and finalize 1099 forms without hassle.

-

How can I benefit from using DO NOT FILE March 30, DRAFT AS OF 1099 Software?

Using the DO NOT FILE March 30, DRAFT AS OF 1099 Software can signNowly reduce the time spent on tax preparation. It allows for easy collaboration among team members, ensuring all parties can review and edit documents efficiently before the final draft.

-

Is there customer support available for the DO NOT FILE March 30, DRAFT AS OF 1099 Software?

Yes, airSlate SignNow offers robust customer support for users of the DO NOT FILE March 30, DRAFT AS OF 1099 Software. Whether you need technical assistance or guidance on using the software, our support team is ready to help via chat, email, or phone.

Get more for DO NOT FILE March 30, DRAFT AS OF 1099 Software

Find out other DO NOT FILE March 30, DRAFT AS OF 1099 Software

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free