700 Sov Formpdffillercom 2016

What is the 700 Sov Formpdffillercom

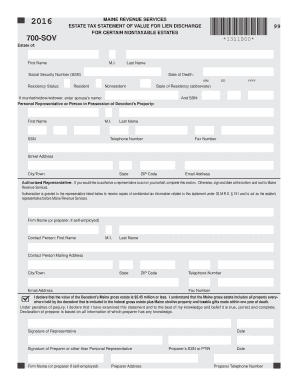

The 700 Sov Formpdffillercom is a specific form used primarily for tax-related purposes in the United States. This form allows individuals and businesses to report financial information accurately and efficiently. It includes fillable fields that users can complete online, ensuring that all necessary information is captured. The form is designed to meet government requirements and IRS specifications, making it a crucial tool for taxpayers.

How to use the 700 Sov Formpdffillercom

Using the 700 Sov Formpdffillercom involves several straightforward steps. First, access the form through a secure online platform. Once you have the form open, fill in the required fields with accurate information. It is important to review the completed form for any errors before proceeding to sign. After ensuring all details are correct, you can use an eSignature feature to sign the document digitally. This process simplifies submission and enhances security.

Steps to complete the 700 Sov Formpdffillercom

Completing the 700 Sov Formpdffillercom can be broken down into a few essential steps:

- Access the form through a reliable online service.

- Fill in all required fields with accurate information.

- Review the completed form for any inconsistencies or errors.

- Utilize the eSignature feature to sign the document digitally.

- Submit the completed form electronically or as required.

Legal use of the 700 Sov Formpdffillercom

The legal use of the 700 Sov Formpdffillercom is essential for compliance with IRS regulations. The form must be filled out accurately and submitted within the designated deadlines to avoid penalties. The IRS recognizes eSignatures as valid, which means that users can sign the form digitally without needing to print it. This feature not only streamlines the process but also ensures that the form is legally binding when submitted correctly.

Filing Deadlines / Important Dates

Filing deadlines for the 700 Sov Formpdffillercom are critical for taxpayers to adhere to. Typically, the deadline for submitting tax forms falls on April fifteenth of each year. However, this date may vary based on specific circumstances, such as weekends or holidays. It is advisable to check the IRS guidelines for any updates or changes to these deadlines to ensure timely submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 700 Sov Formpdffillercom. These guidelines include instructions on the information required, the format in which it should be presented, and the acceptable methods of submission. Understanding these guidelines is crucial for ensuring compliance and avoiding potential issues with the IRS. Taxpayers should consult the IRS website or other official resources for the most current information.

Quick guide on how to complete 700 sov formpdffillercom 2016

Your assistance manual on how to prepare your 700 Sov Formpdffillercom

If you’re wondering how to create and submit your 700 Sov Formpdffillercom, here are some brief guidelines on how to simplify tax processing.

To begin, you just need to set up your airSlate SignNow account to change how you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and return to modify details as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your 700 Sov Formpdffillercom in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your 700 Sov Formpdffillercom in our editor.

- Fill in the necessary fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to insert your legally-recognized electronic signature (if required).

- Examine your document and rectify any mistakes.

- Save your modifications, print a copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return mistakes and delay refunds. And, before submitting your taxes electronically, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 700 sov formpdffillercom 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

In 2016, how many marks, out of 700 were needed to get a home posting in ITI via SSC CGL exam?

In CGLE 2016, the cutoff for the post of ITI in UR category was 558.75.So as per me u must have 15 to 20 marks lead to get the post in your nearby or home state. Marks are not the sole point to get a post in your home state, there must be enough vacancies.Thnks..

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

Create this form in 5 minutes!

How to create an eSignature for the 700 sov formpdffillercom 2016

How to make an eSignature for the 700 Sov Formpdffillercom 2016 in the online mode

How to make an electronic signature for the 700 Sov Formpdffillercom 2016 in Google Chrome

How to generate an eSignature for signing the 700 Sov Formpdffillercom 2016 in Gmail

How to create an electronic signature for the 700 Sov Formpdffillercom 2016 right from your smartphone

How to make an eSignature for the 700 Sov Formpdffillercom 2016 on iOS devices

How to create an electronic signature for the 700 Sov Formpdffillercom 2016 on Android

People also ask

-

What is 700 Sov FormsignNowcom and how does it work with airSlate SignNow?

700 Sov FormsignNowcom is a document template that can be seamlessly integrated into airSlate SignNow, allowing users to fill out and eSign forms quickly and efficiently. With airSlate SignNow, you can easily upload, customize, and share these forms with your team or clients, streamlining your document management process.

-

How much does airSlate SignNow cost for using 700 Sov FormsignNowcom?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains competitively priced to provide great value for users handling documents like 700 Sov FormsignNowcom. Each plan includes features that cater to different business needs, ensuring that you can find one that fits your budget while maximizing functionality.

-

What features does airSlate SignNow offer for 700 Sov FormsignNowcom?

airSlate SignNow offers a range of features for 700 Sov FormsignNowcom, including customizable templates, advanced eSignature capabilities, and secure cloud storage. These features help streamline your workflow and ensure that your documents are signed and managed efficiently.

-

Can I integrate 700 Sov FormsignNowcom with other applications using airSlate SignNow?

Yes, airSlate SignNow supports integrations with various applications, making it easy to work with 700 Sov FormsignNowcom alongside your other essential tools. This flexibility allows you to enhance productivity and automate your workflows seamlessly.

-

Is airSlate SignNow secure for handling 700 Sov FormsignNowcom documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents, including 700 Sov FormsignNowcom, are protected with advanced encryption and secure servers. You can trust that your sensitive information remains confidential and safe.

-

What are the benefits of using airSlate SignNow for 700 Sov FormsignNowcom?

Using airSlate SignNow for 700 Sov FormsignNowcom offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. The platform's user-friendly interface makes it easy for anyone to adopt, helping teams save time and improve their document processes.

-

How can I get started with airSlate SignNow for 700 Sov FormsignNowcom?

Getting started with airSlate SignNow for 700 Sov FormsignNowcom is simple. You can sign up for a free trial on the airSlate SignNow website, where you'll be guided through the process of uploading your documents and creating eSignatures with ease.

Get more for 700 Sov Formpdffillercom

- Eea4 form download word

- Form dsa 311 request for examination for state of california documents dgs ca

- Form 4822

- D 40b form

- Defensible space sunrise powerlink fire mitigation grant program form

- Kms dance team information and contract

- Lease or rental agreement of horse trailer with option to form

- Ashland city fire department 101 court st ashland city tn form

Find out other 700 Sov Formpdffillercom

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free