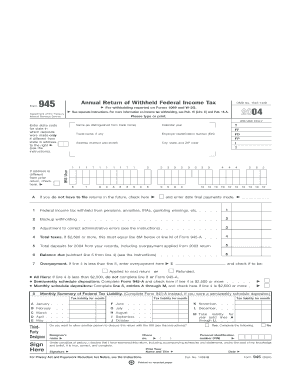

Annual Return of Withheld Federal Income Tax Sign Here Form

What is the Annual Return Of Withheld Federal Income Tax Sign Here

The Annual Return Of Withheld Federal Income Tax Sign Here is a crucial tax form used in the United States. It serves as a formal declaration of the federal income tax withheld from an individual's wages or payments throughout the year. This form is essential for both employees and employers, as it ensures that the correct amount of tax is reported and submitted to the Internal Revenue Service (IRS). Understanding this form is vital for accurate tax reporting and compliance with federal tax laws.

How to use the Annual Return Of Withheld Federal Income Tax Sign Here

To effectively use the Annual Return Of Withheld Federal Income Tax Sign Here, individuals must first gather all necessary documentation related to income and withheld taxes. This includes W-2 forms from employers and any 1099 forms for other income sources. Once the relevant information is compiled, the individual fills out the form, detailing the total amount of federal income tax withheld. After completing the form, it must be signed and submitted to the IRS by the designated deadline, ensuring compliance with tax regulations.

Steps to complete the Annual Return Of Withheld Federal Income Tax Sign Here

Completing the Annual Return Of Withheld Federal Income Tax Sign Here involves several key steps:

- Gather all necessary documents, including W-2 and 1099 forms.

- Fill out the form accurately, entering total income and withheld tax amounts.

- Review the completed form for any errors or omissions.

- Sign the form in the designated area to validate the information provided.

- Submit the form to the IRS by the specified deadline, either electronically or by mail.

Legal use of the Annual Return Of Withheld Federal Income Tax Sign Here

The legal use of the Annual Return Of Withheld Federal Income Tax Sign Here is governed by IRS regulations. This form must be filed accurately to avoid penalties and ensure compliance with federal tax laws. Misreporting or failing to file this form can lead to legal consequences, including fines and increased scrutiny from the IRS. It is essential for individuals and businesses to understand their obligations regarding this form to maintain legal standing and avoid complications during tax audits.

Filing Deadlines / Important Dates

Filing deadlines for the Annual Return Of Withheld Federal Income Tax Sign Here are critical for compliance. Typically, the form must be submitted by April 15 of the following year after the tax year ends. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines or regulations to ensure timely submission and avoid penalties.

Required Documents

To complete the Annual Return Of Withheld Federal Income Tax Sign Here, several documents are required:

- W-2 forms from employers detailing wages and withheld taxes.

- 1099 forms for any additional income sources.

- Previous year’s tax return for reference, if applicable.

- Any supporting documentation for deductions or credits claimed.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Annual Return Of Withheld Federal Income Tax Sign Here. These guidelines include instructions on how to fill out the form accurately, what information is required, and the consequences of non-compliance. Familiarizing oneself with these guidelines is essential for ensuring that the form is completed correctly and submitted on time, thereby minimizing the risk of errors and penalties.

Quick guide on how to complete annual return of withheld federal income tax sign here

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly solution to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly without any holdups. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you would like to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign [SKS] to ensure outstanding communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Annual Return Of Withheld Federal Income Tax Sign Here

Create this form in 5 minutes!

How to create an eSignature for the annual return of withheld federal income tax sign here

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to submit my Annual Return Of Withheld Federal Income Tax signNow using airSlate SignNow?

To submit your Annual Return Of Withheld Federal Income Tax signNow using airSlate SignNow, simply upload your document to the platform, add necessary fields for signatures and information, and send it to the required parties. Our intuitive system guides you through each step, ensuring a smooth signing experience.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore the features and functionalities, including those for managing the Annual Return Of Withheld Federal Income Tax signNow. This gives you a risk-free opportunity to see how our platform can streamline your eSigning processes.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the Annual Return Of Withheld Federal Income Tax signNow, offers several advantages. It ensures secure and efficient signature collection, reduces turnaround time, and improves compliance with regulatory requirements, simplifying your tax submission process.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports various integrations with applications you already use, making it easy to incorporate the Annual Return Of Withheld Federal Income Tax signNow into your existing workflows. Integrating with tools like CRM systems and cloud storage enhances productivity and data management.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes security, employing industry-standard measures such as data encryption, secure cloud storage, and authentication protocols to protect your documents, including the Annual Return Of Withheld Federal Income Tax signNow. You can trust that your sensitive information is handled with the highest level of security.

-

How does airSlate SignNow compare to traditional methods of signing documents?

Compared to traditional methods, airSlate SignNow streamlines the process of signing documents like the Annual Return Of Withheld Federal Income Tax signNow. It eliminates the need for physical paperwork, reduces delays in processing, and enhances tracking with real-time notifications on your document status.

-

What features does airSlate SignNow offer to help with tax compliance?

airSlate SignNow provides features that help ensure tax compliance, such as customizable templates for documents like the Annual Return Of Withheld Federal Income Tax signNow, robust audit trails, and secure storage of signed documents. These features allow you to maintain compliance effortlessly while managing your tax-related documentation.

Get more for Annual Return Of Withheld Federal Income Tax Sign Here

- Substitution request northwest region to project form

- Private placement program pdf form

- The muslim law shariahcouncil uk the joseph interfaith form

- Sheria sacco downloads form

- Zahtjev za doznaku hrvatske mirovine preko banke form

- Heydary form

- Prp section 20 200 form

- Application for change of ownership caa co form

Find out other Annual Return Of Withheld Federal Income Tax Sign Here

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online