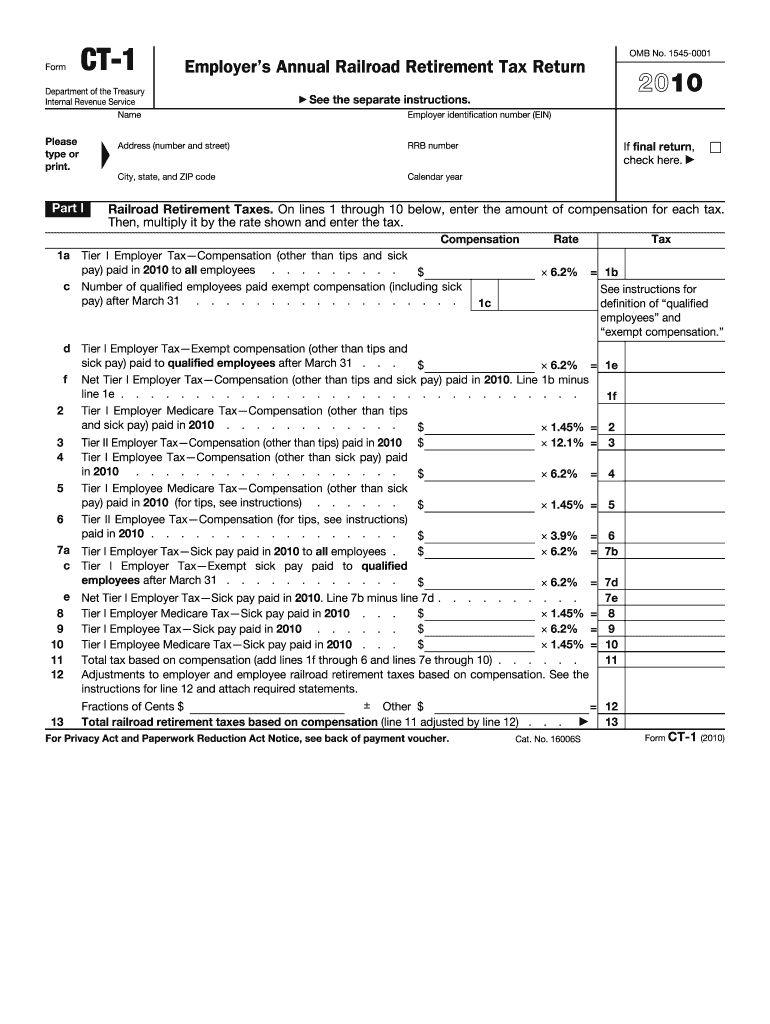

On Lines 1 through 10 Below, Enter the Amount of Compensation for Each Tax Form

Understanding the Form for Compensation Amounts

The form requiring you to enter the amount of compensation for each tax on lines one through ten is essential for accurately reporting your financial obligations. This form is typically used in various tax filings, ensuring that all compensation amounts are clearly documented. It is crucial for both individuals and businesses to complete this form correctly to comply with tax regulations.

Steps to Complete the Compensation Amount Form

To fill out the form correctly, follow these steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Identify the specific taxes that apply to your situation, such as federal income tax, state income tax, or self-employment tax.

- For each line from one to ten, enter the corresponding compensation amount accurately, ensuring that you do not skip any lines that apply to your tax situation.

- Review your entries for accuracy before submission to avoid potential penalties.

Legal Use of the Compensation Amount Form

This form serves a legal purpose in documenting compensation amounts for tax reporting. Accurate completion is vital, as it can affect your tax liability and eligibility for certain deductions or credits. Failing to report compensation correctly can lead to audits or penalties imposed by tax authorities.

Required Documents for Submission

When preparing to fill out the form, ensure you have the following documents ready:

- W-2 forms from employers, which report annual wages.

- 1099 forms for any freelance or contract work, detailing non-employee compensation.

- Any additional documentation that supports your reported compensation, such as bank statements or payment receipts.

IRS Guidelines for Reporting Compensation

The IRS provides specific guidelines on how to report compensation accurately. Familiarize yourself with these guidelines to ensure compliance. Key points include:

- Understanding the difference between earned income and unearned income.

- Knowing which tax forms to use based on your employment status.

- Being aware of deadlines for submitting your compensation amounts to avoid late fees.

Examples of Compensation Reporting

Providing examples can clarify how to complete the form. For instance:

- If you earned fifty thousand dollars in salary, you would report that amount on the applicable line.

- For freelance work that earned fifteen thousand dollars, enter that figure on the designated line for self-employment income.

Quick guide on how to complete on lines 1 through 10 below enter the amount of compensation for each tax

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the suitable form and securely preserve it online. airSlate SignNow provides all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax

Create this form in 5 minutes!

How to create an eSignature for the on lines 1 through 10 below enter the amount of compensation for each tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax' refer to?

'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax' refers to a guideline for accurately reporting compensation across various tax lines. This ensures compliance and avoids penalties. Properly filling this out helps streamline the tax filing process.

-

How does airSlate SignNow simplify the process of entering compensation amounts?

airSlate SignNow allows users to easily prepare and eSign documents including tax forms. With its intuitive interface, you can quickly fill in relevant fields like 'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax' without hassle, promoting accuracy and efficiency.

-

What features make airSlate SignNow a cost-effective solution for document eSigning?

airSlate SignNow offers robust features such as unlimited document signing, templates, and collaboration tools at competitive pricing. These tools streamline workflows, particularly when needing to address 'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax,' making it a smart investment for any business.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, enhancing the overall workflow. This allows users to efficiently handle tasks such as 'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax' while syncing with financial records.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides secure storage, easy access, and efficient document sharing. This is particularly beneficial when you need to ensure accuracy for 'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax,' streamlining the entire process.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides comprehensive customer support to assist users with any queries, including those related to 'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax.' Support is available via chat, email, and phone for timely assistance.

-

How secure is my data with airSlate SignNow?

Your data security is a top priority at airSlate SignNow. They employ advanced encryption and compliance measures to ensure that sensitive information, such as that entering 'On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax,' is well protected.

Get more for On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax

- Satish chandra memorial school online teaching class 3 form

- Bass and meineke application for employment snagajob form

- Miscellaneous income miscellaneous income tfp data systems form

- Shipping articles cg 705a us coast guard uscg form

- Sample bond of good behaviour form

- Rollover request for service credit purchases state of north dakota nd form

- Apply for a vehicle registration certificate form v62 apply for a vehicle registration certificate form v62pdf epub mobi

- Africa a history denied worksheet answers form

Find out other On Lines 1 Through 10 Below, Enter The Amount Of Compensation For Each Tax

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application