Form 945 IRS Irs

What is the Form 945 IRS

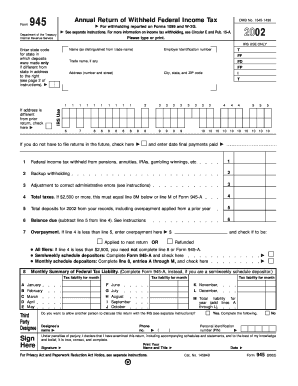

The Form 945 is an annual return used by employers to report withheld federal income tax from nonpayroll payments. This includes payments made to independent contractors, pension distributions, and certain other payments. The form is essential for ensuring compliance with IRS regulations regarding tax withholding. By accurately completing and submitting Form 945, businesses can fulfill their tax obligations and avoid potential penalties.

How to use the Form 945 IRS

Using Form 945 involves several key steps. First, gather all necessary information regarding the payments made and the amounts withheld. Next, fill out the form, ensuring that all details are accurate, including the payer's information and the total amount of federal income tax withheld. Once completed, the form must be submitted to the IRS by the designated deadline. It is important to retain a copy for your records as proof of compliance.

Steps to complete the Form 945 IRS

Completing Form 945 requires careful attention to detail. Follow these steps:

- Obtain the latest version of Form 945 from the IRS website.

- Provide your name, address, and Employer Identification Number (EIN) at the top of the form.

- Report the total amount of federal income tax withheld in the appropriate section.

- Double-check all entries for accuracy, including any calculations.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the IRS by mail or electronically, if applicable.

Filing Deadlines / Important Dates

Form 945 must be filed annually, with the deadline typically set for January 31 of the following year. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial to adhere to this timeline to avoid late filing penalties. Additionally, if you are required to make deposits of withheld taxes, those deadlines must also be followed throughout the year.

Penalties for Non-Compliance

Failure to file Form 945 on time or to accurately report withheld taxes can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of time the form is late. Additionally, interest may accrue on any unpaid taxes. To mitigate these risks, it is advisable to ensure timely and accurate filing of Form 945.

Digital vs. Paper Version

Form 945 can be submitted either digitally or on paper. The digital version allows for quicker processing and can reduce the risk of errors. However, some businesses may prefer the paper version for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that the form is completed accurately and submitted by the deadline to maintain compliance with IRS regulations.

Quick guide on how to complete form 945 irs irs

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic environmentally friendly substitute to conventional printed and signed documentation, as you can easily locate the right form and securely preserve it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly and without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to distribute your form, via email, SMS, or an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 945 IRS Irs

Create this form in 5 minutes!

How to create an eSignature for the form 945 irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 945 IRS Irs, and why do I need it?

Form 945 IRS Irs is used for reporting annual federal tax withheld from nonpayroll payments. Businesses that make such payments are required to file this form to stay compliant with IRS regulations. It's crucial for ensuring accurate tax reporting and avoiding potential penalties.

-

How does airSlate SignNow simplify the process of filling out Form 945 IRS Irs?

airSlate SignNow provides a user-friendly interface that allows businesses to easily fill out and eSign Form 945 IRS Irs with minimal hassle. By using templates and automated workflows, you can streamline the process, making it faster and more efficient. This ensures you meet deadlines without stress.

-

Is airSlate SignNow affordable for managing Form 945 IRS Irs?

Yes, airSlate SignNow offers cost-effective solutions suitable for businesses of all sizes. With flexible pricing plans, you can choose the one that best fits your needs while efficiently managing Form 945 IRS Irs. This helps maintain budget integrity while ensuring compliance.

-

What features does airSlate SignNow offer for eSigning Form 945 IRS Irs?

airSlate SignNow includes features like customizable templates, instant notifications, and secure cloud storage specifically for documents like Form 945 IRS Irs. These functionalities enhance your efficiency and security when signing documents electronically. Additionally, you can track the signing process in real time.

-

Can I integrate airSlate SignNow with other tools to manage Form 945 IRS Irs?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your Form 945 IRS Irs alongside other business tools. This integration promotes a centralized workflow, enhancing efficiency and helping you work smarter.

-

What are the benefits of using airSlate SignNow for Form 945 IRS Irs?

Using airSlate SignNow simplifies the management of Form 945 IRS Irs by providing an intuitive platform for document handling. Key benefits include increased compliance, reduced paperwork errors, and faster processing times. This means less time spent on administrative tasks and more focus on your business operations.

-

Is airSlate SignNow secure for handling sensitive information like Form 945 IRS Irs?

Yes, airSlate SignNow takes security seriously, employing advanced encryption and authentication measures to protect your data, including Form 945 IRS Irs. Your information is safeguarded against unauthorized access, ensuring compliance with industry standards and regulations.

Get more for Form 945 IRS Irs

Find out other Form 945 IRS Irs

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free