Form 3800 Tax Computation for Certain Children with Unearned Income 2024-2026

Understanding the 2024 California Form 3800

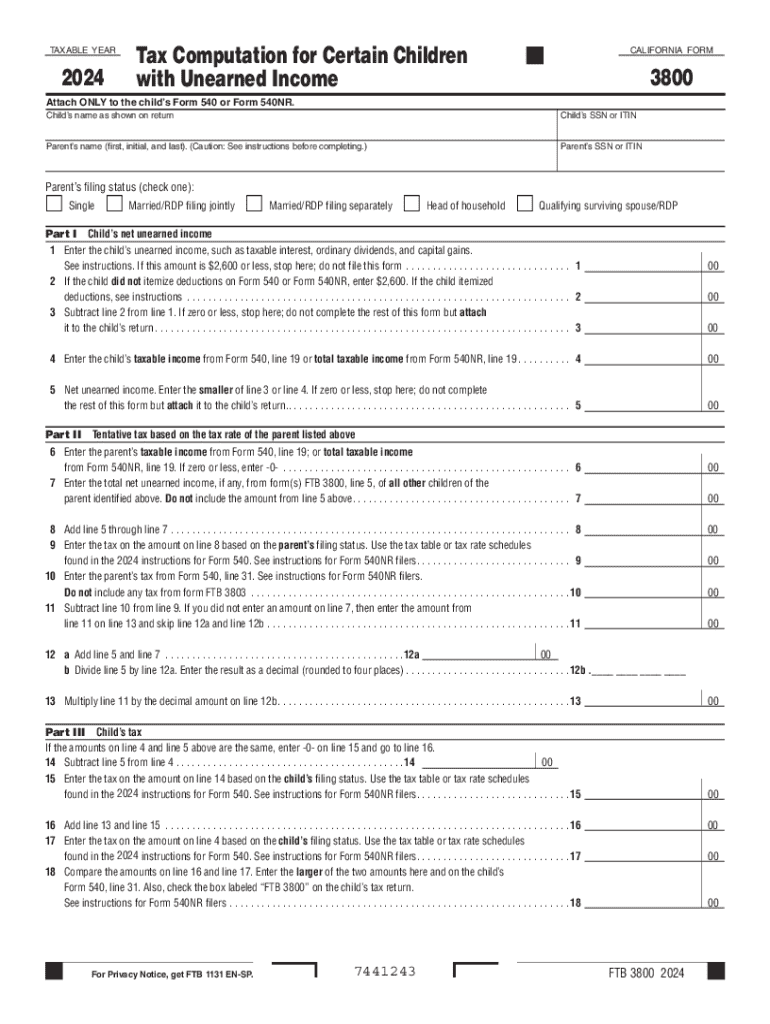

The 2024 California Form 3800, officially known as the Tax Computation for Certain Children With Unearned Income, is designed for children who have unearned income exceeding a specific threshold. This form helps in calculating the tax owed on that income, ensuring compliance with state tax regulations. It is particularly relevant for parents or guardians filing on behalf of their children, as it addresses the unique tax situations that arise from unearned income sources such as dividends, interest, and capital gains.

Steps to Complete the 2024 California Form 3800

Completing the 2024 California Form 3800 involves several steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements for the child.

- Determine the child’s total unearned income for the tax year.

- Follow the form’s instructions to calculate the applicable tax using the provided tax tables.

- Fill out the form accurately, ensuring all entries reflect the child’s financial situation.

- Review the completed form for errors before submission.

Eligibility Criteria for the 2024 California Form 3800

To be eligible to use the 2024 California Form 3800, the child must meet specific criteria. The child must be under the age of 19 at the end of the tax year or under 24 if a full-time student. Additionally, their unearned income must exceed a certain limit set by the IRS. This form is typically filed by parents or guardians on behalf of their children, making it essential to understand these eligibility requirements before proceeding with the form.

How to Obtain the 2024 California Form 3800

The 2024 California Form 3800 can be obtained through several channels. It is available online through the California Franchise Tax Board's official website, where users can download and print the form. Additionally, physical copies can be requested from local tax offices or obtained at various community centers that offer tax assistance services. Ensuring access to the correct version of the form is crucial for accurate filing.

Filing Deadlines for the 2024 California Form 3800

Filing deadlines for the 2024 California Form 3800 align with the general tax filing deadlines set by the IRS and the California Franchise Tax Board. Typically, the deadline for submitting the form is April 15 of the following year. However, if the deadline falls on a weekend or holiday, it may be extended. Taxpayers should be aware of these dates to avoid penalties and ensure timely compliance.

Penalties for Non-Compliance with the 2024 California Form 3800

Failure to file the 2024 California Form 3800 accurately and on time can result in penalties. These may include fines and interest on any unpaid taxes. Additionally, if the form is not filed when required, it may lead to complications with future tax filings. Understanding these potential consequences emphasizes the importance of completing the form correctly and submitting it within the designated timeframe.

Create this form in 5 minutes or less

Find and fill out the correct form 3800 tax computation for certain children with unearned income 772017644

Create this form in 5 minutes!

How to create an eSignature for the form 3800 tax computation for certain children with unearned income 772017644

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 California 3800 form?

The 2024 California 3800 form is a tax form used by businesses in California to report certain tax credits. It is essential for ensuring compliance with state tax regulations and maximizing available credits. Understanding this form can help businesses save money and streamline their tax processes.

-

How can airSlate SignNow help with the 2024 California 3800 form?

airSlate SignNow provides an efficient platform for businesses to eSign and send the 2024 California 3800 form securely. With its user-friendly interface, you can easily manage document workflows and ensure timely submissions. This helps in maintaining compliance and avoiding penalties.

-

What are the pricing options for using airSlate SignNow for the 2024 California 3800 form?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes features that facilitate the eSigning and management of documents like the 2024 California 3800 form. You can choose a plan that fits your budget while ensuring you have the necessary tools for efficient document handling.

-

Are there any integrations available for the 2024 California 3800 form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the 2024 California 3800 form. These integrations allow you to connect with popular tools like CRM systems and cloud storage services, streamlining your workflow. This ensures that all your documents are easily accessible and organized.

-

What features does airSlate SignNow offer for managing the 2024 California 3800 form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for forms like the 2024 California 3800 form. These features help you create, send, and manage your documents efficiently. Additionally, you can monitor the status of your forms in real-time.

-

How does airSlate SignNow ensure the security of the 2024 California 3800 form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 2024 California 3800 form. The platform employs advanced encryption and secure access protocols to protect your data. This ensures that your documents remain confidential and secure throughout the signing process.

-

Can I access the 2024 California 3800 form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage the 2024 California 3800 form from any device. This flexibility ensures that you can eSign and send documents on the go, making it easier to stay productive and meet deadlines.

Get more for Form 3800 Tax Computation For Certain Children With Unearned Income

Find out other Form 3800 Tax Computation For Certain Children With Unearned Income

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template