Return of Organization Exempt from Income Tax Nccsdataweb Urban Form

What is the Return Of Organization Exempt From Income Tax Nccsdataweb Urban

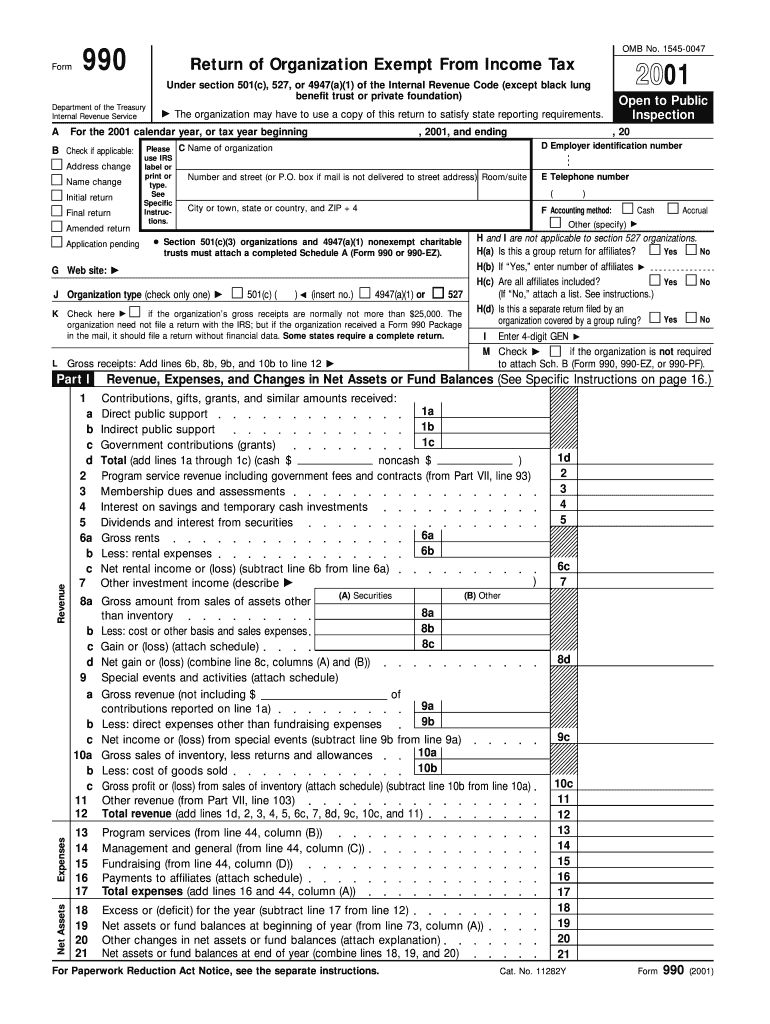

The Return Of Organization Exempt From Income Tax, often referred to as Form 990, is a crucial document for nonprofit organizations in the United States. This form is designed to provide the IRS with information about the organization's activities, finances, and governance. It is essential for maintaining tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. The form helps ensure transparency and accountability, allowing the public and the government to understand how these organizations operate and utilize their funds.

How to use the Return Of Organization Exempt From Income Tax Nccsdataweb Urban

Using the Return Of Organization Exempt From Income Tax involves several steps that organizations must follow to ensure compliance with IRS regulations. First, organizations must gather financial records, including income statements, balance sheets, and details of program activities. Next, they should complete the form accurately, providing all required information about revenue sources, expenses, and governance practices. Once completed, the form must be filed with the IRS, either electronically or via mail, depending on the organization's size and revenue.

Steps to complete the Return Of Organization Exempt From Income Tax Nccsdataweb Urban

Completing the Return Of Organization Exempt From Income Tax requires careful attention to detail. Here are the steps organizations should follow:

- Gather necessary financial documents, including previous tax returns, bank statements, and receipts.

- Access the appropriate version of Form 990 for your organization’s size and type.

- Fill out the form, ensuring all sections are completed accurately, including revenue, expenses, and program services.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS by the deadline, either electronically or by mail.

Legal use of the Return Of Organization Exempt From Income Tax Nccsdataweb Urban

The legal use of the Return Of Organization Exempt From Income Tax is mandated by the IRS for organizations seeking or maintaining tax-exempt status. Filing this form is not only a legal requirement but also a means of demonstrating compliance with federal regulations. Nonprofits must adhere to specific guidelines regarding the information disclosed, ensuring that it accurately reflects their operations and financial health. Failure to file or inaccuracies in the form can lead to penalties or loss of tax-exempt status.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the Return Of Organization Exempt From Income Tax. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December 31, the form is due by May 15 of the following year. Organizations can apply for an extension if necessary, but they must file the extension request before the original deadline.

Required Documents

To complete the Return Of Organization Exempt From Income Tax, organizations need to prepare several key documents. These typically include:

- Financial statements for the fiscal year, including income and expense reports.

- Details of program activities and accomplishments.

- Records of governance, including board meeting minutes and bylaws.

- Supporting documentation for any claims made on the form, such as contributions and grants received.

Quick guide on how to complete return of organization exempt from income tax nccsdataweb urban

Easily set up [SKS] on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a superb eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more dealing with missing or lost files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Return Of Organization Exempt From Income Tax Nccsdataweb Urban

Create this form in 5 minutes!

How to create an eSignature for the return of organization exempt from income tax nccsdataweb urban

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Return Of Organization Exempt From Income Tax Nccsdataweb Urban?

The Return Of Organization Exempt From Income Tax Nccsdataweb Urban is a crucial tax form that certain organizations need to file to maintain their tax-exempt status. This document provides the IRS with details about the organization’s financial status and activities. Understanding this process is essential for organizations wishing to remain compliant with tax regulations.

-

How can airSlate SignNow help with the Return Of Organization Exempt From Income Tax Nccsdataweb Urban?

airSlate SignNow simplifies the process of preparing and submitting the Return Of Organization Exempt From Income Tax Nccsdataweb Urban by allowing users to eSign and manage documents electronically. Our intuitive platform ensures that your form is accurate and submitted on time. This not only saves time but also reduces the risk of errors.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to fit various organizational needs, ensuring that services related to the Return Of Organization Exempt From Income Tax Nccsdataweb Urban are accessible for all budgets. You can choose from monthly or annual subscriptions, with no hidden fees, allowing for straightforward financial planning.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow features a robust suite of document management tools designed to streamline the completion of the Return Of Organization Exempt From Income Tax Nccsdataweb Urban. Users can create templates, automate workflows, and track document statuses in real-time, providing a user-friendly experience that enhances productivity.

-

Are there integrations available with airSlate SignNow?

Yes, airSlate SignNow offers various integrations with popular applications, making it easy to connect your existing systems while managing the Return Of Organization Exempt From Income Tax Nccsdataweb Urban. Whether you use CRM platforms, cloud storage solutions, or project management tools, our integrations enable seamless functionality.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents related to the Return Of Organization Exempt From Income Tax Nccsdataweb Urban offers multiple benefits including increased security, reduced turnaround time, and enhanced compliance. Our solution ensures that signatures are legally binding and protects sensitive information during the signing process.

-

Is airSlate SignNow user-friendly for those unfamiliar with technology?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with technology. Our interface is intuitive and includes helpful guides, ensuring that everyone can efficiently manage their Return Of Organization Exempt From Income Tax Nccsdataweb Urban documents without a steep learning curve.

Get more for Return Of Organization Exempt From Income Tax Nccsdataweb Urban

- Dcrp eligibility status change verification form newjersey

- Credit card payment authority form kimberley college kimberleycollege

- Cuny tuition waiver form

- General deed of gift to revocable living trust form

- Sigma chi military pin form

- Patient referral form request for radiology imaging amp reporting dental pitt

- Comerica park application form

- Unit 11 capitalization lesson 72 answer key form

Find out other Return Of Organization Exempt From Income Tax Nccsdataweb Urban

- Electronic signature Maine Website Development Services Agreement Mobile

- eSignature Tennessee Reseller Agreement Mobile

- Can I Electronic signature Louisiana Website Development Services Agreement

- eSignature Tennessee Reseller Agreement Now

- Electronic signature Maine Website Development Services Agreement Now

- How To eSignature Tennessee Reseller Agreement

- Electronic signature Maine Website Development Services Agreement Later

- How Do I eSignature Tennessee Reseller Agreement

- Electronic signature Maine Website Development Services Agreement Myself

- eSignature Tennessee Reseller Agreement Later

- Help Me With eSignature Tennessee Reseller Agreement

- How Can I eSignature Tennessee Reseller Agreement

- Can I eSignature Tennessee Reseller Agreement

- Electronic signature Maine Website Development Services Agreement Free

- eSignature Tennessee Reseller Agreement Myself

- Electronic signature Maryland Website Development Services Agreement Online

- Electronic signature Maine Website Development Services Agreement Secure

- Electronic signature Maryland Website Development Services Agreement Computer

- Electronic signature Maryland Website Development Services Agreement Mobile

- Electronic signature Maine Website Development Services Agreement Fast