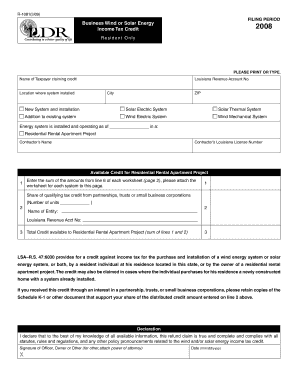

R 1081309 Business Wind or Solar Energy Income Tax Credit Resident Only FILING PERIOD PLEASE PRINT or TYPE Revenue Louisiana Form

Understanding the R 1081309 Business Wind or Solar Energy Income Tax Credit

The R 1081309 Business Wind or Solar Energy Income Tax Credit is a tax incentive designed for residents in Louisiana who invest in renewable energy sources. This credit allows eligible taxpayers to reduce their state income tax liability based on the costs associated with the installation of wind or solar energy systems. The program aims to promote sustainable energy practices and reduce reliance on fossil fuels.

Eligibility Criteria for the Tax Credit

To qualify for the R 1081309 credit, applicants must meet specific criteria. The following conditions typically apply:

- The installation must be for a residential property located in Louisiana.

- The energy system must be certified and meet state guidelines.

- Applicants must be residents of Louisiana and file state income taxes.

- Documentation proving the installation costs and system specifications is required.

Steps to Complete the R 1081309 Form

Filling out the R 1081309 form involves several key steps:

- Gather all necessary documentation, including receipts and installation contracts.

- Complete the form by providing personal information and details about the installed energy system.

- Calculate the eligible credit amount based on the costs incurred.

- Review the form for accuracy before submission.

- Submit the completed form to the Louisiana Department of Revenue by the specified filing deadline.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the R 1081309 tax credit. Typically, the form must be submitted by the due date of your state income tax return. Keeping track of these dates ensures that you can take full advantage of the available tax credits.

Required Documents for Submission

When applying for the R 1081309 Business Wind or Solar Energy Income Tax Credit, certain documents must be included with your submission:

- Proof of installation, such as contracts and receipts.

- Documentation showing the costs associated with the energy system.

- Any additional forms required by the Louisiana Department of Revenue.

Form Submission Methods

The R 1081309 form can be submitted through various methods, including:

- Online submission via the Louisiana Department of Revenue website.

- Mailing a physical copy of the completed form to the appropriate address.

- In-person submission at designated state revenue offices.

Quick guide on how to complete r 1081309 business wind or solar energy income tax credit resident only filing period please print or type revenue louisiana

Complete [SKS] effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely archive it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without waiting. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to R 1081309 Business Wind Or Solar Energy Income Tax Credit Resident Only FILING PERIOD PLEASE PRINT OR TYPE Revenue Louisiana

Create this form in 5 minutes!

How to create an eSignature for the r 1081309 business wind or solar energy income tax credit resident only filing period please print or type revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the R 1081309 Business Wind Or Solar Energy Income Tax Credit Resident Only FILING PERIOD PLEASE PRINT OR TYPE Revenue Louisiana?

The R 1081309 Business Wind Or Solar Energy Income Tax Credit Resident Only FILING PERIOD PLEASE PRINT OR TYPE Revenue Louisiana is a tax incentive aimed at promoting renewable energy investments. This credit applies to Louisiana residents who invest in wind or solar energy systems. It's essential for taxpayers to understand this credit to maximize their tax benefits.

-

How can airSlate SignNow assist with the R 1081309 Business Wind Or Solar Energy Income Tax Credit?

airSlate SignNow provides an efficient platform to handle all documentation required for the R 1081309 Business Wind Or Solar Energy Income Tax Credit. Users can easily create, send, and eSign necessary forms electronically, ensuring a streamlined process. This automation can save you time and reduce errors in your submissions.

-

What features does airSlate SignNow offer for document management related to tax credits?

With airSlate SignNow, users can access features like customizable templates, real-time collaboration, and secure cloud storage for documents needed for the R 1081309 Business Wind Or Solar Energy Income Tax Credit. Additionally, the platform allows you to track document status, ensuring you never lose sight of your submissions. These features enhance efficiency for tax-related paperwork.

-

Is airSlate SignNow cost-effective for small businesses applying for tax credits?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to apply for the R 1081309 Business Wind Or Solar Energy Income Tax Credit. The subscription plans are designed to fit various budgets and provide exceptional value with comprehensive eSigning capabilities. Simplifying document management can lead to signNow savings in both time and resources.

-

What are the benefits of using airSlate SignNow for the R 1081309 Business Wind Or Solar Energy Income Tax Credit?

Using airSlate SignNow streamlines the process of managing documents related to the R 1081309 Business Wind Or Solar Energy Income Tax Credit, offering benefits such as enhanced security, improved accuracy, and faster turnaround times on submissions. The user-friendly interface helps ensure that even those unfamiliar with digital tools can navigate the process efficiently. This leads to a smoother experience when applying for tax credits.

-

Can I integrate airSlate SignNow with other business tools?

Absolutely! airSlate SignNow can seamlessly integrate with various business applications, enhancing your workflow for managing the R 1081309 Business Wind Or Solar Energy Income Tax Credit. Popular integrations include CRM systems and project management tools. This interoperability helps ensure that all your documents and processes are aligned without leaving any gaps.

-

What support options does airSlate SignNow provide for users applying for tax credits?

airSlate SignNow offers robust support options for users navigating the R 1081309 Business Wind Or Solar Energy Income Tax Credit. Users can access a detailed knowledge base, tutorials, and customer support to answer any inquiries. This comprehensive support system ensures that you have assistance every step of the way.

Get more for R 1081309 Business Wind Or Solar Energy Income Tax Credit Resident Only FILING PERIOD PLEASE PRINT OR TYPE Revenue Louisiana

Find out other R 1081309 Business Wind Or Solar Energy Income Tax Credit Resident Only FILING PERIOD PLEASE PRINT OR TYPE Revenue Louisiana

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF