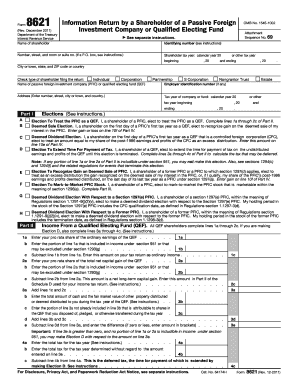

Form 8621 Rev December Internal Revenue Service

What is the Form 8621 Rev December Internal Revenue Service

The Form 8621 Rev December is a tax form issued by the Internal Revenue Service (IRS) that is used by U.S. taxpayers to report information regarding passive foreign investment companies (PFICs). This form is essential for individuals who own shares in foreign corporations that meet the criteria of a PFIC, as it helps in determining the tax implications of such investments. The form requires detailed information about the foreign corporation, including income, distributions, and gains, which are necessary for accurate tax reporting.

How to use the Form 8621 Rev December Internal Revenue Service

Using Form 8621 involves several steps to ensure compliance with IRS regulations. Taxpayers must first determine if they have an interest in a PFIC. If they do, they need to complete the form by providing information about the foreign corporation, including its income and distributions. It is important to accurately report all required details to avoid penalties. Once completed, the form should be submitted along with the taxpayer's annual tax return, ensuring that all information is consistent with other tax documents.

Steps to complete the Form 8621 Rev December Internal Revenue Service

Completing Form 8621 requires careful attention to detail. Here are the steps to follow:

- Gather information about the foreign corporation, including its name, address, and tax identification number.

- Determine the type of income received from the PFIC and any distributions made during the tax year.

- Fill out the required sections of the form, ensuring that all income and distributions are accurately reported.

- Review the completed form for accuracy and completeness.

- File the form with your annual tax return by the due date.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines associated with Form 8621 to avoid penalties. Generally, the form must be filed by the due date of the taxpayer's annual return, which is typically April 15 for most individuals. If an extension is filed for the tax return, the deadline for submitting Form 8621 may also be extended. However, it is essential to check the IRS guidelines for any updates or changes to these dates.

Required Documents

When completing Form 8621, certain documents are necessary to provide accurate information. Taxpayers should have:

- Documentation of ownership in the foreign corporation, such as stock certificates or statements.

- Records of any income received from the PFIC, including dividends and interest.

- Details of any distributions made during the tax year.

- Previous tax returns that may contain relevant information about the foreign investment.

Penalties for Non-Compliance

Failure to file Form 8621 or inaccuracies in the information provided can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, taxpayers may face increased scrutiny during audits, leading to further complications. It is advisable to ensure that the form is completed accurately and submitted on time to avoid these potential issues.

Quick guide on how to complete form 8621 rev december internal revenue service

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8621 Rev December Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 8621 rev december internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8621 Rev December submitted to the Internal Revenue Service?

Form 8621 Rev December is a tax form required by the Internal Revenue Service for certain U.S. shareholders of Passive Foreign Investment Companies (PFIC). This form helps report income and gain, ensuring compliance with U.S. tax regulations. Understanding its requirements is crucial for avoiding penalties.

-

How can airSlate SignNow help me with Form 8621 Rev December submissions?

airSlate SignNow offers an easy-to-use platform for preparing and sending Form 8621 Rev December to the Internal Revenue Service securely. Our solution allows for swift eSigning and sharing of your documents, ensuring that your submissions are efficient and well-managed. This helps streamline the process of meeting tax obligations.

-

Is there a cost to use airSlate SignNow for submitting Form 8621 Rev December?

Yes, while airSlate SignNow provides a cost-effective solution for document eSigning, pricing varies based on the plan you choose. We offer various subscription options tailored to your needs, making it affordable for both individuals and businesses managing Form 8621 Rev December submissions to the Internal Revenue Service.

-

What features does airSlate SignNow offer for handling tax forms like Form 8621 Rev December?

airSlate SignNow includes a range of features tailored for handling tax documents, including customizable templates, advanced eSigning capabilities, and secure document storage. Additionally, it supports workflow automation, ensuring timely submission of Form 8621 Rev December to the Internal Revenue Service with minimal effort.

-

Can I integrate airSlate SignNow with other applications for handling Form 8621 Rev December?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for managing Form 8621 Rev December. Integration with platforms such as Google Drive, Dropbox, and more allows for efficient document storage and retrieval, simplifying the overall process.

-

What benefits does eSigning provide for Form 8621 Rev December?

eSigning provides a quick and efficient method to sign and submit Form 8621 Rev December, reducing the time taken compared to traditional methods. With airSlate SignNow, you can ensure that your submissions are legally binding and securely transmitted, which is essential when dealing with the Internal Revenue Service.

-

How secure is my information when using airSlate SignNow for Form 8621 Rev December?

Security is a top priority at airSlate SignNow. We use industry-leading encryption and secure servers to protect your information when preparing and submitting Form 8621 Rev December to the Internal Revenue Service. You can trust that your data will stay confidential and protected throughout the process.

Get more for Form 8621 Rev December Internal Revenue Service

- Ratios grade 6 form

- Admission form r5 nielit gov in

- A p p l i c a t i o n f o r m i personal data iii iiee org form

- Credit card payment slip us hang gliding and paragliding ushpa form

- Pos perkins statewide articulation agreement documentation coversheet student name secondary school name secondary school form

- Request for authorization for rescheduled training form

- Ewr form pdf

- Sanction renewal american contract bridge league web2 acbl form

Find out other Form 8621 Rev December Internal Revenue Service

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney