Fform 5095 2013-2026

What is the Form 5095?

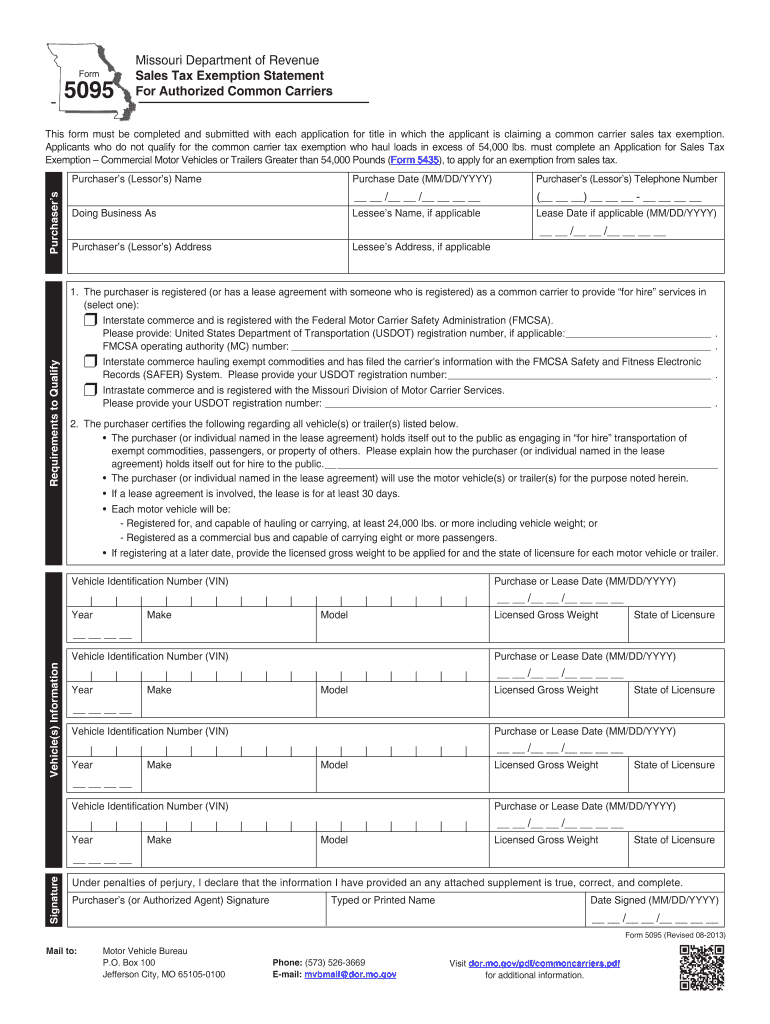

The Form 5095 is a document used in Missouri for claiming sales tax exemptions. This form is particularly relevant for businesses and individuals who qualify for certain tax exemptions under state law. It serves as a formal declaration to the Missouri Department of Revenue, indicating that the filer is eligible for a tax exemption on specific purchases. Understanding the purpose and requirements of the Form 5095 is essential for ensuring compliance with state tax regulations.

How to Use the Form 5095

Using the Form 5095 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the purchases for which you are claiming an exemption. This includes details about the items, the total amount, and the reason for the exemption. Next, fill out the form completely, ensuring that all fields are accurate and truthful. Once completed, submit the form to the appropriate state authority as specified in the instructions provided with the form.

Steps to Complete the Form 5095

Completing the Form 5095 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 5095 from the Missouri Department of Revenue.

- Fill in your personal or business information, including your name, address, and tax identification number.

- List the items for which you are claiming the exemption, including descriptions and prices.

- Indicate the reason for the exemption, ensuring it aligns with state guidelines.

- Review the form for accuracy before signing and dating it.

Legal Use of the Form 5095

The legal use of the Form 5095 is governed by Missouri state tax laws. It is essential for filers to understand the specific exemptions they qualify for and to use the form accordingly. Misuse of the form, such as claiming exemptions for ineligible purchases, can lead to penalties and legal consequences. Therefore, it is advisable to consult with a tax professional if there are any uncertainties regarding eligibility or the completion of the form.

Eligibility Criteria

To be eligible to use the Form 5095, individuals and businesses must meet specific criteria set forth by the Missouri Department of Revenue. Generally, these criteria include being a registered business entity in Missouri, making purchases that qualify for sales tax exemptions, and providing valid reasons for claiming the exemption. It is important to review the detailed eligibility requirements outlined by the state to ensure compliance.

Form Submission Methods

The Form 5095 can be submitted through various methods, depending on the preferences of the filer. Options typically include:

- Online submission through the Missouri Department of Revenue's website.

- Mailing a printed version of the completed form to the designated address.

- In-person submission at local revenue offices.

Choosing the appropriate submission method can impact processing times, so filers should consider their circumstances when deciding how to submit the form.

Quick guide on how to complete mo form 5095 2013 2018

Your assistance manual on how to prepare your Fform 5095

If you’re curious about how to finalize and send your Fform 5095, here are some concise recommendations to simplify tax reporting.

To begin, you simply need to sign up for your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a highly intuitive and powerful document tool that enables you to adjust, produce, and finish your income tax paperwork effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, allowing you to revisit and modify details as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and user-friendly sharing.

Follow these steps to complete your Fform 5095 in just a few minutes:

- Create your account and start working on PDFs in moments.

- Utilize our library to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Fform 5095 in our editor.

- Complete the necessary fillable sections with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Keep in mind that paper submissions can lead to increased errors and delayed refunds. Before e-filing your taxes, be sure to review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct mo form 5095 2013 2018

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

What is the procedure to fill out a form for more than one post in AAI 2018?

Hello dear AAI JOB aspirantFill up different posts of present recruitment 02/2018 by using different email IDs but phone number can be same.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

Create this form in 5 minutes!

How to create an eSignature for the mo form 5095 2013 2018

How to create an electronic signature for your Mo Form 5095 2013 2018 in the online mode

How to generate an electronic signature for the Mo Form 5095 2013 2018 in Chrome

How to create an electronic signature for signing the Mo Form 5095 2013 2018 in Gmail

How to generate an electronic signature for the Mo Form 5095 2013 2018 straight from your smart phone

How to generate an electronic signature for the Mo Form 5095 2013 2018 on iOS

How to make an eSignature for the Mo Form 5095 2013 2018 on Android OS

People also ask

-

What is Fform 5095 and how does it work with airSlate SignNow?

Fform 5095 is a digital document that allows users to facilitate various business transactions within the airSlate SignNow platform. With airSlate SignNow, you can easily create, send, and eSign Fform 5095, ensuring that your documents are legally binding and securely stored. The platform simplifies the entire process, making it user-friendly for businesses of all sizes.

-

How much does airSlate SignNow cost for Fform 5095 processing?

airSlate SignNow offers flexible pricing plans to accommodate businesses needing to process Fform 5095. Depending on the features and number of users, plans start at an affordable rate, ensuring that you get the best value for your investment. You can also take advantage of a free trial to explore the platform's capabilities before committing.

-

What features does airSlate SignNow offer for managing Fform 5095?

airSlate SignNow provides a range of features for managing Fform 5095, including customizable templates, automated workflows, and real-time tracking of document status. These features streamline the eSigning process, allowing you to send and receive documents quickly and efficiently. Additionally, you can integrate Fform 5095 with other tools to enhance your workflow.

-

Is airSlate SignNow secure for handling Fform 5095?

Yes, airSlate SignNow is committed to security, which is crucial when handling sensitive documents like Fform 5095. The platform uses advanced encryption and complies with industry standards to protect your data. This ensures that your documents remain confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for Fform 5095?

Absolutely! airSlate SignNow offers robust integrations with various applications, allowing you to streamline the process of managing Fform 5095. You can connect with CRM systems, cloud storage solutions, and more to create a seamless workflow that enhances productivity and efficiency.

-

What are the benefits of using airSlate SignNow for Fform 5095?

Using airSlate SignNow for Fform 5095 offers numerous benefits, including time savings, improved accuracy, and reduced paperwork. The platform enables you to eSign documents from anywhere, making it easier for your team to collaborate remotely. Additionally, digital tracking features ensure that you always know the status of your documents.

-

How does airSlate SignNow improve the efficiency of Fform 5095 transactions?

airSlate SignNow improves the efficiency of Fform 5095 transactions by automating key processes and reducing manual errors. With customizable workflows, you can streamline the approval and signing process, allowing documents to move quickly through your organization. This efficiency leads to faster turnaround times and enhanced customer satisfaction.

Get more for Fform 5095

- Application for accreditation in medical radiation technology iema iema illinois form

- Cooper university hospital volunteer program consent form

- Implementation report template form

- Gifted individualized education plan form

- Ellis island virtual tour worksheet form

- Early release sign out sheet ceres after school program form

- Construction site safety plan sample form

- Eh public counter services form

Find out other Fform 5095

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple