for Calendar Year or the Taxable Year Beginning , , Ending , 20 2019

Understanding the Alaska Corporation Net Income Tax Return

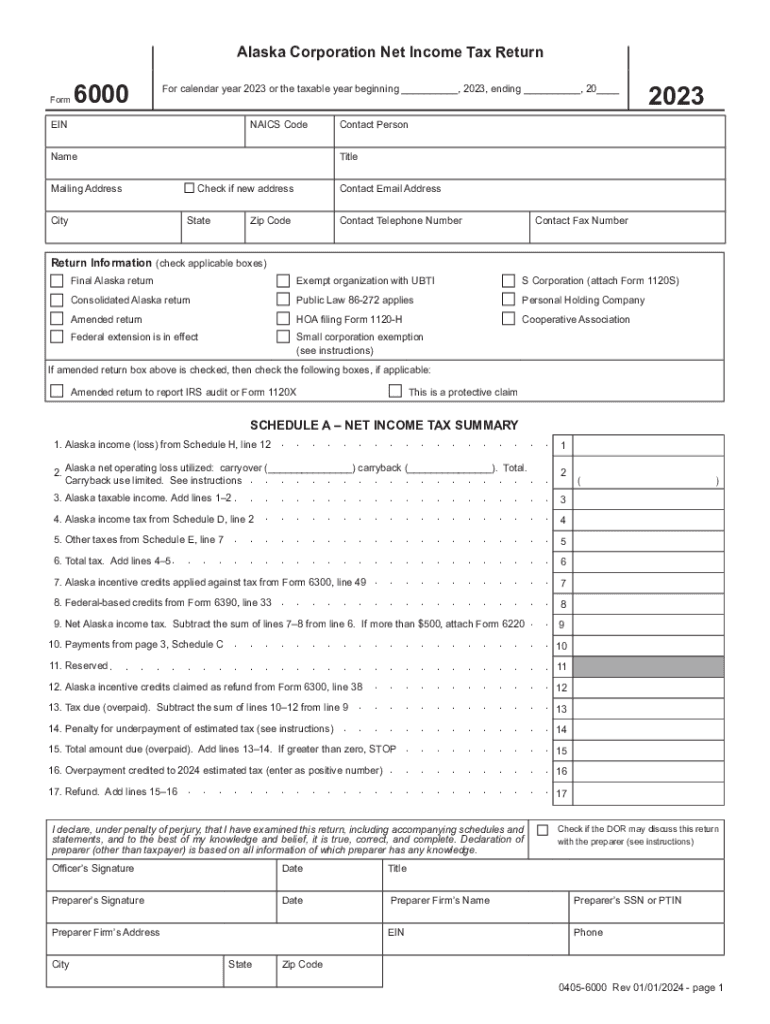

The Alaska Corporation Net Income Tax Return is essential for businesses operating within the state. This form, often referred to as the Alaska 6000 Corporation Income Tax Return Form, is used to report the net income of corporations. It is crucial for compliance with state tax laws and ensures that businesses contribute their fair share to state revenue. The form requires detailed financial information, including income, deductions, and credits applicable to the corporation.

Key Elements of the Alaska 6000 Corporation Income Return

When completing the Alaska 6000 Corporation Income Return, several key elements must be addressed:

- Tax Period: Indicate the calendar year or taxable year for which the return is being filed.

- Gross Income: Report total income earned during the tax period, including sales, services, and other revenue sources.

- Deductions: Include allowable deductions that reduce taxable income, such as operating expenses and depreciation.

- Tax Calculation: Calculate the corporation's tax liability based on net income after deductions.

- Signatures: Ensure that authorized individuals sign the return, verifying the accuracy of the information provided.

Steps to Complete the Alaska 6000 Corporation Income Return

Completing the Alaska 6000 Corporation Income Return involves several systematic steps:

- Gather all financial records, including income statements and expense reports.

- Determine the tax period for which you are filing the return.

- Calculate gross income and allowable deductions accurately.

- Complete the form, ensuring all sections are filled out correctly.

- Review the return for accuracy and completeness before submission.

- Submit the form by the specified deadline to avoid penalties.

Filing Deadlines and Important Dates

Timely filing of the Alaska Corporation Net Income Tax Return is crucial to avoid penalties. The standard deadline for submission is typically the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year basis, this means the due date is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also apply for an extension, but it is important to understand that this does not extend the time for payment of any taxes owed.

Required Documents for Submission

To complete the Alaska 6000 Corporation Income Return, several documents are necessary:

- Financial statements, including balance sheets and income statements.

- Records of all income received during the tax period.

- Documentation for all deductions claimed, such as receipts and invoices.

- Previous tax returns, if applicable, for reference.

Penalties for Non-Compliance

Failure to file the Alaska Corporation Net Income Tax Return on time can result in significant penalties. These may include:

- Late Filing Penalties: A percentage of the unpaid tax may be assessed for each month the return is late.

- Interest Charges: Interest accrues on any unpaid tax from the due date until payment is made.

- Potential Legal Action: Continued non-compliance may lead to more severe legal consequences, including liens or levies on corporate assets.

Quick guide on how to complete for calendar year or the taxable year beginning ending 20

Complete For Calendar Year Or The Taxable Year Beginning , , Ending , 20 seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly, eliminating delays. Engage with For Calendar Year Or The Taxable Year Beginning , , Ending , 20 on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign For Calendar Year Or The Taxable Year Beginning , , Ending , 20 effortlessly

- Locate For Calendar Year Or The Taxable Year Beginning , , Ending , 20 and click on Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searching, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and electronically sign For Calendar Year Or The Taxable Year Beginning , , Ending , 20 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year or the taxable year beginning ending 20

Create this form in 5 minutes!

How to create an eSignature for the for calendar year or the taxable year beginning ending 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of alaska net income for businesses?

Understanding alaska net income is crucial for businesses operating in the state, as it affects tax obligations and financial planning. By accurately calculating net income, businesses can effectively manage their expenses and optimize their profitability. airSlate SignNow assists in efficient document management, streamlining the process of maintaining accurate financial records.

-

How does airSlate SignNow help with calculating alaska net income?

airSlate SignNow provides tools that simplify the management and signing of financial documents, which can include income statements. By ensuring documents are complete and signed electronically, businesses can more easily calculate their alaska net income and ensure compliance with state regulations. This eliminates the hassle associated with manual documentation.

-

Is there a pricing plan for airSlate SignNow that fits small businesses calculating alaska net income?

Yes, airSlate SignNow offers a range of pricing plans designed to accommodate small businesses. These plans provide essential features to help track and manage documents related to alaska net income without excessive costs. You can choose a plan that meets your needs while keeping your budget in check.

-

What features does airSlate SignNow include for managing alaska net income?

airSlate SignNow includes features like customizable templates, secure e-signatures, and automated reminders that are beneficial for managing documents related to alaska net income. These features allow you to streamline your documentation process, ensuring timely and accurate financial reporting. Overall, it enhances efficiency in tracking and maintaining financial documentation.

-

Can airSlate SignNow integrate with accounting software to manage alaska net income?

Absolutely! airSlate SignNow can integrate with popular accounting software, making it easier to manage documents relevant to alaska net income. This integration facilitates seamless data transfer, ensuring that your financial records are accurate and up to date without manual entry. It simplifies the accounting process and reduces errors.

-

What benefits does airSlate SignNow provide to businesses dealing with alaska net income?

By using airSlate SignNow, businesses can save time and resources in handling documents related to alaska net income. The ability to sign documents electronically enhances the speed and security of transactions while improving compliance with regulations. Ultimately, it supports businesses in making informed financial decisions.

-

How secure is airSlate SignNow for sensitive information related to alaska net income?

Security is a top priority for airSlate SignNow, especially when handling sensitive data like alaska net income. The platform uses advanced encryption protocols to protect your documents and transactions. This ensures that your financial information remains confidential and secure from unauthorized access.

Get more for For Calendar Year Or The Taxable Year Beginning , , Ending , 20

Find out other For Calendar Year Or The Taxable Year Beginning , , Ending , 20

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien