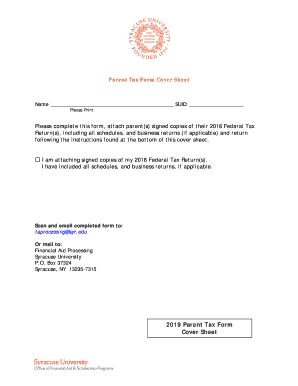

Parent Tax Form Cover Sheet Financial Aid

What is the Parent Tax Form Cover Sheet for Financial Aid

The Parent Tax Form Cover Sheet for Financial Aid is a document used by parents to provide essential tax information when applying for financial aid for their children’s education. This cover sheet typically accompanies other financial documents and is designed to summarize key financial data, ensuring that educational institutions can assess a family's financial situation accurately. It is crucial for determining eligibility for various financial aid programs, including grants, scholarships, and loans.

How to Use the Parent Tax Form Cover Sheet for Financial Aid

Using the Parent Tax Form Cover Sheet for Financial Aid involves a few straightforward steps. First, gather all relevant financial documents, including tax returns and income statements. Next, fill out the cover sheet with accurate details, such as the parent’s income, tax filing status, and any other required financial information. Once completed, attach the cover sheet to the financial aid application and submit it according to the institution's guidelines. This ensures that the financial aid office has all necessary information to process the application efficiently.

Steps to Complete the Parent Tax Form Cover Sheet for Financial Aid

Completing the Parent Tax Form Cover Sheet for Financial Aid requires careful attention to detail. Follow these steps:

- Collect your most recent tax return and any other relevant financial documents.

- Enter your personal information, including name, address, and Social Security number.

- Provide details about your income, including wages, salaries, and any other sources of income.

- Indicate your tax filing status, such as single, married filing jointly, or head of household.

- Review the information for accuracy before submission.

Key Elements of the Parent Tax Form Cover Sheet for Financial Aid

Several key elements are essential for the Parent Tax Form Cover Sheet for Financial Aid. These include:

- Personal Information: Names and contact information of the parents.

- Income Details: Total income from all sources, including wages and investments.

- Tax Filing Status: Indicates how the parents file their taxes.

- Signature: Required to verify the accuracy of the information provided.

Required Documents for the Parent Tax Form Cover Sheet for Financial Aid

When preparing the Parent Tax Form Cover Sheet for Financial Aid, certain documents are typically required. These may include:

- Most recent federal tax return (IRS Form 1040).

- W-2 forms from employers.

- Documentation of any untaxed income, such as child support or Social Security.

- Any additional financial statements that provide context to the family's financial situation.

Form Submission Methods for the Parent Tax Form Cover Sheet for Financial Aid

Submitting the Parent Tax Form Cover Sheet for Financial Aid can be accomplished through various methods, depending on the institution’s requirements. Common submission methods include:

- Online Submission: Many schools offer online portals where documents can be uploaded securely.

- Mail: Printed forms can be sent via postal service to the financial aid office.

- In-Person Delivery: Families may choose to deliver the documents directly to the financial aid office.

Quick guide on how to complete parent tax form cover sheet financial aid

Prepare Parent Tax Form Cover Sheet Financial Aid effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Parent Tax Form Cover Sheet Financial Aid on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Parent Tax Form Cover Sheet Financial Aid without hassle

- Find Parent Tax Form Cover Sheet Financial Aid and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Parent Tax Form Cover Sheet Financial Aid to ensure excellent communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the parent tax form cover sheet financial aid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Parent Tax Form Cover Sheet Financial Aid and why is it important?

The Parent Tax Form Cover Sheet Financial Aid is a crucial document required by many educational institutions to accompany tax forms submitted for financial aid applications. This cover sheet helps ensure that your tax information is organized and easily accessible, streamlining the financial aid process. Properly completing this form can enhance your chances of obtaining financial support for your education.

-

How does airSlate SignNow facilitate the submission of the Parent Tax Form Cover Sheet Financial Aid?

airSlate SignNow offers an efficient platform to electronically sign and submit the Parent Tax Form Cover Sheet Financial Aid. The intuitive interface allows users to fill out, eSign, and send documents securely, ensuring your information is processed quickly. This can save you time and reduce the stress associated with financial aid applications.

-

Is airSlate SignNow a cost-effective solution for processing the Parent Tax Form Cover Sheet Financial Aid?

Yes, airSlate SignNow provides a cost-effective solution for managing the Parent Tax Form Cover Sheet Financial Aid. With flexible pricing plans, customers can select a package that fits their needs and budget. This affordability makes it accessible for families seeking financial aid to streamline their documentation process.

-

What features does airSlate SignNow offer for managing documents like the Parent Tax Form Cover Sheet Financial Aid?

airSlate SignNow includes features such as eSigning, document storage, template creation, and real-time tracking. These tools make it easy to manage the Parent Tax Form Cover Sheet Financial Aid efficiently. Additionally, the platform allows users to collaborate and share documents seamlessly with financial aid offices.

-

Can I integrate airSlate SignNow with other software for my Parent Tax Form Cover Sheet Financial Aid?

Yes, airSlate SignNow supports integrations with various software applications that are commonly used for financial management and education. This functionality allows you to incorporate the Parent Tax Form Cover Sheet Financial Aid into your existing processes, making document management even more efficient. Some integrations include popular tools like Google Drive, Dropbox, and more.

-

What benefits does electronic signing provide for the Parent Tax Form Cover Sheet Financial Aid?

Using electronic signing for the Parent Tax Form Cover Sheet Financial Aid offers several benefits, including increased security and reduced processing time. Electronic signatures are legally binding and provide a seamless way to complete required documentation from anywhere. This can greatly enhance the experience for parents applying for financial aid.

-

How secure is the information submitted through airSlate SignNow for the Parent Tax Form Cover Sheet Financial Aid?

airSlate SignNow prioritizes your privacy and data security by using advanced encryption and security protocols. All documents, including the Parent Tax Form Cover Sheet Financial Aid, are stored securely. You can have peace of mind knowing that your sensitive information is well protected throughout the submission process.

Get more for Parent Tax Form Cover Sheet Financial Aid

- Kansas post 497307546 form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out kansas form

- Property manager agreement kansas form

- Agreement for delayed or partial rent payments kansas form

- Tenants maintenance repair request form kansas

- Guaranty attachment to lease for guarantor or cosigner kansas form

- Warning notice due to complaint from neighbors kansas form

- Lease subordination agreement kansas form

Find out other Parent Tax Form Cover Sheet Financial Aid

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now