Budget Worksheet for Students 2018-2026

What is the budget worksheet for students

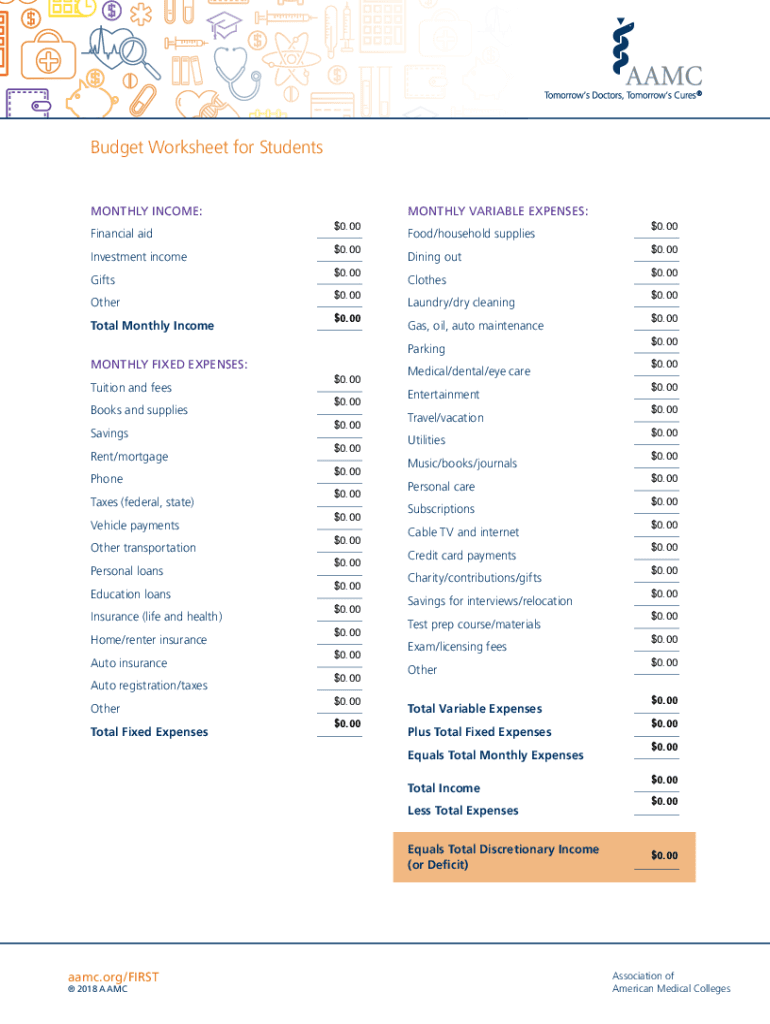

The budget worksheet for students is a financial planning tool designed to help students manage their income and expenses effectively. This worksheet allows students to track their spending habits, set financial goals, and ensure they stay within their budget. It typically includes sections for listing income sources, such as part-time jobs or allowances, and various expense categories, including tuition, housing, food, transportation, and entertainment. By using this worksheet, students can gain a clearer understanding of their financial situation and make informed decisions about their spending.

How to use the budget worksheet for students

Using the budget worksheet for students involves several straightforward steps. First, students should gather all relevant financial information, including income statements and bills. Next, they can categorize their income and expenses into sections provided on the worksheet. It is essential to input accurate figures to reflect true financial status. After filling in the worksheet, students should analyze their spending patterns, identify areas where they can cut costs, and adjust their budget accordingly. Regularly updating the worksheet can help maintain financial discipline and adapt to changing circumstances.

Key elements of the budget worksheet for students

The budget worksheet for students typically includes several key elements that facilitate effective financial management. These elements often consist of:

- Income section: A space to list all sources of income, such as wages, scholarships, and grants.

- Expense categories: Sections for fixed expenses (like rent and tuition) and variable expenses (such as groceries and entertainment).

- Monthly totals: Areas to calculate total income and total expenses, allowing students to see their net balance.

- Savings goals: A section to outline savings targets and track progress towards achieving them.

Steps to complete the budget worksheet for students

Completing the budget worksheet for students involves a series of organized steps. Begin by listing all sources of income for the month. Next, categorize and list all expenses, ensuring to differentiate between fixed and variable costs. After entering all data, calculate the total income and total expenses. Subtract total expenses from total income to determine the net balance. If expenses exceed income, students should revisit their expense categories to find areas for reduction. Finally, set savings goals based on the net balance and adjust the budget as necessary.

Examples of using the budget worksheet for students

Examples of using the budget worksheet for students can illustrate its practical application. For instance, a student might use the worksheet to plan for a semester abroad, estimating costs for travel, accommodation, and daily expenses. Another example could involve a student managing a part-time job's income while balancing tuition payments and living expenses. By documenting these financial scenarios, students can visualize their budget and make necessary adjustments to stay on track.

Digital vs. paper version of the budget worksheet for students

Students can choose between a digital or paper version of the budget worksheet, each with its advantages. The digital version often includes interactive features, such as automatic calculations and easy updates, making it convenient for tech-savvy students. Conversely, a paper version allows for a tactile experience and can be useful for those who prefer writing by hand. Ultimately, the choice depends on individual preferences and learning styles, but both formats serve the same purpose of aiding financial management.

Quick guide on how to complete budget worksheet for students

Complete Budget Worksheet For Students seamlessly on any gadget

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, as you can find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Budget Worksheet For Students on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and electronically sign Budget Worksheet For Students effortlessly

- Locate Budget Worksheet For Students and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or blackout sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred method of delivering your form, by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Budget Worksheet For Students and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct budget worksheet for students

Create this form in 5 minutes!

How to create an eSignature for the budget worksheet for students

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a budget worksheet for students?

A budget worksheet for students is a financial tool designed to help students track their income and expenses. This worksheet simplifies the budgeting process, allowing students to manage their finances effectively while in school. Using a budget worksheet can lead to better financial literacy and responsibility.

-

How can airSlate SignNow help students with budgeting?

AirSlate SignNow can facilitate the creation and signing of budget worksheets for students, ensuring they have effective tools at their fingertips. Students can easily collaborate with peers or mentors and electronically sign documents related to their financial plans. This streamlines the budgeting process and helps students stay organized.

-

Is airSlate SignNow cost-effective for students?

Yes, airSlate SignNow is a cost-effective solution that provides signNow value for students. The platform offers various pricing plans that cater to different needs and budgets. By using airSlate SignNow, students can save time and money while managing their budget worksheet efficiently.

-

Can I customize my budget worksheet for students using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize your budget worksheet for students according to your specific financial needs. You can tailor the categories to fit your income sources and expenses, enhancing the utility of the worksheet. This flexibility makes it easier for students to manage their unique financial situations.

-

Does airSlate SignNow integrate with other budgeting tools?

Yes, airSlate SignNow offers integrations with various budgeting tools and applications. This allows students to connect their budget worksheet with other financial management software seamlessly. Such integrations can enhance the overall budgeting experience and provide comprehensive insights into student finances.

-

What features does airSlate SignNow offer for budget worksheets?

AirSlate SignNow provides several features for budget worksheets, including document templates, electronic signatures, and collaboration tools. These features make it simple for students to create and manage their budgets. The user-friendly interface ensures that students can focus on budgeting rather than grappling with complex software.

-

Can airSlate SignNow assist in group budgeting projects for students?

Yes, airSlate SignNow is perfect for group budgeting projects among students. The platform allows multiple users to access and edit the budget worksheet collaboratively. This feature fosters teamwork and ensures that everyone in the group can contribute to the financial planning process.

Get more for Budget Worksheet For Students

Find out other Budget Worksheet For Students

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document