Sodexo Wotc Form

What is the Sodexo WOTC Form

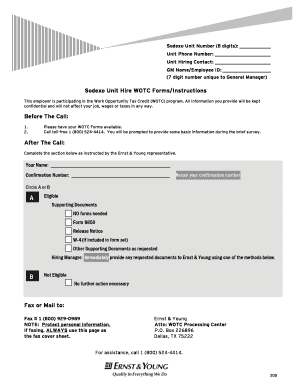

The Sodexo WOTC form is a document used to claim the Work Opportunity Tax Credit (WOTC), which provides tax incentives to employers who hire individuals from specific target groups facing barriers to employment. This form is essential for businesses looking to reduce their federal tax liability while supporting the employment of underrepresented populations. The WOTC program is designed to encourage the hiring of veterans, individuals receiving public assistance, and other eligible groups.

Steps to Complete the Sodexo WOTC Form

Completing the Sodexo WOTC form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the new hire, including their personal details and the specific target group they belong to. Next, fill out the form by providing the required information, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it. Finally, retain a copy for your records and submit the form to the appropriate authority for processing.

How to Obtain the Sodexo WOTC Form

The Sodexo WOTC form can typically be obtained through the Sodexo website or directly from your human resources department. Employers may also request the form from the IRS or relevant state agencies. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. If you are unsure where to find the form, contacting your HR representative can provide guidance on obtaining the necessary documentation.

Eligibility Criteria

To qualify for the Work Opportunity Tax Credit using the Sodexo WOTC form, employers must hire individuals from specific target groups. These groups include veterans, individuals receiving Temporary Assistance for Needy Families (TANF), Supplemental Nutrition Assistance Program (SNAP) recipients, and other designated categories. Each group has unique eligibility requirements, so it is essential for employers to verify that new hires meet these criteria before submitting the form.

Form Submission Methods

The completed Sodexo WOTC form can be submitted through various methods, including online submission, mailing a physical copy, or delivering it in person to the relevant agency. Employers should choose the method that best suits their operational needs and ensure that they adhere to any specific submission guidelines outlined by the IRS or state agencies. Timely submission is crucial to secure the tax benefits associated with the WOTC program.

Key Elements of the Sodexo WOTC Form

The Sodexo WOTC form includes several key elements that are critical for its completion. These elements typically encompass the employer's information, the employee's details, and the specific target group designation. Additionally, the form may require information about the employee's start date and any relevant certifications. Understanding these key components is essential for accurately filling out the form and ensuring compliance with WOTC requirements.

Quick guide on how to complete sodexo wotc form

Complete Sodexo Wotc Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Sodexo Wotc Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Sodexo Wotc Form easily

- Obtain Sodexo Wotc Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Decide how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Sodexo Wotc Form and guarantee clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sodexo wotc form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sodexo WOTC form?

The Sodexo WOTC form is a document utilized for claiming the Work Opportunity Tax Credit (WOTC) for eligible employees. This form helps businesses maximize their tax credits while ensuring compliance with federal regulations. Completing and submitting the sodexo wotc form accurately can provide signNow financial benefits.

-

How can airSlate SignNow help with the Sodexo WOTC form?

airSlate SignNow streamlines the process of completing and eSigning the sodexo wotc form. Our platform offers an intuitive interface that allows users to fill out, sign, and send documents securely and efficiently. By using airSlate SignNow, you can reduce paperwork and expedite the submission of the sodexo wotc form.

-

Is there a cost associated with using airSlate SignNow for the Sodexo WOTC form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Exploring our cost-effective solutions for handling the sodexo wotc form will help you find the package that works best for your organization. You can benefit from our competitive pricing while enjoying robust features.

-

What features does airSlate SignNow offer for the Sodexo WOTC form?

Our platform provides essential features for the sodexo wotc form, including customizable templates, eSignature capabilities, and document tracking. These tools are designed to enhance efficiency and ensure that all forms are completed correctly. Moreover, users can collaborate easily with team members throughout the signing process.

-

Can I integrate airSlate SignNow with other software for the Sodexo WOTC form?

Yes, airSlate SignNow supports various integrations that facilitate seamless workflows for the sodexo wotc form. You can connect our platform with popular CRMs, HR systems, and cloud storage services. This integration capability helps streamline your documentation process, saving time and reducing errors.

-

How do I ensure compliance when using the Sodexo WOTC form?

Using airSlate SignNow to complete the sodexo wotc form enhances compliance by providing a structured and secure environment for document handling. Our platform maintains industry-standard security practices and ensures that all eSignatures are legally binding. Regular updates also ensure that you are aligned with the latest regulations.

-

Is it easy to track the status of my Sodexo WOTC form submissions?

Absolutely! airSlate SignNow offers comprehensive tracking capabilities for your sodexo wotc form submissions. You can easily monitor who has signed, view completion dates, and receive notifications, allowing you to stay informed throughout the process. This transparency streamlines your document management signNowly.

Get more for Sodexo Wotc Form

- To rescind form

- Full text of ampquotmontgomerys manual of federal procedure form

- Alias and pluries summons assess fee form

- In summary ejectment form

- Judgment in action of possessory lien on motor vehicle form

- On the civil sidespecial rules for summary ejectment form

- A small claim action has been commenced against you form

- Special rules for summary ejectment actions on the civil side form

Find out other Sodexo Wotc Form

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template