Continued Monthly Residence Form CalPERS Long Term Care

What is the Continued Monthly Residence Form CalPERS Long Term Care

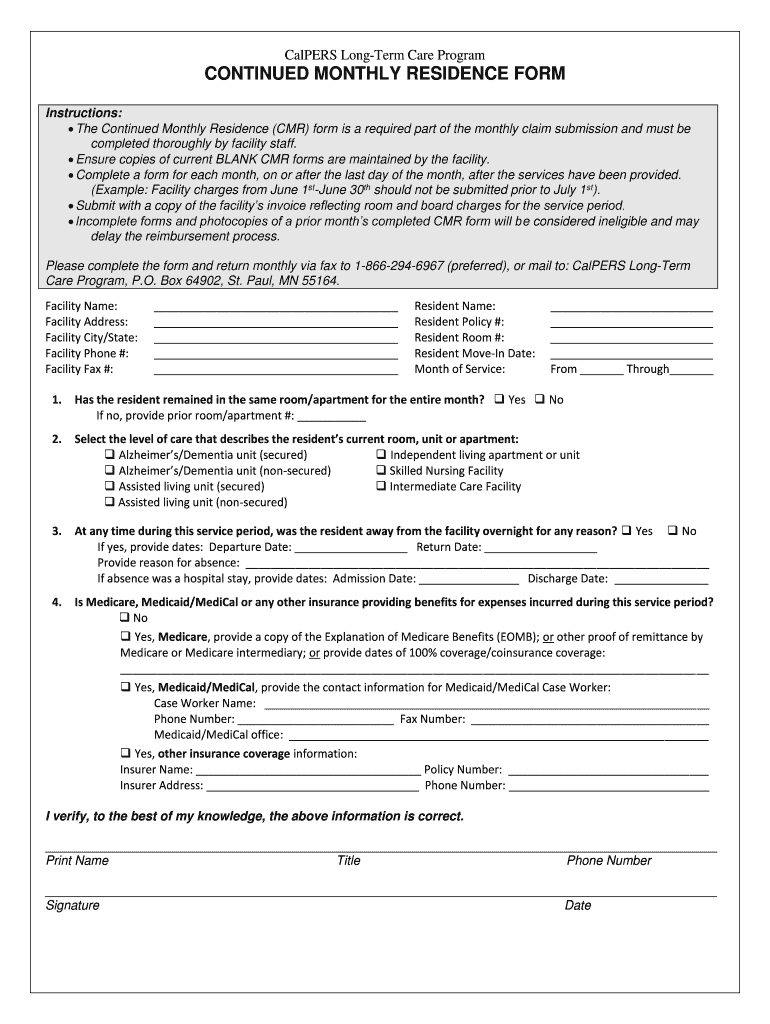

The Continued Monthly Residence Form is a crucial document for individuals enrolled in the California Public Employees' Retirement System (CalPERS) Long Term Care program. This form is designed to verify the residency of beneficiaries who are receiving long-term care benefits. By confirming residency, CalPERS ensures that the benefits are allocated appropriately and in compliance with state regulations. Accurate completion of this form is essential for maintaining eligibility for ongoing benefits.

How to use the Continued Monthly Residence Form CalPERS Long Term Care

Using the Continued Monthly Residence Form involves several straightforward steps. First, ensure you have the most recent version of the form, which can be obtained from the CalPERS website or through customer service. Fill out the required sections, including personal identification details and residency verification. It is important to provide accurate information to avoid delays in processing. Once completed, submit the form according to the instructions provided, ensuring that all necessary documentation is included.

Steps to complete the Continued Monthly Residence Form CalPERS Long Term Care

Completing the Continued Monthly Residence Form requires careful attention to detail. Follow these steps for successful submission:

- Obtain the latest version of the form from CalPERS.

- Fill in your personal information, including your name, address, and contact details.

- Provide information regarding your residency status, including how long you have lived at your current address.

- Attach any supporting documents that verify your residency, such as utility bills or lease agreements.

- Review the form for accuracy and completeness before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Key elements of the Continued Monthly Residence Form CalPERS Long Term Care

The Continued Monthly Residence Form contains several key elements that are essential for proper completion. These include:

- Personal Information: Your name, address, and contact information.

- Residency Verification: Details about your current living situation and how long you have resided at your address.

- Supporting Documentation: Requirements for proof of residency, which may include utility bills or rental agreements.

- Signature: Your signature certifying that the information provided is accurate and truthful.

Legal use of the Continued Monthly Residence Form CalPERS Long Term Care

The Continued Monthly Residence Form serves a legal purpose in the context of the CalPERS Long Term Care program. By submitting this form, beneficiaries confirm their residency status, which is a requirement for receiving benefits. Failing to provide accurate information can lead to penalties, including the potential loss of benefits. Therefore, understanding the legal implications of this form is vital for all participants in the program.

Eligibility Criteria

To be eligible for the benefits associated with the Continued Monthly Residence Form, individuals must meet specific criteria set forth by CalPERS. Generally, applicants must be enrolled in the Long Term Care program and must provide proof of residency in California. Additionally, beneficiaries must remain compliant with all program requirements to maintain their eligibility for ongoing benefits. Regular submission of the residency form is often necessary to confirm continued eligibility.

Quick guide on how to complete continued monthly residence form calpers long term care

Effortlessly Prepare Continued Monthly Residence Form CalPERS Long Term Care on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Continued Monthly Residence Form CalPERS Long Term Care on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Modify and Electronically Sign Continued Monthly Residence Form CalPERS Long Term Care with Ease

- Find Continued Monthly Residence Form CalPERS Long Term Care and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Continued Monthly Residence Form CalPERS Long Term Care and ensure excellent communication throughout every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the continued monthly residence form calpers long term care

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the calpers continued monthly residence form?

The calpers continued monthly residence form is a document required by CalPERS for members to verify their residence status. Completing this form helps ensure that members maintain their eligibility for benefits. It is important to fill it out correctly and submit it on time to avoid any interruptions in your benefits.

-

How can airSlate SignNow help with the calpers continued monthly residence form?

airSlate SignNow provides an efficient platform for electronically signing and sending the calpers continued monthly residence form. With its user-friendly interface, you can easily complete and submit your form, streamlining the process and reducing the risk of errors. This ensures a hassle-free experience and timely submission.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different needs, including individual, business, and enterprise options. Each plan provides access to essential features that streamline document signing processes, like the calpers continued monthly residence form. Pricing is competitive, making it a cost-effective choice for your signing needs.

-

Are there templates available for the calpers continued monthly residence form?

Yes, airSlate SignNow offers customizable templates for commonly used documents, including the calpers continued monthly residence form. Using a template can save time by allowing you to pre-fill standard information and quickly prepare your form for signature. This feature ensures consistency and helps maintain compliance with CalPERS requirements.

-

Is airSlate SignNow secure for handling sensitive documents like the calpers continued monthly residence form?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your documents, including the calpers continued monthly residence form. With features like encryption, secure cloud storage, and access control, you can trust that your information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for managing the calpers continued monthly residence form?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, making it easy to manage the calpers continued monthly residence form alongside your other business processes. Integration with platforms such as Google Drive, Dropbox, and CRM systems allows for efficient document storage and retrieval. This enhances productivity and streamlines your workflow.

-

How quickly can I get the calpers continued monthly residence form signed?

With airSlate SignNow, you can expect a faster turnaround for signing the calpers continued monthly residence form. The platform allows you to send the form to multiple signers simultaneously and receive notifications when it has been signed. This quickens the process and ensures you meet any necessary deadlines.

Get more for Continued Monthly Residence Form CalPERS Long Term Care

- Last will testament document form

- Wisconsin legal last will and testament form for a single person with minor children

- Alabama deed form

- Al widow form

- Arkansas legal last will and testament form for divorced person not remarried with adult children

- Arizona legal last will and testament form for married person with adult children from prior marriage

- California marital legal separation and property settlement agreement no children parties may have joint property or debts form

- California last will template form

Find out other Continued Monthly Residence Form CalPERS Long Term Care

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF