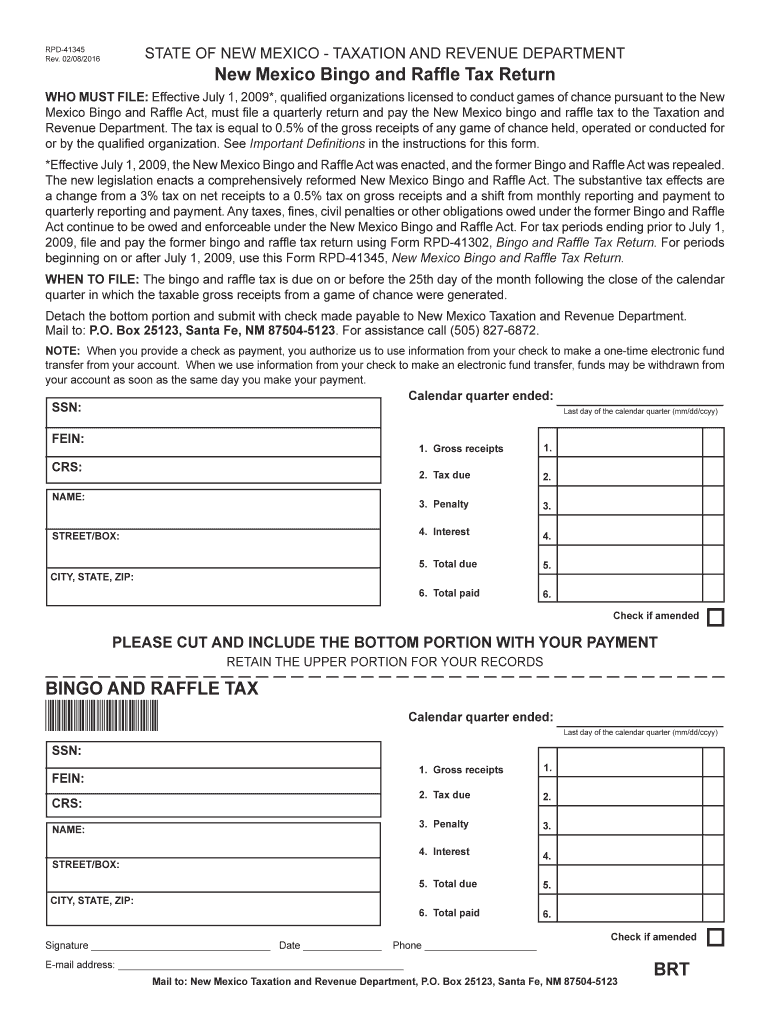

New Mexico Bingo and Raffle Tax Return 2016-2026

What is the New Mexico CRS Filing?

The New Mexico CRS filing refers to the Combined Reporting System filing, which is a tax return form used by businesses operating in New Mexico. This form consolidates various tax obligations, including gross receipts tax, compensating tax, and withholding tax. It is essential for businesses to accurately report their earnings and tax liabilities to comply with state regulations. The CRS filing helps ensure that businesses contribute appropriately to state revenue while maintaining transparency in their financial reporting.

Steps to Complete the New Mexico CRS Filing

Completing the New Mexico CRS filing involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including sales records, expense reports, and payroll information.

- Determine the appropriate tax rates applicable to your business activities, as these can vary based on location and type of service.

- Fill out the CRS form, ensuring all required fields are completed accurately. Include total gross receipts, deductions, and any applicable tax credits.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail by the designated filing deadline to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the New Mexico CRS filing is crucial for compliance. Typically, businesses must file their CRS returns on a monthly, quarterly, or annual basis, depending on their revenue levels. The specific deadlines are as follows:

- Monthly filers: Due on the 25th of the month following the reporting period.

- Quarterly filers: Due on the 25th of the month following the end of the quarter.

- Annual filers: Due on January 31 of the following year.

It is important to stay informed about any changes to these deadlines, as state regulations may evolve.

Required Documents for CRS Filing

To complete the New Mexico CRS filing, businesses need to prepare several documents to support their tax return. These documents include:

- Sales records detailing gross receipts.

- Expense documentation to substantiate any deductions claimed.

- Payroll records if the business has employees subject to withholding tax.

- Previous CRS filings, if applicable, to ensure consistency and accuracy in reporting.

Having these documents ready can streamline the filing process and help avoid potential issues with the New Mexico Taxation and Revenue Department.

Form Submission Methods

Businesses can submit their New Mexico CRS filing through various methods, providing flexibility based on preference and capability:

- Online Submission: The preferred method for many businesses, allowing for quick processing and confirmation of receipt.

- Mail Submission: Businesses can print the completed form and send it via postal service. Ensure it is postmarked by the filing deadline.

- In-Person Submission: Some businesses may choose to deliver their forms directly to a local Taxation and Revenue Department office.

Each submission method has its own advantages, and businesses should choose the one that best fits their operational needs.

Penalties for Non-Compliance

Failing to file the New Mexico CRS filing on time or inaccurately reporting tax information can lead to significant penalties. Common consequences include:

- Monetary fines based on the amount of tax due.

- Interest charges on unpaid taxes, which can accumulate over time.

- Potential legal action for repeated non-compliance or fraudulent reporting.

It is vital for businesses to adhere to filing requirements to avoid these penalties and maintain good standing with state tax authorities.

Quick guide on how to complete new mexico bingo and raffle tax return

Your assistance manual on how to prepare your New Mexico Bingo And Raffle Tax Return

If you’re wondering how to generate and submit your New Mexico Bingo And Raffle Tax Return, here are some quick pointers on how to simplify tax filing.

To start, you merely need to set up your airSlate SignNow profile to change the way you manage documents online. airSlate SignNow is a user-friendly and robust document solution that allows you to modify, draft, and finalize your tax documents without hassle. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and go back to adjust responses as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your New Mexico Bingo And Raffle Tax Return in no time:

- Establish your account and start working on PDFs in moments.

- Browse our library to locate any IRS tax form; explore versions and schedules.

- Hit Get form to access your New Mexico Bingo And Raffle Tax Return in our editor.

- Populate the required fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to incorporate your legally-binding eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Store modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper can lead to errors and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct new mexico bingo and raffle tax return

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

When I fill out my tax information for a new employer, what do I put for max withholding, to get the biggest possible tax return?

It sounds like you wish to get a large tax return. In that case when filling out your W-4 form you should claim S-0 (that’s single with zero exemptions). This means that your employer will take out the maximum amount. For those people who insist upon the government having use of their money all year there is also an option to have additional funds taken out and held and then returned when your annual return is filed. For that matter you could allow the government to keep it all during the year and then when you file your return instead of taking a refund just tell them to keep it toward next years return. Seriously, I know the large tax return seems nice and for some people that is how they save for vacations and other things, but a tax return is not a gift from the USA. It is your money and receiving a large tax return means that you allowed someone else to have your money for a year without paying you interest for the privilege of keeping your money.

Create this form in 5 minutes!

How to create an eSignature for the new mexico bingo and raffle tax return

How to make an electronic signature for your New Mexico Bingo And Raffle Tax Return online

How to create an eSignature for your New Mexico Bingo And Raffle Tax Return in Chrome

How to make an eSignature for signing the New Mexico Bingo And Raffle Tax Return in Gmail

How to generate an eSignature for the New Mexico Bingo And Raffle Tax Return right from your mobile device

How to make an eSignature for the New Mexico Bingo And Raffle Tax Return on iOS

How to create an electronic signature for the New Mexico Bingo And Raffle Tax Return on Android OS

People also ask

-

What is New Mexico CRS filing and why is it important?

New Mexico CRS filing refers to the process of submitting tax returns to the New Mexico Taxation and Revenue Department. It's crucial for businesses operating in New Mexico to comply with state tax regulations, ensuring they remain in good standing and avoid penalties. Proper CRS filing helps organizations maintain accurate records and support their financial health.

-

How does airSlate SignNow simplify New Mexico CRS filing?

airSlate SignNow streamlines the New Mexico CRS filing process by allowing businesses to easily prepare, send, and eSign necessary documents. With a user-friendly interface, it minimizes the time spent on paperwork and ensures compliance with state regulations. This feature is particularly valuable for businesses looking to enhance efficiency and accuracy in their filing processes.

-

Is airSlate SignNow cost-effective for New Mexico CRS filing?

Yes, airSlate SignNow offers a cost-effective solution for New Mexico CRS filing, eliminating the need for costly paper-based processes. By reducing administrative overhead and minimizing errors associated with manual filing, businesses can save both time and money. Moreover, the pricing plans are competitive and tailored to suit different business needs.

-

What features does airSlate SignNow offer for New Mexico CRS filing?

Key features of airSlate SignNow for New Mexico CRS filing include customizable templates, automatic reminders, and secure eSigning capabilities. These tools enable businesses to efficiently manage their filing processes, keep track of deadlines, and ensure that all documents are securely handled. Overall, these features enhance the filing experience for users across New Mexico.

-

Can airSlate SignNow be integrated with accounting software for New Mexico CRS filing?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making the New Mexico CRS filing process even more efficient. By syncing data between systems, businesses can reduce double entry and enhance accuracy. This integration helps ensure that all necessary information is readily available for timely filing.

-

How can I ensure compliance with New Mexico CRS filing using airSlate SignNow?

To ensure compliance with New Mexico CRS filing, airSlate SignNow provides resources and support to help users understand state requirements. The platform offers templates that align with New Mexico regulations, guiding businesses through the filing process. Regular updates and notifications also help users stay informed about any changes in tax legislation.

-

What are the benefits of using airSlate SignNow for New Mexico CRS filing?

The benefits of using airSlate SignNow for New Mexico CRS filing include increased efficiency, improved accuracy, and enhanced security. Businesses can complete their filings quickly, reducing the risk of errors that could lead to penalties. Moreover, the secure eSigning feature ensures that sensitive documents are handled safely throughout the process.

Get more for New Mexico Bingo And Raffle Tax Return

- Unlawful detainer florida form

- Two month notice to end tenancy residential tenancy office form

- Virgin money income and expenditure form

- 5107428900 form

- Readywrap size chart form

- Full legal name of nominee mailing address street city form

- Meet entry form pay swim payswim

- Pet sitter pet bcare authorizationb form neffsville veterinary clinic

Find out other New Mexico Bingo And Raffle Tax Return

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe