Own Form

What is the uniform residential loan application form?

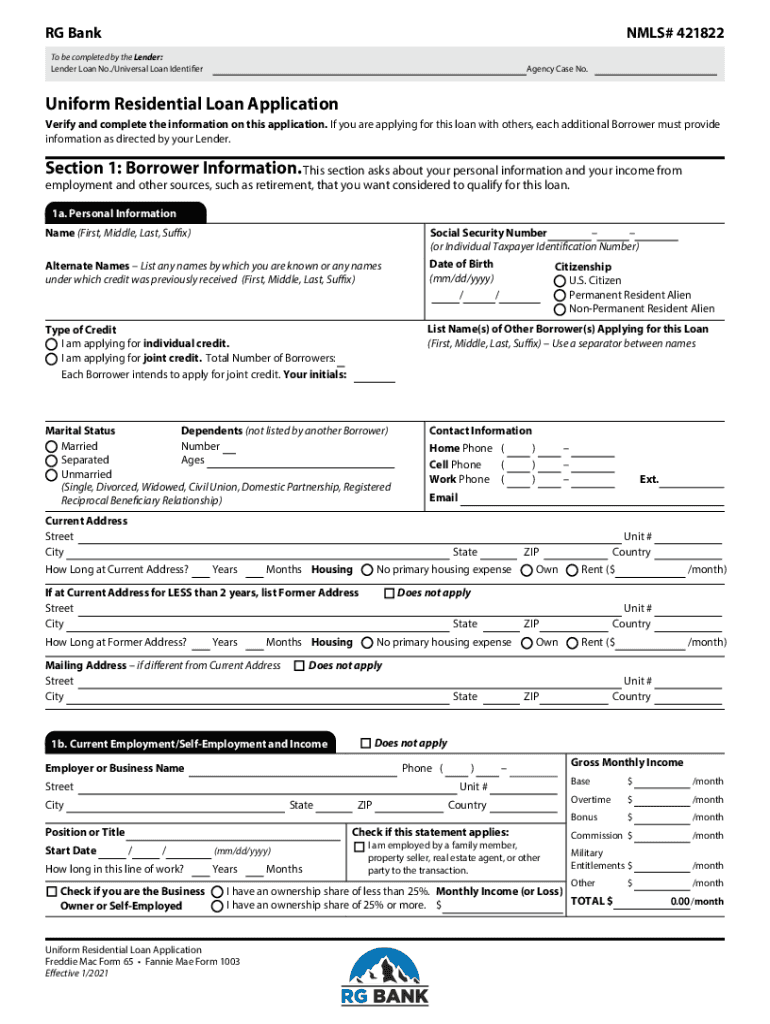

The uniform residential loan application form, often referred to as the 1003 form, is a standardized document used by lenders in the United States to collect essential information from borrowers applying for a mortgage. This form captures details about the applicant's financial history, employment, and the property being financed. It serves as a critical tool for lenders to assess the creditworthiness of potential borrowers and determine their eligibility for a loan.

Key elements of the uniform residential loan application form

The uniform residential loan application form includes several key sections that provide a comprehensive overview of the borrower's financial situation. These sections typically cover:

- Borrower Information: Personal details such as name, address, and Social Security number.

- Employment History: Information about current and previous employers, including job titles and income.

- Financial Information: Details regarding assets, liabilities, and monthly expenses.

- Property Information: Description of the property being purchased or refinanced, including its address and estimated value.

Steps to complete the uniform residential loan application form

Completing the uniform residential loan application form involves several straightforward steps:

- Gather necessary documents, including pay stubs, bank statements, and tax returns.

- Fill in personal information accurately, ensuring all details match official documents.

- Provide comprehensive employment and income details, including any additional sources of income.

- List all assets and liabilities to give a complete picture of financial standing.

- Review the completed form for accuracy before submission.

Legal use of the uniform residential loan application form

The uniform residential loan application form is legally recognized and widely accepted by lenders across the United States. It is essential for borrowers to provide truthful and accurate information on this form, as discrepancies can lead to delays in the loan approval process or even denial of the application. Additionally, lenders are required to comply with federal regulations regarding the use of this form, ensuring that borrowers are treated fairly throughout the mortgage application process.

Who issues the uniform residential loan application form?

The uniform residential loan application form is issued by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). These government-sponsored enterprises provide the framework for the form to ensure consistency and standardization across the mortgage lending industry. Lenders typically use this form to streamline the application process and facilitate communication between borrowers and financial institutions.

Form submission methods

Borrowers can submit the uniform residential loan application form through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer digital platforms where borrowers can fill out and submit the form electronically.

- Mail: Borrowers can print the completed form and send it via postal mail to the lender's office.

- In-Person: Some borrowers may prefer to submit the form in person at a local branch of the lending institution.

Quick guide on how to complete own

Manage Own effortlessly on any gadget

Digital document handling has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, allowing you to locate the right template and securely save it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your files quickly and without holdups. Work on Own using airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to alter and electronically sign Own with ease

- Search for Own and click on Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and select the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Own and ensure outstanding communication through every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the own

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the uniform residential loan application form?

The uniform residential loan application form is a standardized document used by lenders to collect essential information from borrowers. This form helps streamline the mortgage application process, ensuring that all necessary data is presented in a uniform manner. Using this form can signNowly expedite the approval time for loans.

-

How can airSlate SignNow assist with the uniform residential loan application form?

AirSlate SignNow provides an efficient platform for sending, signing, and storing the uniform residential loan application form electronically. Our easy-to-use interface allows users to fill out, review, and eSign documents quickly, enhancing the overall experience for both borrowers and lenders. This reduces paperwork and speeds up the loan processing journey.

-

Is there a cost associated with using the uniform residential loan application form on airSlate SignNow?

Yes, there are costs associated with using airSlate SignNow for the uniform residential loan application form, but we offer various pricing plans to suit different needs. These plans include features such as unlimited document signing and access to various integrations. You can choose a plan that best fits your budget and requirements.

-

What are the key benefits of using airSlate SignNow for the uniform residential loan application form?

The key benefits of using airSlate SignNow for the uniform residential loan application form include quick turnaround times, enhanced security features, and the ability to access documents from anywhere. Our platform also facilitates easier collaboration among agents and borrowers, ensuring that the application process is smooth and efficient.

-

Can I customize the uniform residential loan application form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the uniform residential loan application form to fit your specific needs. You can add branding, adjust fields, and make it user-friendly for your clients. This customization ensures that your form remains compliant while catering to your business requirements.

-

What integrations does airSlate SignNow offer for managing the uniform residential loan application form?

AirSlate SignNow integrates seamlessly with various CRM and document management systems, enhancing your workflow when dealing with the uniform residential loan application form. Popular integrations include Salesforce, Google Drive, and Dropbox, which help streamline the data capture and document storage process. This integration capability helps keep your operations organized and efficient.

-

How secure is my data when using the uniform residential loan application form on airSlate SignNow?

AirSlate SignNow prioritizes your security, implementing top-tier encryption and industry-standard compliance protocols for all data related to the uniform residential loan application form. Our platform ensures that sensitive borrower information remains protected during the signing and storage processes. Regular audits further reinforce our commitment to data protection.

Get more for Own

- Speaker request form for justices or judgesnebraska

- For use in nebraska state courts and probation offices form

- Claim of the undersigned is hereby made against this estate itemized as follows form

- Summary to accompany application for leave to file form

- Dc 6 10 1adoc form

- Eep employment unemployment hearings united states joint form

- Asd amp counsel for discipline use only date request recd form

- Chapter 6 trial courtsnebraska judicial branch form

Find out other Own

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document