529 College Savings Plan Distribution Request Form

Understanding the 529 College Savings Plan Distribution Request Form

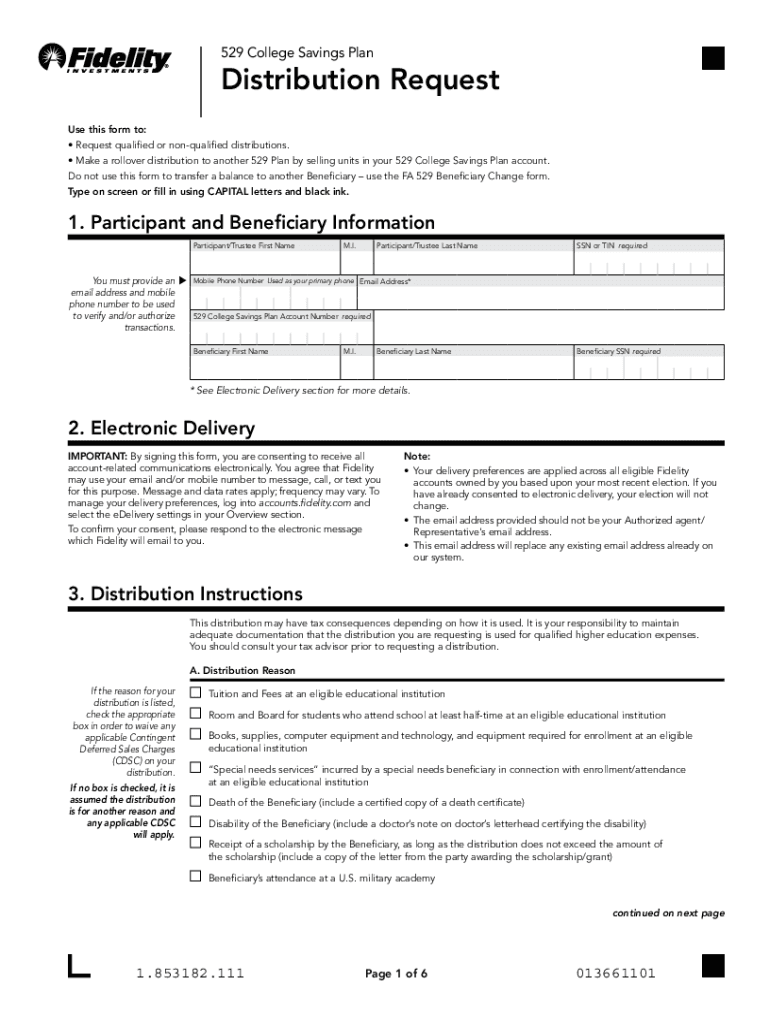

The 529 College Savings Plan Distribution Request Form is a crucial document for account holders wishing to withdraw funds from their 529 plans. These plans are designed to help families save for future education expenses, making it essential to understand the specifics of this form. The form facilitates the distribution of funds for qualified education expenses, ensuring that the withdrawal aligns with IRS regulations.

Steps to Complete the 529 College Savings Plan Distribution Request Form

Completing the 529 College Savings Plan Distribution Request Form involves several key steps:

- Gather Required Information: Collect personal details such as the account holder's name, Social Security number, and the beneficiary's information.

- Specify the Distribution Amount: Clearly indicate how much money you wish to withdraw from the account.

- Detail the Purpose of the Withdrawal: State whether the funds will be used for tuition, books, or other qualified expenses.

- Review and Sign: Ensure all information is accurate, then sign and date the form to validate your request.

How to Obtain the 529 College Savings Plan Distribution Request Form

The form can typically be obtained through the financial institution managing your 529 plan. Most providers offer the form on their official website, allowing for easy access. Alternatively, you may contact customer service for assistance in acquiring the form.

Legal Use of the 529 College Savings Plan Distribution Request Form

Using the 529 College Savings Plan Distribution Request Form legally requires adherence to IRS guidelines. Withdrawals must be for qualified education expenses to avoid penalties and taxes. It is important to keep records of how the funds are used to ensure compliance with federal regulations.

Key Elements of the 529 College Savings Plan Distribution Request Form

Several critical components are included in the 529 College Savings Plan Distribution Request Form:

- Account Holder Information: Details about the person who owns the 529 account.

- Beneficiary Information: Information regarding the student for whom the funds are intended.

- Distribution Amount: The specific amount requested for withdrawal.

- Purpose of Withdrawal: A clear explanation of how the funds will be used.

Form Submission Methods

The completed 529 College Savings Plan Distribution Request Form can usually be submitted through various methods, including:

- Online Submission: Many providers allow for electronic submission via their website.

- Mail: The form can be printed and sent via postal service to the designated address.

- In-Person: Some institutions may permit in-person submissions at their physical locations.

Quick guide on how to complete 529 college savings plan distribution request form

Complete 529 College Savings Plan Distribution Request Form effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage 529 College Savings Plan Distribution Request Form across any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign 529 College Savings Plan Distribution Request Form easily

- Locate 529 College Savings Plan Distribution Request Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 529 College Savings Plan Distribution Request Form to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 529 college savings plan distribution request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 'chet withdrawal form' and why do I need it?

The 'chet withdrawal form' is a specialized document used for withdrawing funds or resources from a designated source. It's essential for maintaining accurate records and ensuring compliance with institutional regulations. By utilizing the 'chet withdrawal form,' you ensure that your withdrawal requests are processed efficiently and securely.

-

How can I fill out a 'chet withdrawal form' using airSlate SignNow?

Filling out a 'chet withdrawal form' with airSlate SignNow is straightforward. You can easily upload the form, fill it in online, and eSign directly on the platform. This streamlined process saves you time and ensures that all required information is accurately captured.

-

Is there a cost associated with using the 'chet withdrawal form' on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to various document templates, including the 'chet withdrawal form.' You can choose a plan that fits your needs, ensuring that you only pay for the services you require. With airSlate SignNow, you get a cost-effective solution for all your document management needs.

-

What features does airSlate SignNow offer for the 'chet withdrawal form'?

AirSlate SignNow provides various features to enhance the use of the 'chet withdrawal form,' including electronic signatures, real-time tracking, and cloud-based storage. These features ensure that you never miss a document and maintain a secure record of all withdrawals. You can also collaborate with team members seamlessly within the platform.

-

Can I integrate the 'chet withdrawal form' with other software tools?

Yes, airSlate SignNow allows for seamless integration with numerous other software applications, enhancing the functionality of your 'chet withdrawal form.' This ensures that you can automate workflows and share documents across different platforms. Popular integrations include CRM systems, payment processors, and project management tools.

-

How secure is my data when using the 'chet withdrawal form' on airSlate SignNow?

Your data security is a top priority at airSlate SignNow. The 'chet withdrawal form' and all documents are protected using industry-standard encryption protocols. Additionally, the platform is compliant with necessary regulations to ensure that your sensitive information remains confidential and secure.

-

What is the benefit of using the eSign option for the 'chet withdrawal form'?

Using the eSign option for the 'chet withdrawal form' streamlines the signing process and speeds up transaction times. It eliminates the need for physical signatures, allowing you to complete withdrawals without delays. This electronic approach is not only more efficient but also enhances the security of your documents.

Get more for 529 College Savings Plan Distribution Request Form

- Representative filed by form

- Fillable online personal representative state the following form

- The inventory must list the property form

- Colorado probate statewide justiaforms

- Petition re determination of heirs or devisees court forms

- Pursuant to 15 12 1303 c form

- Fillable online interim final accounting fax email print form

- Letters testamentary of administration were issued on form

Find out other 529 College Savings Plan Distribution Request Form

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document