Of Annuity Payments Form

What is the Of Annuity Payments

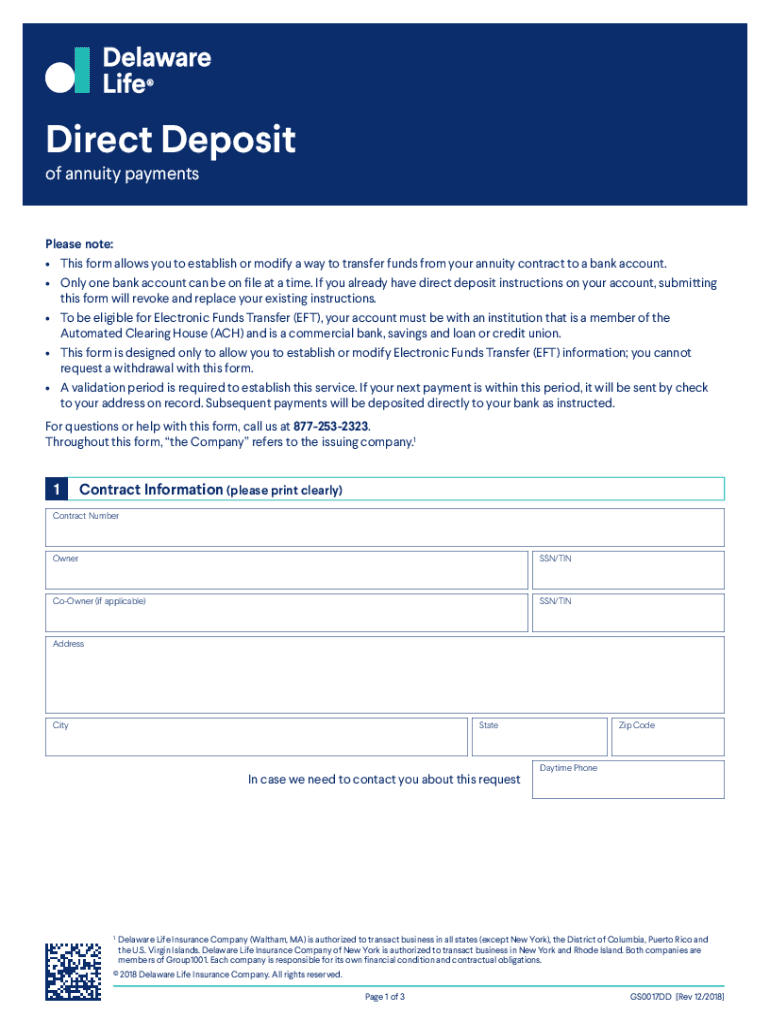

The Of Annuity Payments form is a document used to report the receipt of periodic payments made under an annuity contract. An annuity is a financial product that provides a stream of income, typically used for retirement purposes. This form is essential for individuals receiving these payments, as it helps ensure compliance with tax regulations set forth by the Internal Revenue Service (IRS).

How to use the Of Annuity Payments

To use the Of Annuity Payments form effectively, individuals must first gather all relevant information regarding their annuity payments. This includes the total amount received, the frequency of payments, and any associated fees or deductions. The completed form should be submitted to the appropriate tax authority to accurately report income and fulfill tax obligations.

Steps to complete the Of Annuity Payments

Completing the Of Annuity Payments form involves several key steps:

- Collect all necessary documentation related to your annuity payments.

- Fill out the form with accurate details, including personal information and payment amounts.

- Review the completed form for any errors or omissions.

- Submit the form to the designated tax authority by the specified deadline.

Legal use of the Of Annuity Payments

The legal use of the Of Annuity Payments form is crucial for ensuring compliance with federal tax laws. Failure to report annuity payments can result in penalties or fines. It is important to understand the legal implications of the form and to maintain accurate records of all payments received to avoid potential issues with the IRS.

Key elements of the Of Annuity Payments

Key elements of the Of Annuity Payments form include:

- Personal identification information, such as name and Social Security number.

- Details of the annuity contract, including the issuer and policy number.

- The total amount of payments received during the reporting period.

- Any deductions or adjustments that may apply to the reported income.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of annuity payments. It is essential for individuals to familiarize themselves with these guidelines to ensure accurate reporting. The IRS outlines the tax treatment of annuity payments, including any applicable tax rates and reporting requirements. Adhering to these guidelines helps prevent issues with tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Of Annuity Payments form are typically aligned with the annual tax filing schedule. Individuals should be aware of these important dates to ensure timely submission. Missing a deadline can result in penalties or interest charges, making it crucial to stay informed about filing requirements and timelines.

Quick guide on how to complete of annuity payments

Easily Prepare Of Annuity Payments on Any Device

Digital document handling has become increasingly favored by businesses and individuals alike. It offers a perfect eco-conscious substitute to traditional printed and signed documents, as you can access the needed form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your files quickly and without holdups. Manage Of Annuity Payments on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related task today.

How to Modify and eSign Of Annuity Payments Effortlessly

- Locate Of Annuity Payments and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to secure your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Of Annuity Payments and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the of annuity payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for processing of annuity payments?

airSlate SignNow offers robust features for managing the of annuity payments process, including customizable templates, secure electronic signatures, and automated workflows. These features streamline the entire process, ensuring that all documents are accurately completed and securely stored. Additionally, the platform integrates seamlessly with other financial systems for a smoother experience.

-

How does airSlate SignNow enhance the efficiency of handling of annuity payments?

By utilizing airSlate SignNow for the of annuity payments process, businesses can save valuable time and reduce human error. The easy-to-use platform automates reminders and facilitates quick document retrieval, allowing teams to focus on critical tasks rather than paperwork. Enhanced visibility into document status further improves operational efficiency.

-

Is airSlate SignNow cost-effective for managing of annuity payments?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing of annuity payments. With flexible pricing plans, businesses can choose an option that fits their budget without compromising on quality or functionality. This affordability allows teams to invest more resources into customer service and enhancing overall client satisfaction.

-

Can airSlate SignNow integrate with other tools used in the of annuity payments process?

Absolutely! airSlate SignNow offers extensive integrations with popular CRM, ERP, and other financial software to streamline the of annuity payments process. This connectivity ensures that your entire workflow remains seamless, saving time and minimizing potential errors during data transfer.

-

What benefits does airSlate SignNow provide for the customers involved in of annuity payments?

Customers benefit from airSlate SignNow's user-friendly interface and fast turnaround times when it comes to the of annuity payments. The ability to sign documents electronically from anywhere reduces delays, resulting in quicker transaction completions and enhanced satisfaction. Moreover, the robust security measures protect sensitive information throughout the process.

-

How secure is the airSlate SignNow platform for the of annuity payments?

Security is a top priority for airSlate SignNow, especially when dealing with the of annuity payments and sensitive financial data. The platform utilizes industry-leading encryption and compliance measures to safeguard your documents. With features such as audit trails and secure storage, users can trust that their information is protected.

-

What ease of use features make airSlate SignNow ideal for of annuity payments?

airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage the of annuity payments process. Intuitive navigation, guided set-up, and mobile accessibility mean that users can quickly learn the platform, leading to faster implementation. This ease of use reduces the need for extensive training and onboarding.

Get more for Of Annuity Payments

- Judicial branch colorado general assembly form

- Rule change 200115 colorado judicial branch form

- Free county court district court denver juvenile court form

- Court appointed attorneys public defendersanoka form

- Request for administrative review of income tax offset form

- Colorado judicial branch self help appeals criminal appeal form

- Motion to determine factual innocence form

- Colorado circuit court number epsleecswsuedu form

Find out other Of Annuity Payments

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later