PC328 Use of Credit Information Disclosure Form CD 1 PC328 Use of Credit Information Disclosure Form CD 1

Understanding the PC328 Use of Credit Information Disclosure Form

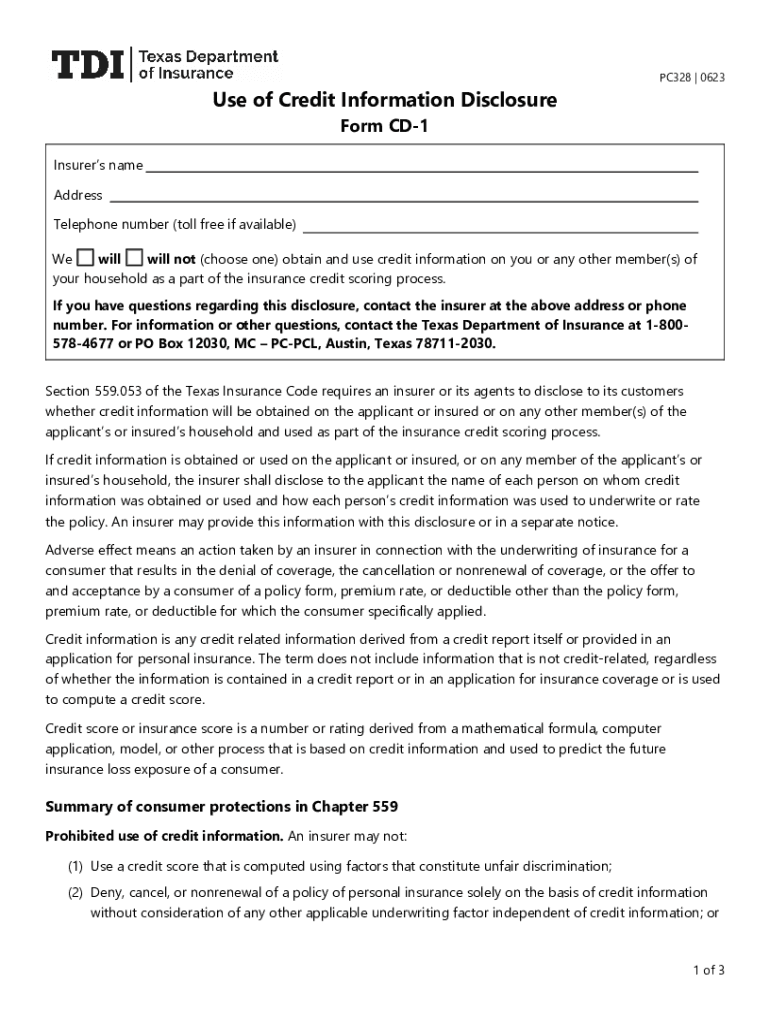

The PC328 Use of Credit Information Disclosure Form is a document designed to facilitate the disclosure of credit information in compliance with U.S. regulations. This form is essential for organizations that need to share credit-related data while ensuring transparency and consumer rights. It helps protect both the entity disclosing the information and the individual whose credit information is being shared.

How to Use the PC328 Use of Credit Information Disclosure Form

Using the PC328 form involves several straightforward steps. First, ensure that you have the latest version of the form, which can be obtained from authorized sources. Once you have the form, fill it out with the necessary details, including the identity of the individual, the specific credit information being disclosed, and the purpose of the disclosure. After completing the form, it should be signed by the authorized representative of the organization and the individual whose information is being disclosed, ensuring that all parties are aware of the disclosure.

Steps to Complete the PC328 Use of Credit Information Disclosure Form

Completing the PC328 form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from an official source.

- Fill in the personal information of the individual whose credit information is being disclosed.

- Clearly specify the type of credit information being shared.

- State the purpose of the disclosure, ensuring it aligns with legal requirements.

- Include signatures from both the disclosing party and the individual.

- Review the completed form for accuracy before submission.

Legal Use of the PC328 Use of Credit Information Disclosure Form

The legal framework surrounding the use of the PC328 form is governed by federal and state regulations. It is crucial for organizations to comply with the Fair Credit Reporting Act (FCRA) and other relevant laws when using this form. The PC328 ensures that credit information is disclosed only with proper consent and for legitimate purposes, thereby protecting consumer rights and maintaining trust in financial transactions.

Key Elements of the PC328 Use of Credit Information Disclosure Form

Several key elements must be included in the PC328 form to ensure it serves its purpose effectively:

- Identifying Information: Full name and contact details of the individual.

- Disclosure Details: Specific credit information being shared.

- Purpose of Disclosure: Clear explanation of why the information is being disclosed.

- Consent Signatures: Signatures from both the individual and the organization.

Obtaining the PC328 Use of Credit Information Disclosure Form

The PC328 form can be obtained through various channels. Organizations can access it via official websites that provide regulatory forms or through legal offices that specialize in credit and financial documentation. It is advisable to ensure that the version obtained is current and complies with any recent changes in regulations.

Quick guide on how to complete pc328 use of credit information disclosure form cd 1 pc328 use of credit information disclosure form cd 1

Prepare PC328 Use Of Credit Information Disclosure Form CD 1 PC328 Use Of Credit Information Disclosure Form CD 1 effortlessly on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage PC328 Use Of Credit Information Disclosure Form CD 1 PC328 Use Of Credit Information Disclosure Form CD 1 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign PC328 Use Of Credit Information Disclosure Form CD 1 PC328 Use Of Credit Information Disclosure Form CD 1 with ease

- Obtain PC328 Use Of Credit Information Disclosure Form CD 1 PC328 Use Of Credit Information Disclosure Form CD 1 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign PC328 Use Of Credit Information Disclosure Form CD 1 PC328 Use Of Credit Information Disclosure Form CD 1 and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pc328 use of credit information disclosure form cd 1 pc328 use of credit information disclosure form cd 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PC328 Use Of Credit Information Disclosure Form CD 1?

The PC328 Use Of Credit Information Disclosure Form CD 1 is a standardized document designed to ensure transparency in the use of credit information. It allows businesses to communicate their credit practices clearly to consumers. Using this form helps build trust and complies with regulations.

-

How can airSlate SignNow help with the PC328 Use Of Credit Information Disclosure Form CD 1?

airSlate SignNow simplifies the process of sending and eSigning the PC328 Use Of Credit Information Disclosure Form CD 1. With its user-friendly interface, you can quickly prepare the document, share it with relevant parties, and obtain signatures seamlessly. This enhances efficiency and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for the PC328 Use Of Credit Information Disclosure Form CD 1?

Yes, there are pricing plans available for using airSlate SignNow to manage the PC328 Use Of Credit Information Disclosure Form CD 1. These plans are designed to be cost-effective, making it affordable for businesses of all sizes to utilize this essential documentation feature. You can choose a plan that suits your needs best.

-

What are the key features of airSlate SignNow for processing the PC328 Use Of Credit Information Disclosure Form CD 1?

airSlate SignNow offers features such as customizable templates, document sharing, eSigning, and tracking options specifically tailored for the PC328 Use Of Credit Information Disclosure Form CD 1. Remote collaboration is simplified, ensuring that all parties can easily access and sign the document. This streamlines your workflow.

-

What benefits does the PC328 Use Of Credit Information Disclosure Form CD 1 provide to businesses?

Utilizing the PC328 Use Of Credit Information Disclosure Form CD 1 allows businesses to maintain compliance while establishing trust with consumers. It clearly outlines how credit information will be used, ensuring transparency. This can lead to improved customer relationships and reduced disputes.

-

Can I integrate airSlate SignNow with other software for the PC328 Use Of Credit Information Disclosure Form CD 1?

Yes, airSlate SignNow offers integrations with various software solutions, enhancing the processing of the PC328 Use Of Credit Information Disclosure Form CD 1. This includes CRM systems and other business applications, which allows for streamlined data flow and improved overall efficiency in managing documents.

-

How secure is the signing process for the PC328 Use Of Credit Information Disclosure Form CD 1 using airSlate SignNow?

The signing process for the PC328 Use Of Credit Information Disclosure Form CD 1 using airSlate SignNow is highly secure. With encrypted connections and compliance with legal standards, you can trust that your sensitive information is protected during transmission. This ensures the integrity of your documents.

Get more for PC328 Use Of Credit Information Disclosure Form CD 1 PC328 Use Of Credit Information Disclosure Form CD 1

- Control number vt p057 pkg form

- Control number vt p058 pkg form

- Vermont small claims forms for court us legal forms

- Roys windows siding ampamp patio rooms window contractor form

- Control number vt p061 pkg form

- Control number vt p062 pkg form

- Control number vt p064 pkg form

- Free vermont sublease agreement templates pdf ampamp docx form

Find out other PC328 Use Of Credit Information Disclosure Form CD 1 PC328 Use Of Credit Information Disclosure Form CD 1

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy